More Helpful Content

It is no surprise that e-commerce has been one of the pandemic winners, and cross-border eCommerce has experienced a comparable increase and it is becoming more popular in customers’ lives. Compared to 2019, it increased by 21% in 2020 and 55% of online customers made a cross-border purchase last year. From luxuries to everyday necessities, people are increasingly purchasing online and from overseas.

In this article, EFEX will delve into the definition, examples, and the expanding market size of cross-border e-commerce, highlighting its benefits and challenges for businesses seeking to tap into this global marketplace.

>> Find out end-to-end cross-border shipping solutions

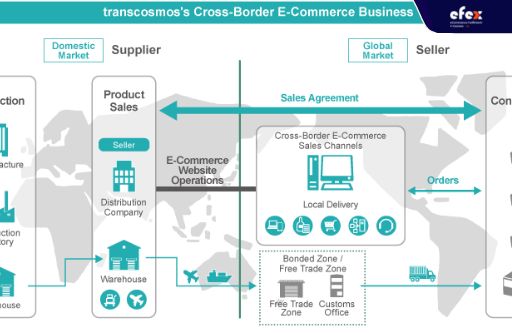

Cross-border ecommerce refers to online transactions between a company which can be a retailer or a brand and a customer (B2C), two companies which is usually brands or wholesalers (B2B), or two private individuals (C2C). It is also described as the process of selling items or services through a website, an online, or an e-commerce shop of a national store from one country to international customers in other countries.

While it is limited to internet sales, another procedure known as cross-border commerce focuses on selling internationally to a worldwide audience using any sales channel, offline or online.

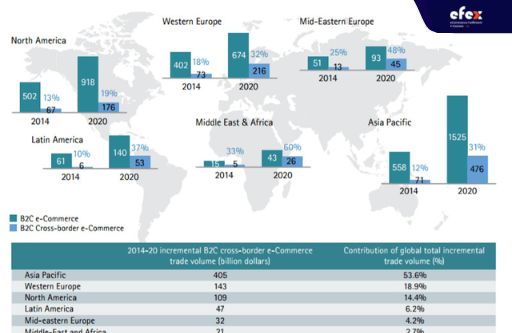

Cross-border ecommerce is not new, but the rate at which items cross borders is increasing quickly. According to Accenture, by 2020, over 2 billion e-shoppers, or 60% of the target worldwide population, would be transacting 13.5% of their total retail consumption online, corresponding to a market value of $3.4 trillion.

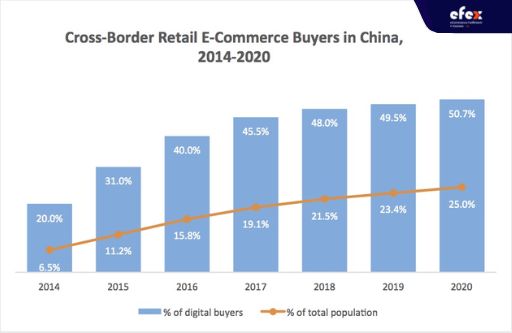

China's cross-border ecommerce is worth $60 billion but regulation may have an impact. The expanding backdoor path known as cross-border ecommerce allows Chinese customers to buy overseas-manufactured items online and easily avoid regulatory obstacles that have hindered access to consumer products.

For the South East Asia area, like Singapore and Indonesia, reports show that the Southeast Asian e-commerce sector will reach $200 billion by 2025, with online sales growing at a CAGR of 32%. It is the world’s largest Internet user market, with 600 million buyers and 260 million individuals online. It follows that both Alibaba and Amazon have boosted their interest in this sector.

While in Europe, France has the fastest-growing e-commerce market. Nearly half of all French customers usually buy from cross-border sellers, and 19% of all online sales in 2016 were made on websites that are not domestic, leading to 4 points higher than the European average of 12%, with Germany, the U.K, Belgium, and China being the most frequent destinations.

Moreover, according to Statista, 27% of American buyers polled claimed they purchase both locally and internationally. This figure rises to 71% among Austrian shoppers.

These statistics indicate that there is a potential for brands and online retailers to sell their products to new markets and increase sales and income. Adding additional markets to your existing selling platforms, like eBay and Amazon, is the most efficient solution to cross-border selling. Amazon is continuing to add additional nations, most recently is Amazon Netherlands. If you are currently selling in your own nation, consider expanding your reach by adding new Amazon channels.

