More Helpful Content

Companies selling tangible goods and those engaged in maintenance and repair both need to keep track of their obsolete inventory. The quantity of obsolete inventory that a company has can be a key sign of whether inventory management and purchasing are being optimized or whether they need to be reevaluated. At this point, journal entry for obsolete inventory comes into play.

Obsolete inventory can hinder a company's capacity to storm a tough patch as it can cause serious cash flow issues. If a business with low margins frequently has inventory that is out of date and doesn't deal with the issue, it could put itself into serious trouble. To avoid this problem, your company needs to find a way to manage obsolete inventory by recording the inventory cost accurately and punctually.

The business will incur considerable inventory expenses due to the amount of its inventory. Inventory outdated is one of them. Since inventory obsolescence is a cost that neither the firm nor its customers profit from, the company will make every effort to keep it to a minimum.

Before the inventory reaches its expiration date and turns obsolete, it will still be listed on the company's balance sheet for quite some time. By then, we are assured in the entire amount of outdated inventory should be recorded as an expense (cost). According to the accrual basis, the cost should be spread out over time as opposed to being recorded in a single month.

So this is the time that the accounting or journal entry for obsolete inventory comes into play. Each accounting period, the business must estimate how much of its inventory will become obsolete and record its expenses. They shouldn't hold off until the inventory is actually out of date.

👉 Read More: How Can You Disposal Of Obsolete Inventory?

Inventory purchases are made by the business and are listed on the balance sheet. The asset will be listed as current assets.

👉 Read More: Is Inventory A Current Asset? Definition and Example

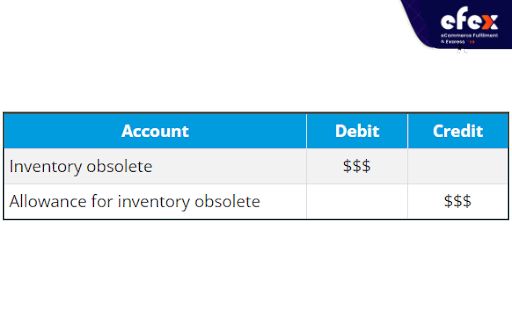

The business is aware that a few of the goods won't be used up and will eventually become obsolete. Therefore, based on its estimation, the company must record the cost. Based on statistics and the type of product, management makes an estimation of the obsolete inventory. At this time, inventory outdated costs are debited and allowance for obsolete inventory is credited in the journal entry

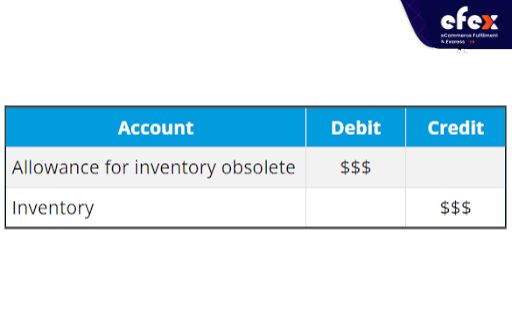

The business must quantify and make the necessary adjustments when the actual inventory becomes obsolete. The out-of-date inventory should be taken off the balance sheet at this point because it will have been disposed of. The business must get rid of the goods and reverse the allowance for outdated inventory. As the firm has already anticipated and documented the expense, the transactions will not affect the expense report on the income statement. Allowance for obsolete inventory is debited and inventory is credited in the journal entry.

The income statement and the inventory's net balance won't be affected by the transaction. The net balance for inventory is calculated as the sum of the cost of inventory and the allowance for outdated items. Therefore, even if this journal lowers both accounts, the overall sum is unaffected.

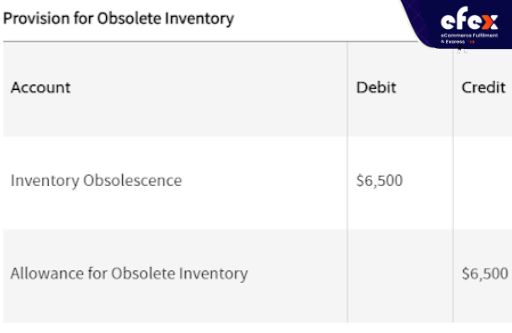

For instance, a business finds the $8,000 value of the outmoded stock. The inventory value is then written down after estimating that it can still be sold on the market at the price of $1,500. As the inventory's value decreased from $8,000 down to $1,500, the difference, or $6,500 = $8,000 - $1,500, is the value decrease that must be recorded in the accounting journal.

In order to keep the initial inventory cost on the inventory account till it is rid of, the allowance for an outdated inventory account is now a reserve that is kept as a contra asset's value. Both the allowance for obsolete inventory and inventory assets are cleared once the obsolete goods have been completely disposed of.

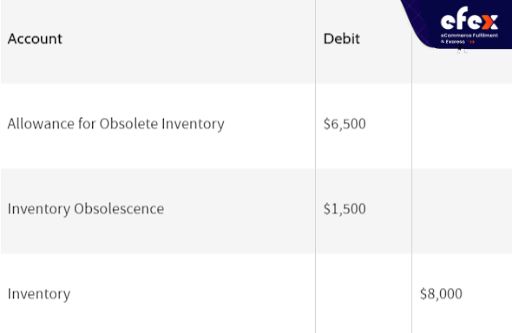

For instance, the corporation would not collect the $1,500 sales value if it threw away its outdated goods. Thus, the business must now record an added cost of $1,500 in addition to writing down the inventory. This journal entry will be made to release the allocation for obsolete inventory:

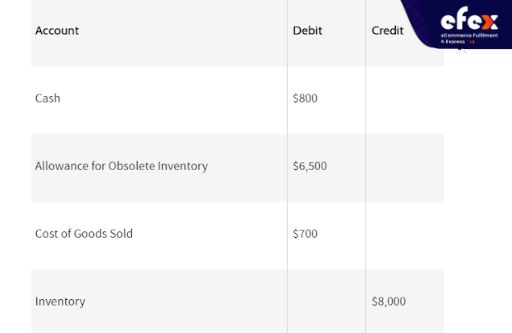

The journal entry eliminates the value of the out-of-date goods from both the inventory account and the allowance for the out-of-date inventory account. Alternately, the business could have sold the merchandise for a profit, like $800 at an auction. In this instance, the $800 in auction revenues is $700 less than the $1,500 in book value.

A cost account will be charged with $700, and the journal entry will reflect the sale of the merchandise and the receiving of $800 from the auction:

The inventory's $1,500 net value less the $800 in sales proceeds resulted in an extra $700 loss on disposal, which was recorded in the COGS account. Investors should be cautious if there is a significant amount of outmoded goods. It may be a sign of subpar items, subpar demand forecasting, and/or subpar inventory management. Investors can determine how well a product is selling and how efficiently a firm manages its inventory by looking at the number of obsolete inventory it produces.

👉 Read More: Inventory Journal Entries in Accouting: Step And Flow

👉 Read More: Perpetual Inventory System Journal Entry: Example, Calculation

A lot of companies spend big bucks on obsolete inventory. Even though it's common for low quantities of inventory to need to be written off, the outmoded stock doesn't need to make up a significant portion of the liabilities on the balance sheet. Ultimately, a journal entry for obsolete inventory is the way to go for recording the inventory cost which helps reduce obsolete inventory. Hope you have a good time with EFEX.