More Helpful Content

Inventory management is essential for firms that make or sell goods. These companies must account for their inventory by recording transactions linked to the purchase and sale of the items that make up their stock.

Learning about various inventory accounting entries will help your company balance its finances and keep track of its inventory transactions. We explain inventory journal entries definition and offer steps and examples of different types of entries for you to utilize in your business in this post.

Inventory transactions can be documented using some inventory journal entries. The majority of the inventory transactions are generated for you by a modern, automated system of inventory tracking, so it's not always clear what journal entries are about.

However, you may need to produce several items below as manually journal entries included in the system of accounting over time.

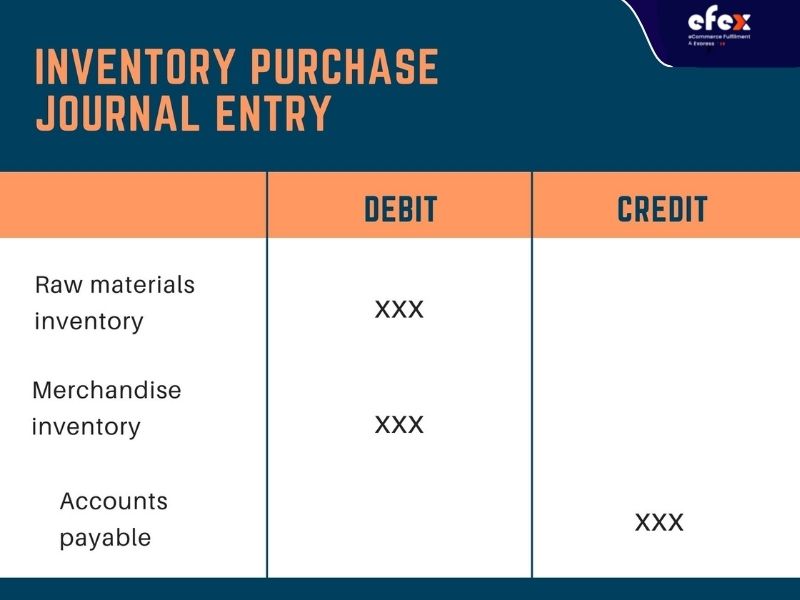

The system of accounts payable is used to process the initial inventory purchase. Relying on the types of the products acquired, either the goods stock or the inventory for raw materials account will be debited. This is the entry:

