More Helpful Content

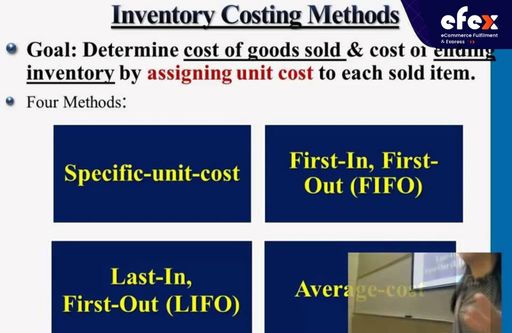

Inventory cost methods assist businesses in putting a monetary value on their most valuable asset. It is critical to comprehend what inventory is and how to calculate ending inventory. Inventories valuation methodologies assist firms in assigning valuations to inventory, gauging financial success, and identifying possibilities for growth. It is a critical inventory KPI for any company. Here's everything you need to know about the most prevalent inventory costing methods.

Specific costing methods must be used once the unit cost of inventory has been calculated using the preceding rationale. To put it another way, each unit of inventory will not have the same cost, hence an assumption must be made to keep a systematic approach to costing units on hand (and to units sold).

Inventory value has a direct and significant impact on a company's reported income, cash flow, and overall financial health. Inventory not only takes up a lot of room on the balance sheet, but it also speaks to a company's core ability when it moves smoothly. For instance, inventory days, sell-through rate, and inventory turnover ratio are all factors to consider.

If you don't have an exact value given to your inventory, all of your inventory measurements are useless. This necessitates the application and knowledge of inventory costing procedures. You may easily sell your products on a DTC or online marketplace once you've gotten your costs under control and accounted for.

The first-in-first-out strategy, sometimes known as FIFO inventory costing, posits that the products you buy first are also the goods you use and sell first. For businesses with perishable inventory or short demand cycles, the FIFO inventory method is used. This form of inventory is used by the majority of restaurants and bars.

Let’s take one example of a Coffee Company:

Following that, the price of the items will increase to $6 per pound.

The COGS FIFO technique formula is as follows:

FIFO Method = Cost of Oldest Inventory per Unit x Inventory Units Sold

If you're utilizing the FIFO approach to calculate COGS, you'll start by calculating the cost of your oldest inventory. Then multiply by the number of goods sold until you reach the total amount purchased at the oldest price. The rest of the inventory sold can then be multiplied by the new price. When you add them all up, you'll have a thorough picture of your COGS.

The LIFO technique, also known as the last-in-first-out approach, is a method of inventory costing that assumes a company's most recently bought goods have been sold first. That is, COGS and the cost of items available for sale are based on the most recent product valuation. The LIFO inventory approach is appropriate for businesses where goods prices fluctuate often.

As a result, the newer, more expensive items get used first. This strategy is unlikely to be used in a bar or restaurant.

The COGS LIFO technique formula is as follows:

LIFO Method = Cost of Most Recent Inventory per Unit x Inventory Units Sold

Let's look at a LIFO method example to see how the LIFO method formula works.

Consider the Coffee Company mentioned before. Let's utilize the same integers as in the last FIFO example:

The LIFO reserve is the $50 difference. With the LIFO approach, it's the amount of taxable income that's delayed.

👉 Read More: LIFO – FIFO Inventory Cost Method: How To Calculate And Example

The HIFO (highest in, first out) approach of inventory valuation posits that the merchandise with the greatest purchase cost is consumed or removed first. This has the costing connotation that COGS should be as high as possible. While keeping the ending inventory's value as low as possible. This can help to balance a company's books.

The HIFO approach isn't often utilized for inventory appraisal. While it reduces taxable income for a short period of time, it isn't considered a best practice. There are two main reasons for this:

The weighted average cost inventory technique determines the cost of inventory items by dividing the total COGS by the total number of inventory items. It's also known as the weighted average inventory method or the average cost inventory method.

Companies can gain an accurate assessment of the cost of items currently available for sale by multiplying the average cost per item by the ending inventory count. The same average cost per item can also be used to calculate COGS for the prior accounting period. Simply multiply it by the number of things sold within that fiscal period.

