Anyone who owns an online store is aware of the damage that rapid expansion can do to the cash balance. Your cash flow could suddenly disappear due to paying off suppliers and placing new orders for inventory. If you need some immediate cash for your company, check out these solutions.

As a long-term strategy, managing your cash conversion cycle can stop this cash drain. This article will demonstrate the impact of poor cash conversion cycle problems and solutions you can use in your own company.

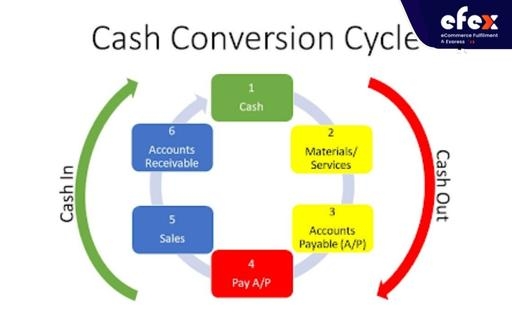

The Cash Conversion Cycle (or CCC) is a periodic measurement (in days) in order for expenditures in inventory as well as other resources to be turned into cash flows from revenue of the finished product within the business's operational cycle.

It is the accumulation of the following discrete cycles:

👉 Read More: Demand Signal: Definition, Process and Benefit

👉 Read More: Balancing Supply and Demand: Definition and Benefit

The negative cash conversion cycle indicates that the company's suppliers are paying for its operations. As their firm grows, no more cash is required. In fact, their cash balance suddenly grows more quickly as their sales increase. The two most popular retailers of all time, Walmart and Amazon, both have very low or negative CCCs.

However, the majority of firms DO NOT experience negative cash conversion cycles. The typical CCC for eCommerce companies we've encountered ranges from 40 to 100 days. This implies that working capital is always "trapped" with 40 to 100 days' worth of operating cash.

Additionally, when your business expands, the amount of "stuck" cash will increase as well, necessitating ongoing capital infusions. Let's use an example where your CCC is 60 days and your daily sales are $3,000. That implies that $180,000 in cash is permanently secured inside your company. You'll need to put $60k into the company if your sales rise to $4k each day, which brings the total to $240k. This will keep your online business cash-poor.

Early on, quick expansion required you to continually invest more money in your company. You must eventually begin putting more effort into raising CCC. But how to do so, let's move on to the next part!

👉 Read More: Dependent Demand Item And Independent Demand Item

To increase CCC, you can push one of three levers:

Your accounts payable seems to be the most crucial element.

The majority of vendors offer their clients 15 to 30 days to complete payment for their bills. This does not imply that you shouldn't request more. You should always be asking for periods longer or more credit as your business expands and your relationships with your vendors get better. Good vendor credit exists. It typically doesn't pay interest, calls for personal guarantees, and isn't secured by any assets.

Gymshark, for instance, has 163 days payable, which indicates that their vendors allow them 163 days to pay their invoices. It is said that their suppliers fund their business activities. They buy stuff, but they sell it long ahead of the 163-day deadline by which they must pay their invoice.

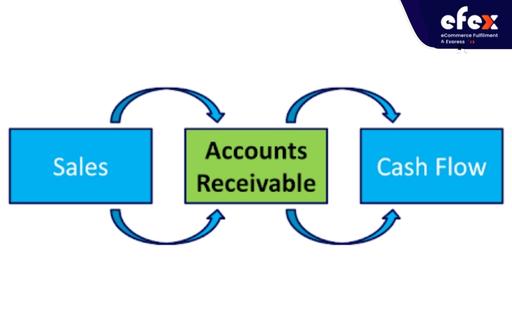

The majority of online stores don't keep an account receivable balance. They would never have more than a few days' value of deposits due from a payment service.

In contrast, it is possible to have unearned revenue, often known as negative accounts receivable. When a client pays you in advance for a service or product you don't yet have or haven't yet provided, this situation arises. The majority of dropshipping companies typically have bad AR. There are three other methods you can get negative AR if your vendors aren't drop-shopping for you.

To execute these strategies, you'll need to collaborate with your clients and vendors and make necessary process changes. But if done right, it can significantly improve your long-run cash flow.

Not least among these is inventory. The biggest expense for any physical items business is often inventory.

You can simply find a ton of techniques to decrease inventory on Google. But here are 2 unconventional methods you can employ to cut down on inventory:

Request that your supplier reserve some of the frequently ordered goods for you at their facility or warehouse, and only charge you once the item has been dispatched from the facility or warehouse. It will facilitate the batch shipment technique discussed above and let you hold less or no inventory.

Only keep the SKUs that are most in demand in your warehouse. Simply extend the delivery time for your consumers for unpopular SKUs. As soon as you receive orders from customers for an uncommon SKU, you will be able to purchase inventory for it. To obtain a negative CCC, you must be able to sell all of the ordered products before your vendor's invoice is due.

👉 Read More: Direct Product Profitability (DPP): Definition and Calculation

Your cash conversion cycle should be regularly measured and optimized if you manage an online store. Depending on your CCC, you can be cash-rich or cash-poor. Having a negative cash conversion cycle is the ultimate goal. When you succeed in doing this, your company becomes a cash-generating engine. Hope you have a good time with Efex.