👉 Read More: Does Amazon Ship To Vietnam?

The last year has had a significant impact on the rise of e-commerce. This is hardly unexpected given the various limits on physical retail sites and the fact that many people are spending more time at home. Connectivity advancements have supported the expansion of global e-commerce, with mobile accounting for more than 50% of worldwide web traffic in early 2021.

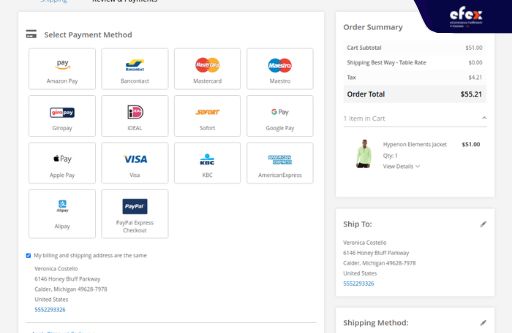

Mobile commerce has become a common method for many customers to acquire things. This tendency will continue to increase in cross-border markets as many online shops accept the introduction of e-wallets and simple worldwide payment options such as PayPal, Skrill, and Google Pay in addition to credit cards and bank transfers.

The power of delivery and logistics management businesses has also changed the way we obtain things and the delivery timeline. Consumers have greater control over their deliveries as more firms provide various package delivery options, allowing flexibility around their lives and when and where things may be delivered, working around their lifestyles. Better sales are likely to receive when online merchants concentrate on developing solutions that are tailored to the local market to whom they are marketing.

There are three outstanding benefits that you should consider in cross-border ecommerce:

Businesses must evaluate how these factors may impact their internet traffic and consumers. These difficulties may influence how individuals engage online and, consequently, their purchase decision.

Credit cards are the most often utilized means of payment for cross-border e-commerce purchases. Most online vendors allow AVSs or address verification systems, which validate credit cards used by purchasers, to reduce credit card fraud. While this reduces the likelihood of payment fraud, it does not accept consumers from countries where AVS does not exist.

Besides, customers may have various expenses added to the overall cost of the items in addition to the potential taxes of cross-border purchases. These prices may vary depending on how the buyer decides to pay for the items. Payment processors, card networks, and baking networks are all included.

Most taxes and restrictions are the same when shipping within the nation, so the entire procedure is pretty simple. However, shipping across borders gets increasingly difficult when new fees, legislation, and import and export procedures enter the picture.

Foreign currency taxation may range from region to country. This will alter the cost of the items sold, and if the additional tax is unclear at the moment of purchase, it may result in a terrible customer experience.

Here are examples of these drawbacks.

The overall cost of sending a product to an international buyer is often much too expensive to make the transaction profitable for the company. In other situations, particular items may be prohibited in other countries, preventing the transaction from taking place.

👉 Read More: Order Fulfillment Cost: All of the Fee You Need to Pay

To support foreign users, an e-commerce seller’s website should be able to handle international languages and currencies. This increases transaction speed, especially when comparing the costs of commodities. Currency values fluctuate, and changing currencies might result in extra expenses. Currency translation efficiency should be a key goal for the e-commerce business looking to maximize sales and reduce cart abandonment.

Unfortunately, because they cannot handle all languages and currencies, they will be confined to a small number. Consumers from countries where the language and currency are not supported will be unable to make purchases as a result.

There is one term that gives almost everyone goosebumps, and it applies to buying, selling, and traveling, which is the Big C - Customs. Each nation has its own restrictions on customs and how to clear them, and if you do not know customs regulations like the back of your hand, you will rapidly find yourself with a boatload of disgruntled consumers.

There is also the option of choosing a delivery firm that is already experienced with customs clearance, such as UPS or FedEx. It is their full-time job to ship parcels all over the world, and you would save a lot of time and possible hassles by letting them handle the grunt work. Learning the rules can take weeks, months, or years, time that might be spent attracting additional cross-border shoppers.

Pitney Bowes published an intriguing report that examined the split of payment methods in various nations, and the results are a little startling. In countries in Asia, for example, Japan - where almost 75% of people purchase online, they have something called “konbini”.

Konbini is similar to a convenience store in that customers locate a product they want online, take the reference number to a konbini, pay for it there, and then have it delivered.