Let’s consider the quarterly inventory ledger of the Coffee Company that we mentioned above.

| Purchased On | # of Items | Cost/Unit | Total Cost |

| 1/6/2021 | 300 | $5 | $1,500 |

| 2/4/2021 | 200 | $5 | $1000 |

| 2/15/2021 | 350 | $6 | $2,100 |

| 3/2/2021 | 125 | $5.50 | $687.50 |

| Total | 975 | $5287.50 |

Assume the Coffee Company sells 640 units during the quarter. The average cost of each unit is calculated by dividing the entire inventory value by the total number of units sold.

$5,287.50 / 975 = $5.42

The COGS is calculated by multiplying the average unit cost by the number of units sold:

$5.42 x 640 = $3,468.8

And the cost of products available for sale is calculated by multiplying the average unit cost by the ending inventory. That is the 335 units that were not sold.

$5.42 x 335 = $1,815.7

The Weighted Average Cost Inventory Method has a disadvantage known as the "smoothing" effect. This effect can potentially distort the actual cost of goods sold and the value of ending inventory, especially in a volatile pricing environment. Under the Weighted Average Cost method, the cost of goods sold and the value of ending inventory are calculated by averaging the costs of all units in stock, regardless of when they were purchased.

While this method can provide a relatively stable and predictable cost flow, it may not accurately reflect the current market prices of the goods. This smoothing effect can distort financial ratios, mislead stakeholders, and potentially violate the principle of matching expenses with revenues. As a response to this disadvantage, some companies may opt for more specific inventory costing methods, such as First-In, First-Out (FIFO) or Last-In, First-Out (LIFO), to better align with the actual flow of costs and market prices.

The replacement cost of inventory is another approach to value it. The inventory replacement cost technique sets a value based on how much your company will spend to replace that inventory item once it has been sold. This, of course, means that the value allocated changes over time, based on the pricing of the provider at the time of replacement.

Along with the quantity of your order, the cost of replacement may be reduced with a MOQ and bulk shipping savings. It is critical to emphasize that the replacement cost should be less than the market value. This is because market value is a forecast, whereas replacement cost is actual money spent that is now locked up in inventory. The other alternative, as previously said, is the market price. This gets us to the lower cost or market criterion in GAAP.

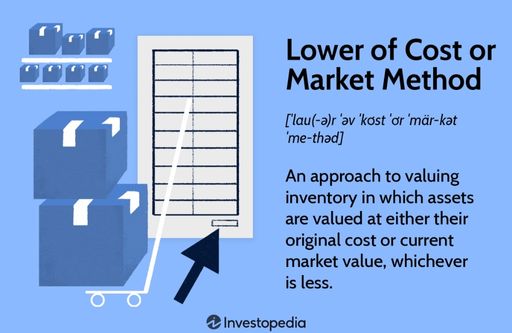

The lower cost or market method or rule provides value to inventory based on the lower acquisition cost or the inventory's current market worth.

Inventory value fluctuates over time. When the market value of inventory is less than the cost of acquisition, the business suffers a loss. When this occurs, businesses can record the loss using the lowest cost or market. As a result, companies with outmoded inventory prefer the lowest cost or market rule. Long-held inventory often has a lower cost or market value. And the lowest cost or market rule is governed by GAAP.

Here's how the lower-cost technique works. Consider the Coffee Company once more. Here's what they've got:

| Coffee Type | Current Inventory | Unit Cost | Total Inventory Cost | Market Value per Unit | Lower of Cost or Market |

| Robusta | 800 | $6 | $4,800 | $10 | $4,800 |

| Excelsa | 700 | $9 | $6,300 | $4 | $2,800 |

| Arabica | 1000 | $5 | $5,000 | $11 | $5,000 |

| Liberica | 500 | $5 | $2,500 | $10 | $2,500 |

It's worth noting that the Excelsa coffee beans have a lower market value per unit than the price at which they were purchased. That's a setback. Companies in this situation are permitted by GAAP to record the inventory value at market value (the lower of the two). As a result, businesses are protected from severe price swings. Consider what would happen if that Coffee Company had to register $2,800 in coffee at the acquired price of $6,300. That disparity would have a significant influence on their balance sheet's soundness.

No, there is no such thing as a lower cost or market formula. The lower cost or market rule is a method of accounting, not necessarily a computation. It assists firms in reducing their recorded losses in a GAAP-compliant manner. You may have guessed by now that inventory management may be as easy or as complex as you want it to be. One thing is certain: it can provide you with a critical picture of your company's health. It might assist to challenge your preconceptions about the strength of your sales by highlighting the cost of products sold and the time it takes to shift various types of stock.