More Helpful Content

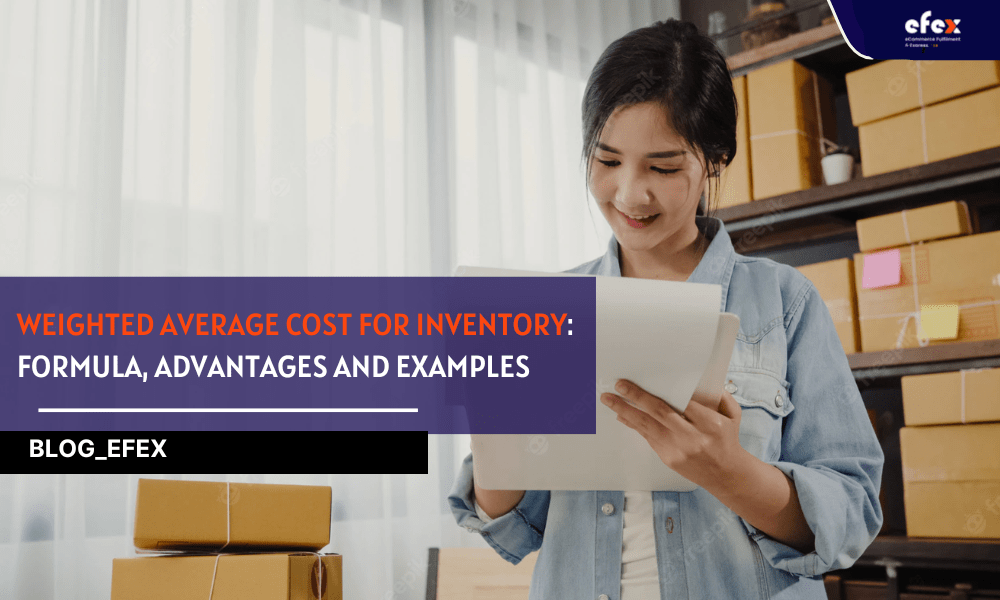

Companies that have inventory on hand should be aware of the average inventory costs by individual expenses and the total number of groups stored. Keeping track of stock levels as well as the value is important for eCommerce companies. You can effectively manage your inventory and estimate potential profit by using the suitable inventory tracking method. Various eCommerce inventory valuation approaches streamline the process. The inventory weighted average cost formula is one of the most common solutions. In this article, let's discuss how to determine the inventory weighted average cost and its pros and cons.

In accounting, the phrase “weighted average cost” (WAC) or inventory weighted average mentions to the method of calculating costs related to a company's COGS (cost of goods sold) and inventory. Since particular types of inventory are not available, it is usual for companies to pay varied prices when purchasing inventory. This may get mixed up with specific pricing eventually. The weighted average cost for inventory approach assists companies in determining the total cost of inventories and COGS.

