More Helpful Content

Beginning inventory refers to a measure that can help you assess demand, monitor inventory management, and budget for deducting tax. Therefore, knowing how to determine the beginning inventory value and what this quantity represents for your business's health is critical. In this post, you'll learn about the definition of beginning inventory, the beginning inventory calculation, as well as its meaning for your company's finances. If you're still having trouble with inventory management, we recommend reading the full article.

Beginning inventory refers to the cost of inventory recorded in a company's accounting records at the beginning of a period of the accounting. It is the inventory cost recorded at the end of the previous accounting period and carried forward to the beginning of the next accounting period. Beginning inventory refers to an existing asset that is recorded as an asset account.

Theoretically, it does not show on the balance sheet because the balance sheet is prepared as of a specified date, which is basically the end of the accounting period, and thus the ending inventory balance is included. Beginning inventory, on the other hand, is the same as ending inventory from the previous accounting period, hence it appears on the balance sheet as ending inventory from the previous period.

From the beginning of an accounting period, you'll determine the beginning inventory. Beginning inventory may provide details about your business's success, including inventory value and inventory turnover, by comparing it from one period to another. Knowing the cost of starting inventory is advantageous to your company for several reasons, including:

Any adjustment in beginning inventory counting from the prior period usually indicates a company shift. For example, increasing sales over time can have led to a lower starting stock total than the month before. A rise in initial inventory might signal a drop in sales. Beginning inventory is a crucial part of inventory accounting that you'll have to utilize in the following areas at the start of an accounting period.

If you didn't repurchase sufficient stock, a more increased quantity of products left than expected could signal a deterioration in your inventory management process. When you have small or even no initial inventory, it's possible that you ordered too many things in the prior period.

Similarly, keeping too much or too little inventory than normal may signal an issue in the supply chain. It's conceivable that your provider lost your order or that just a part of your inventory buys arrived.

You may preorder inventory once you know how much you'll need for the next period as well as how much stock you have at the conclusion of an accounting period. By reducing your tax liability, you can minimize the tax liability.

When the amount of inventory that should’ve been reported differs from what was reported in reality, it is called shrinkage. For retailers and online sellers, this problem might be caused by damaged goods, human error, or potentially stolen things. While errors may occur, it's critical to keep track of shrinkage trends to ensure that staff isn't taking goods.

Beginning inventory is considered to be a method for a deeper understanding of your small business's selling and functional trends. You can optimize your inventory management strategy using this information and the summaries you can derive from it. Besides, you can also reduce inventory costs and increase gross profit by using a better inventory technique.

The below-beginning inventory formula commonly coincides with determining the initial inventory of an accounting period, whether you're utilizing a perpetual inventory system or the periodic inventory technique.

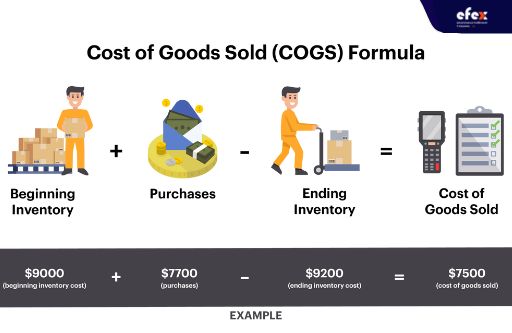

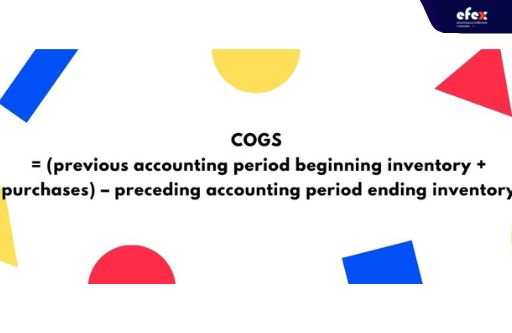

You can utilize the records from the preceding accounting period to estimate the cost of goods sold at the close of an accounting period.

| Cost of Goods Sold (COGS) = (Beginning Inventory + Purchases) – Ending Inventory |

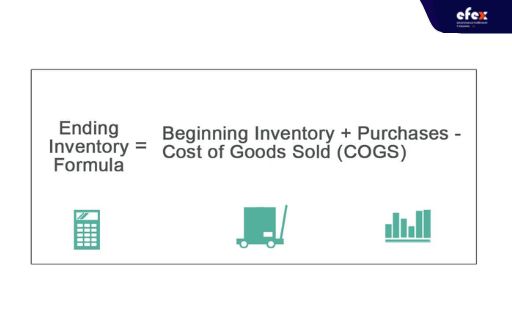

You can use your accounting records from the previous financial period to figure out where you left off. In other terms, your Q2 ending inventory becomes your Q3 beginning inventory. If you're estimating ending inventory for the first time, you'll need to figure out the quantity of fresh stock that was purchased and sold over a period of time. Beginning inventory plus net purchases are purchased stock in total in a period of time.

| Ending Inventory = Beginning Inventory + Net Purchases – COGS |

Note: Selecting the perfect inventory valuation technique for your beginning and ending inventory is critical for keeping your balance sheet healthy. LIFO, FIFO, or even an inventory weighted average can all be used to value inventory.

The basic beginning inventory and ending inventory formula you can see here is straightforward:

Beginning Inventory = COGS + Ending Inventory - Purchases

Let's go over the stages for finding the starting inventory:

It's critical to double-check your calculations if you're going to manually estimate this figure using the starting inventory calculation. Using a wrong number for initial inventory might lead to a cascade of errors and misguide future judgments. You might want to use a basic inventory calculator to assure accuracy.

Here's a beginning inventory example to aid you to get more acquainted with the basic starting inventory formula:

COGS = 1,000 x $20 = $20,000

Jazi's Mugs had 500 mugs available at the close of the preceding accounting year, then they produced 1,000 more the following year.

Ending inventory: 500 x $20 = $1,000 New inventory: 1,000 x $20 = $20,000

For example: $1,000 + $20,000 = $21,000

Beginning inventory + net purchases - ending inventory

Example: $21,000-$20,000 = $1,000

Large companies that transport a significant number of orders across multiple areas sometimes outgrow centralized inventory and go for a 'distributed' inventory system, in which inventory is split up and housed in multiple fulfillment facilities across the country. This can help accelerate order delivery while lowering shipping expenses. The good news is that utilizing several warehouses does not necessitate locating the beginning merchandise inventory in each. You can enter it into your inventory management system and get real-time inventory counts can be achieved by engaging a tech-enabled third-party logistics (3PL) business.

- See more: Tracking signal calculator And Example

One factor in strengthening the system of inventory management as well as the financial condition of your organization is understanding the methods to calculate the beginning inventory. Beginning inventory, like any business accounting, is a useful approach to better understand a company's sales and operational patterns and make modifications to the business model based on the data. Take control of your company and make wise decisions that will enable you to manage, sell, and expand it.