The accounting team must use standard costing to allocate costs to completed items since journal entries were not recorded when inventory was used. In this way, the production expenses are "flushed back" into the cycle and allocated to the appropriate commodities and categories.

In order to track expenditures throughout the production process, a distinct journal entry would typically be needed for each stage of manufacture. For a single product, this may build up to hundreds of entries. But what happens if your company manufactures a thousand goods. There is a significant amount of extra accounting tasks created as a result.

How do you handle that? The answer is backflush costing! Let’s discuss backflush costing in-depth and how this method benefits your business!

Backflush costing refers to an accounting approach where costs are recorded after a product or service is sold or rendered. The necessity of maintaining work-in-process accounts while manually allocating charges to various production phases is eliminated by this approach. This costing strategy is typically used by businesses using just-in-time (JIT) inventory systems. The computer manages every aspect of this fully automated pricing system.

It does away with the expensive and labor-intensive practice of reporting each expense as it arises and instead "flushes" each expense into a single entry when the production process is complete. As a result, backflush costing can be more straightforward and more cost-effective for companies as they are not required to report every expense as it happens.

👉 Read More: What Is Cash Conversion Cycle: Formula, Example, Calculator

👉 Read More: What Is Cycle Stock: Formula And Example

When using backflush costing, a business must first estimate the value of manufacturing each unit of a given item before assigning this price as the standard unit cost for that specific item. Once the manufacturing cycle is complete, the standard cost is multiplied by the quantity produced to determine whether the expenditure journal entry is accurate. At the conclusion of the manufacturing cycle, this journal entry is once recorded.

When processing an order, just the most basic details—such as amount, product code, and delivery date—are submitted. After the production process is complete, backflushing is used. For instance, a manufacturer who projects a standard cost of $10 per item and puts out 2,000 items over the course of the manufacturing cycle will record an expense of $20,000 in the expense journal.

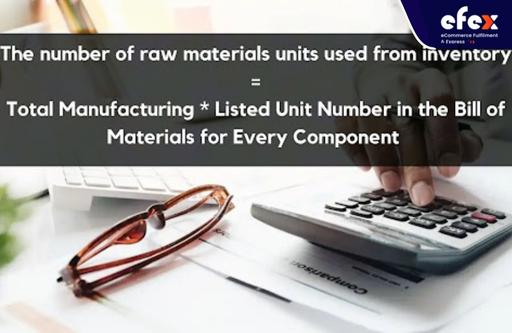

The management utilizes standard or normal costing afterward and works backward to assign a cost to the items or services because no journal entries are originally or sometimes made. In this way, the expenditures are "flushed back" to the manufacturing cycle that has already ended. Despite the fact that this approach is entirely automated, the cost is assigned using a formula.

👉 Read More: What is Cycle service level: Formula and Example

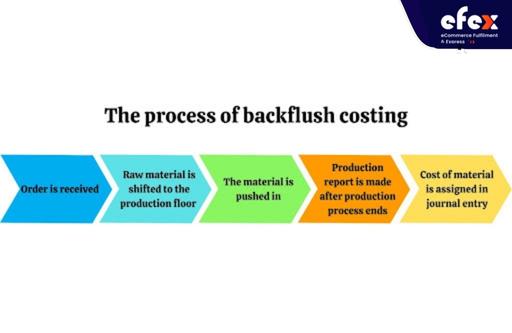

You can see a brief process of backflush costing through the graph below:

Typically, businesses with low quantities of inventory and high levels of inventory turnover employ backflush costing. It is due to expenses are still noted very soon after they have arisen. Because an item may go unsold for a prolonged period of time, businesses having sluggish inventory turnover have a tendency to record expenses as they have arisen.

When several expenses are involved in manufacturing a product, the backflush costing approach performs very effectively. It can greatly ease the accounting procedure in such a case. Thus, backflush costing is applied by so many manufacturing companies with complicated manufacturing processes.

On the contrary, this approach is less ideal for businesses that sell more customized goods since the unit cost will frequently fluctuate.

👉 Read More: What is Goods Receipt? Process and Template

Companies with complicated products or those with multi-stage production processes benefit more from using this costing strategy. For such businesses, it would need many journal entries for each stage of manufacturing to adequately document the cost.

For a single product, it may lead to dozens of entries, which would make accountants' tasks incredibly difficult. The accounts team won't need to submit journal entries during the process of production if the business implements backflush costing. Thus, we may conclude that this system streamlines accounting and costing operations without significantly sacrificing information.

Another advantage of this method is:

The fact that this costing approach does not adhere to GAAP (standing for "generally accepted accounting principles"), which makes it challenging to audit, is one of its major drawbacks. Because this costing approach allocates costs after the completion of manufacturing, it frequently charges the product with standard expenses. The real expenses thus could differ.

Therefore, in reality, businesses need to be aware of these variations. By contrasting the labor cost given to the production with the real cash outflow for the labor expenditures, for instance, one may see the variance. Other disadvantages with this backflush costing system include:

As a result, the records will be incomplete during this period. The manufacturing cycle must be shortened or accelerated in order to guarantee that records are updated promptly.

When employing backflush costing, businesses will make one journal entry at the conclusion of the manufacturing cycle with the standard cost and the quantity produced. An example of a typical journal entry with several entries and backflush costs is shown below.

| Date | Transaction | Debit | Credit |

| January 30 | Raw Materials | $10,000 | |

| Cash | $10,000 | ||

| Purchased raw materials for production | |||

The following journal entries were accepted for backflush costing:

| Date | Transaction | Debit | Credit |

| January 30 | Raw Materials | $5,000 | |

| Cash | $5,000 | ||

| Purchased raw materials for production | |||

| January 20 | Raw Materials | $5,000 | |

| Cash | $5,000 | ||

| Purchased raw materials for production | |||

| January 30 | Raw Materials | $5,000 | |

| Cash | $5,000 | ||

| Purchased raw materials for production | |||

The entries that follows demonstrates just how much time-consuming it may be to use different accounting techniques. As expenses increase during the process of production, the entries would resume.

A company wants to utilize backflush accounting to track the expenses associated with producing a new type of headphone. The startup plans to produce 500 pairs of headphones at a typical cost per unit of $100. On March 7, May 10, and May 17, they bought parts for the manufacturing process that cost $20,000, $15,000, and $15,000 respectively.

On May 31, they completed the manufacture of the headphones. If the business employs backflush costs, they would enter a $50,000 debit to costs and a $50,000 credit to cash on May 31.

- Read More: Order Management System: Definition, Process And Value

- Read More: Order management system for Ecommerce: Definition, Key Effect, Benefit

The backflush costing approach, which is a streamlined method of tracking expenses made in product production, accounts for all costs after a period of time has passed since they were incurred. This method can be applied in a hybrid system when several production accounting techniques are implemented.

However, it could show to be a conceptually elegant approach for sophisticated accounting solutions. It might not be appropriate for a business with a longer manufacturing process. Hope you have a good time with Efex.