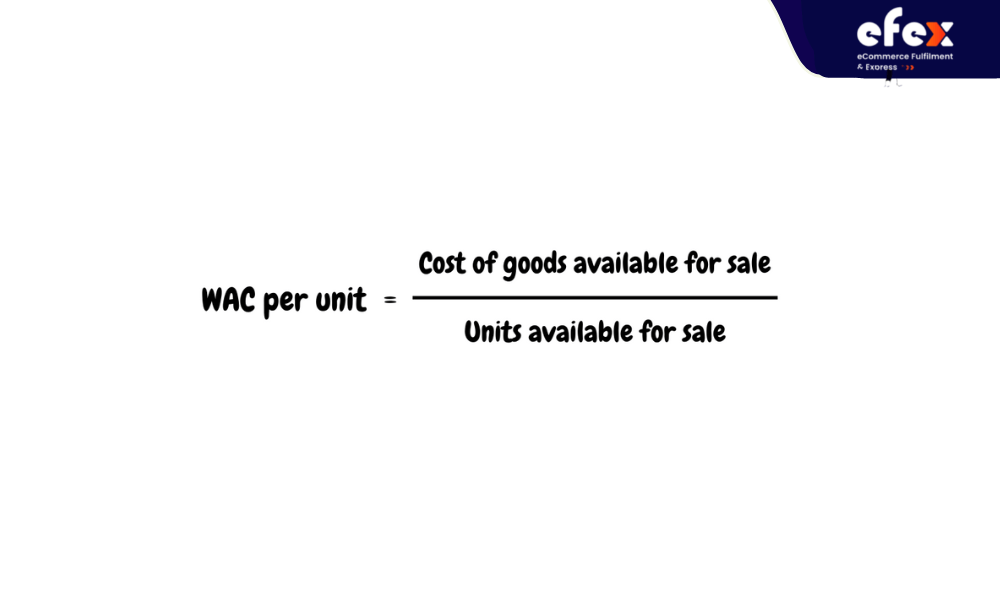

In order to calculate this cost, you simply divide the cost of goods ordered by the number of units listed for sale to get the WAC. You'll need to have the full sum of beginning inventory and new additions to calculate the cost of products listed for trading. The final figure will yield an inventory weighted average pricing for each item on the market.

In which:

To further understand how the average cost method of inventory is calculated, let's consider the following examples using the weighted average inventory formula:

At the start of its fiscal year on 1st Jan, a reported a starting inventory of 400 units at $100 per unit. The following purchases were made by the end of the first quarter:

So, the total number of units available before sales: 400+200+100+300 = 1000 (units). The sales were reported as follows:

So, 104+210+196 = 510 units sold in total during 1st quarter. The accountants at the firm want to utilize the periodic inventory system, which determines the COGS and items available for sale at the end of the 1st quarter as follows:

| WAC per unit =(400*$100+$1,000+$12,000+$9,000)/1000=$62 |

The business set aside $62 per unit sold for the sale of 510 units from January to March. The remaining items were placed in ending inventory, yielding the following figures:

Businesses that use the perpetual inventory system calculate the average cost before selling units. Before the January sale of 104 units, the average unit cost would have been as follows:

| WAC per unit = ($40,000 + $1,000)/(400+200)=$68.33 |

Following the January sale of 121 units, the costs are as follows:

Due to the various advantages it provides, such as time efficiency and accuracy, the average weighted cost of inventory approach is one of the most widely used stock valuation techniques. Here are several benefits of including the weighted-average cost in your inventory management strategy.

Keeping track of inventory levels is one issue; managing the costs of purchasing and storing goods is another. Unlike FIFO (first in, first out) and LIFO (last in, first out), which employ a range of costs, the WAC method utilizes a blended average, making inventory valuation easier to calculate and control.

To calculate the average price of all in stock, the WAC technique needs a single cost calculation. You do not need to keep accurate inventory purchasing documents because each item is priced at the same value, which means less paperwork to keep care of.

If you do not really take the time and effort to streamline your managing inventory process, it might eat into your earnings. Rather than calculating each sellable group and then combining the price of each item, the WAC method gives a simpler way to calculate the current stock value, which saves you money in the long run. Deploy an inventory management tool and/or engage with a third-party logistics (3PL) service that offers inventory management software, real-time inventory reports, and eCommerce warehousing to streamline your process and minimize inventory management costs. You can also eliminate human mistakes, labor costs, and inventory carrying costs by improving your inventory control and reorder quantity.

When your inventory values vary considerably, you may well not be able to recover the prices of the more expensive items. You may even make a loss on your sales price using this method. The theory behind the strategy is that you will recoup any losses by selling the lower-priced items. If this does not occur, you may be forced to discontinue the product, never recouping the losses incurred when the expensive goods are sold. This method implies that all units are the same, which isn't necessarily the case. Improvements or extra features may have been applied to newer batches of products, making them eligible for a better price than previous stock units. This is especially difficult when a supplier updates a product with a new one that shares the same name as the old one. Lastly, the average cost technique is retrospective, in that it examines what was paid per unit over a period of time.

When mentioning controlling levels of inventory, consistency is vital, and it can make the process of taxes and analyzing financials annually easier. The WAC method is an excellent way to quickly assess inventory value and keep accurate accounting records if you supply numerous SKUs of similar items. You can monitor the value of goods over the year for correct inventory accounting while saving a lot of time by utilizing the inventory weighted average cost approach. However, managing inventory involves much more than just monitoring the value.