While in India, as in other Asian nations, cash is king. Consumers go online, choose an item they desire, and then pay for it with cash when it comes to their doors.

For many European countries, for instance, Germany which is the EU’s most economically powerful country has slightly more than a quarter (30%) of online buyers using one of the major three credit cards, including MasterCard, Visa, and American Express for e-commerce transactions.

In contrast with Germany, Spain’s most popular online payment methods in La Furia Roja are MasterCards, Visa, and American Express. When it comes to online purchasing, almost everyone uses one of these three power cards. France, the land of great wines and cheeses located between Germany and Spain, has around 60% of internet shoppers utilizing a MasterCard, Visa, or American Express.

Foreign currency taxes are not a new occurrence. Date back to the 1600s, the economic instability caused by the pandemic has increased the number of nations charging foreign exchange transfers. According to RXC Intelligence data, before 2020, 8 countries imposed such taxes. This number has now climbed to 11, with only Libya abolishing such a tax in the last year.

It has also been very typical for nations having such taxes to raise them, like Argentina, which raised its PAIS tax from 30% to 35% in September 2020. Such taxes are especially frequent in emerging nations, which saw significant decreases in currency values in the months following the Covid-19 pandemic.

However, it is primarily the customer who suffers this additional expense - frequently without being informed of what they will actually spend. In other situations, when the bank statement arrives, it might be a rude awakening, with taxes and other FX transaction expenses totaling up to 40% of the purchase price.

Thus, card issuers need to offer a breakdown of costs on statements, but it is also important for merchants to provide clarity and openness to cross-border customers regarding the taxes they may be charged.

While taxes may only affect customers in some areas, practically all cross-border ecommerce purchases are subject to various sorts of hidden expenses. When a customer makes a cross-border purchase, the transaction involves more than simply their bank and the merchant's bank. Instead, various additional entities are typically engaged, such as a card network, payment processor, acquiring bank, and issuing bank.

Based on how the customer pays, no matter by choices or merchant’s alternatives, they may confront variable FX margins, which may eventually raise their final purchase price.

In one case studied utilizing FXC Intelligence’s cross-border transaction data, a UK customer who purchased a $100 goods from the U.S. and incurred costs of 5.71% if he/she paid in USD, but it would be 5.36% if paid in GBP. The card network took the majority of the costs in the first choice, whereas the merchant benefitted in the second.

These charges are generally comprised of FX margins, cross-border issuers fees, credit card processing fees, as well as taxes.

The amount a consumer is expected to spend in additional charges might vary substantially depending on where they are in the world and where they are buying from. So, while paying in their local currency is normally cheaper, it is not always true.

Thus, there is a significant possibility for retailers to enhance conversions and thereby income. Consumers are more likely to abandon their cart if they are unable to purchase their native currency, but by managing the currency conversion themselves, businesses can potentially keep more of the costs rather than passing them on to a card issuer.

With that much potential diversity, it is maybe not surprising that large retailers throughout the world handle cross-border transactions differently. According to the simplicity, customer choice, or more profit for the merchant is the priority. Many firms approach the problem of what currency to employ at very different times in the process with potentially dramatic differences for customers.

In certain circumstances, the merchant chooses the currency for the buyers, either by defaulting to the marketplace currency or by selecting a currency depending on the client’s location. According to FXC Intelligence data, it is now the most frequent technique and is particularly prevalent in mobility and education and freelancing, delivery services, and the technology industry.

However, almost one-third of merchants instead allow the consumer to select the currency in which they wish to purchase early in the process, and thereby, they frequently add a conversion fee to the advertised price.

For example, European low-cost airline Easyjet follows this strategy, charging 4.6 to 5% more than the mid-market exchange rate in converting from GBP, which covers both processing costs and profit for the business. Whatever alternative a merchant chooses, the optimal solution may ultimately depend on the product, buyers, and region. It is critical to be clear and open with the consumer.

Entering the world of cross-border ecommerce is an intriguing proposition. If done correctly, you may not only enhance your internet sales but also grow your global exposure. It will be very useful in creating a long-lasting brand that is well-liked by worldwide audiences for future generations. However, you have to consider critical problems like the worldwide demand for your items, how you will distribute them internationally, and how you will provide excellent customer support.