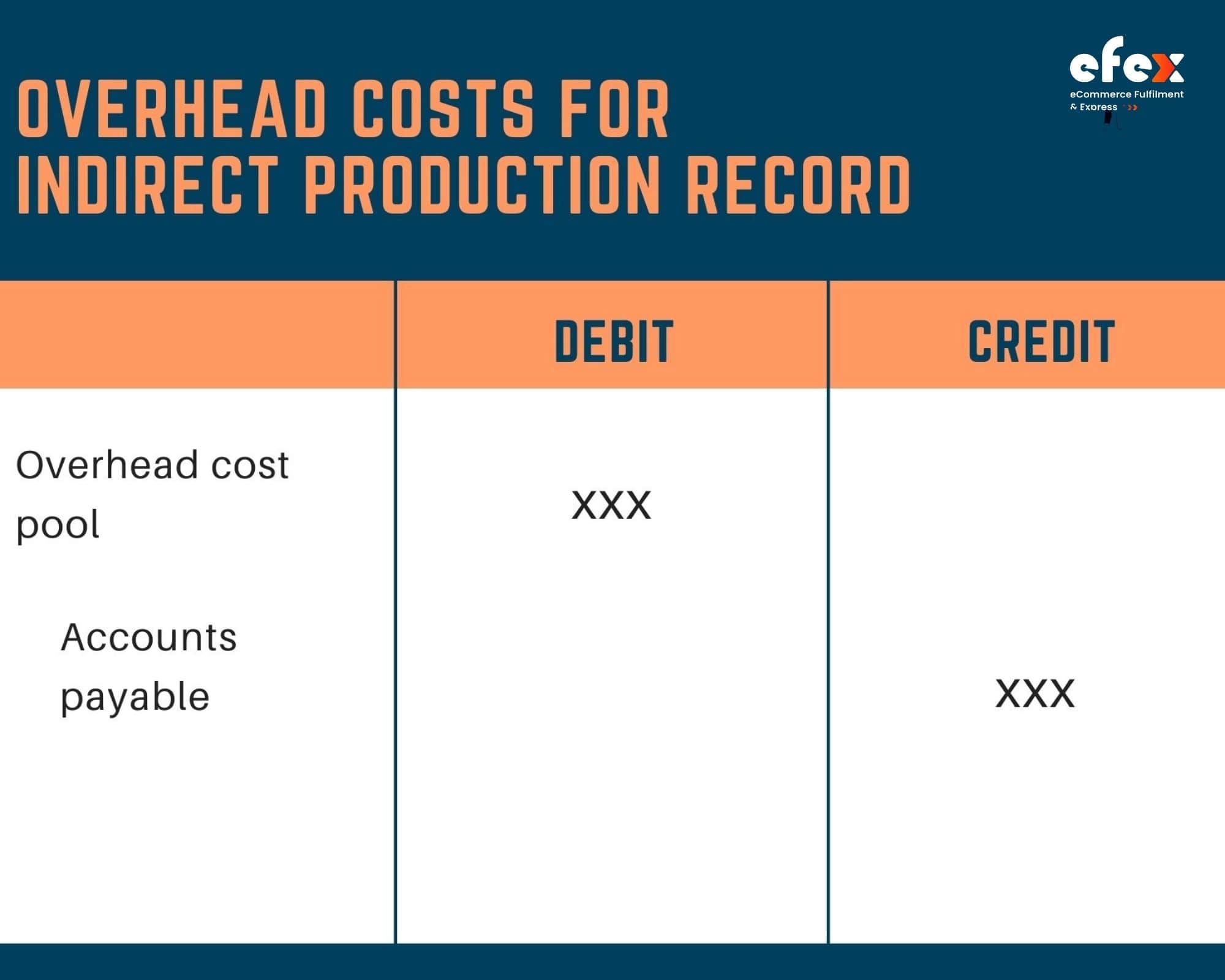

Rentals, utilities, and supplies for the production line are examples of the costs related to the production that is assigned to inventories. These expenses often start as accounts payable, then assigned into an overhead expenses pool before being allocated to inventories and COGS.

The distribution to a cost pool might arise later, but we'll suppose it would happen at the point of the first accounts payable recordation, as indicated by the following entry:

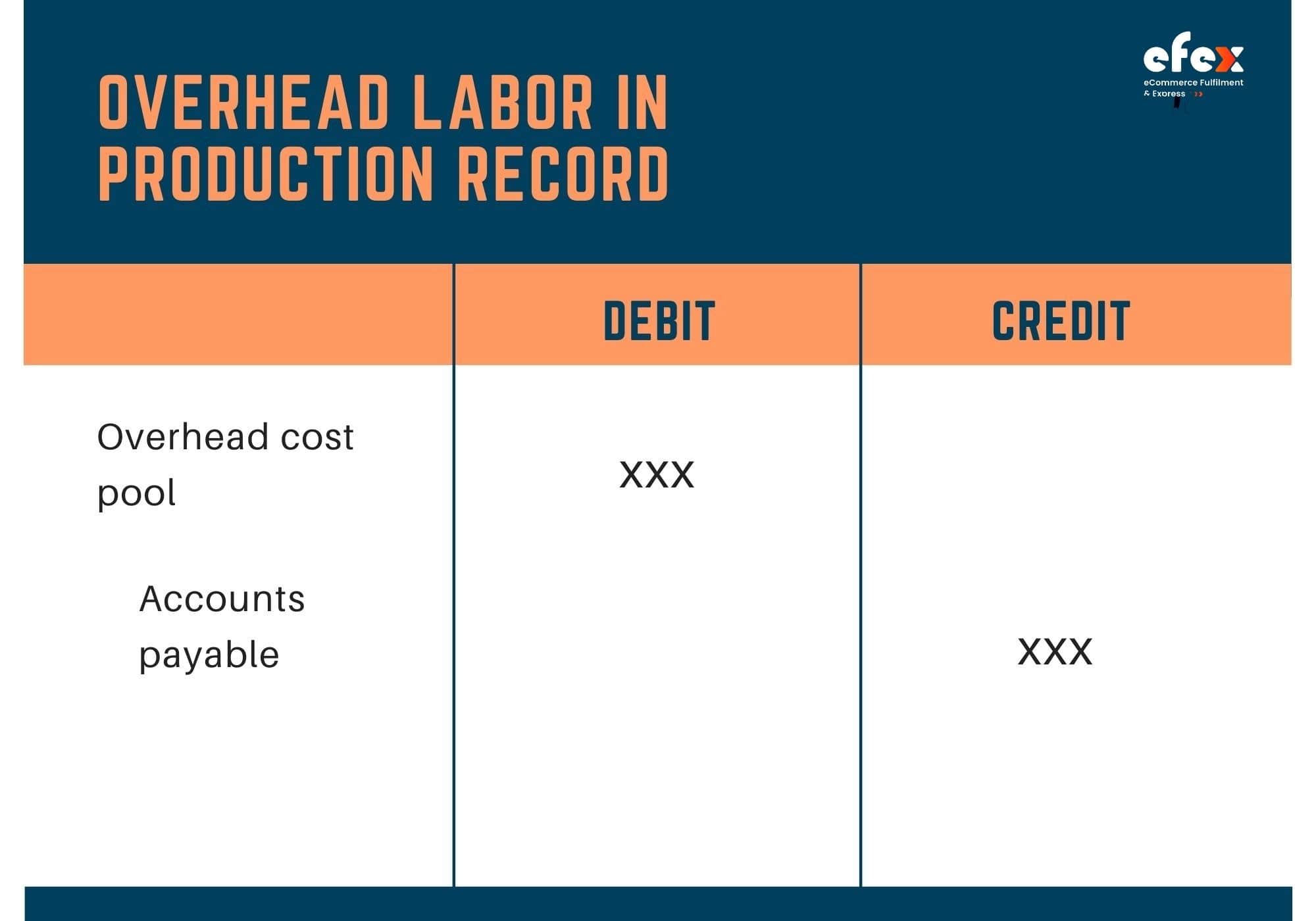

Before being assigned to inventories, production labor, including production planning and control wages and warehouse management salaries, is often processed into an overhead expense pool. This is often accomplished by placing the wage costs into an expense pool, as seen below:

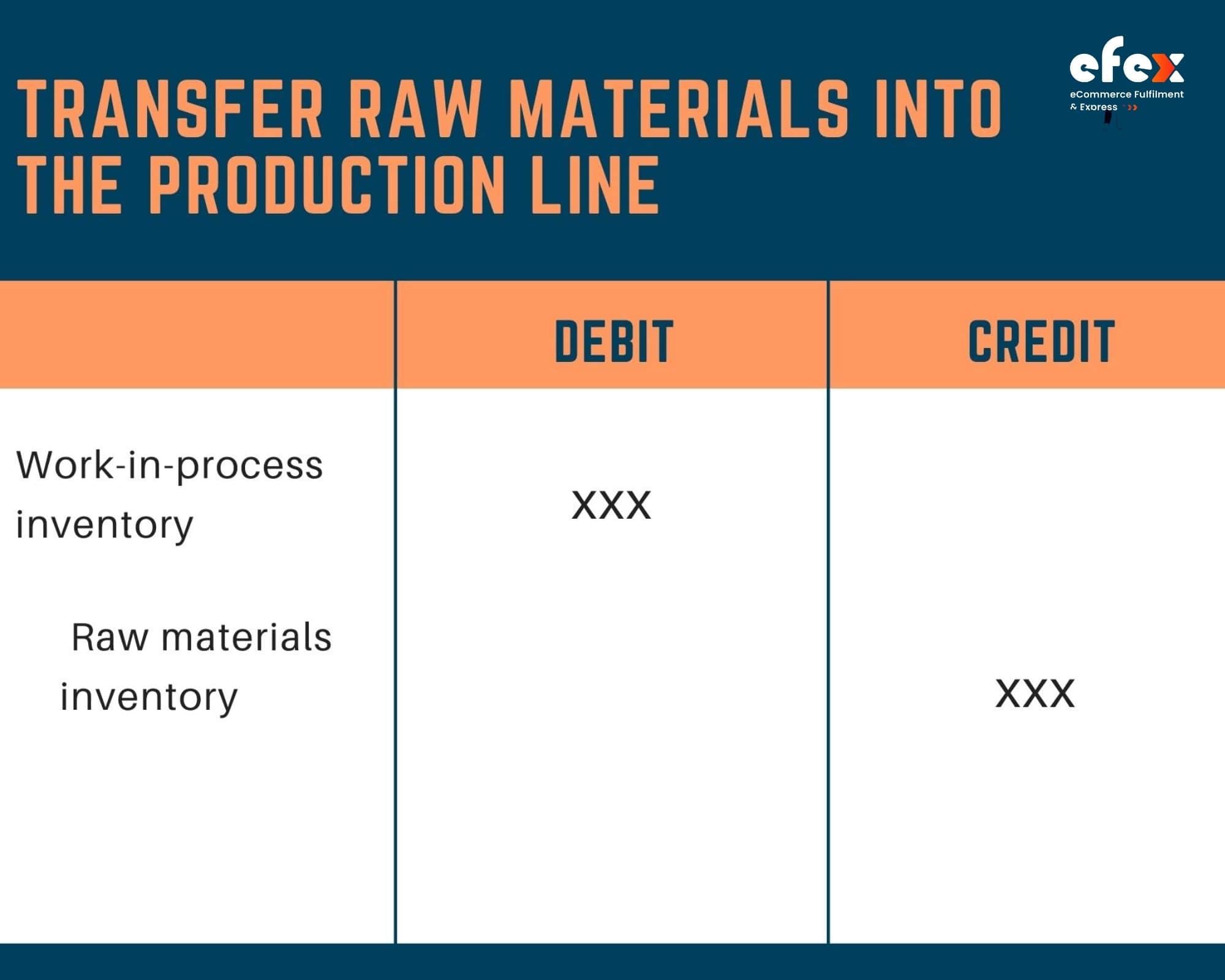

If you run a manufacturing plant, the warehouse employees will select raw materials in inventory and move them to the manufacturing floor, maybe by step number.

An extra journal entry is required to legally transfer the commodities to the account of work-in-process, as indicated in the following table. If the manufacturing process is not too long, it can be more straightforward to move the raw materials costs from the account of work-in-progress to the finished goods account.

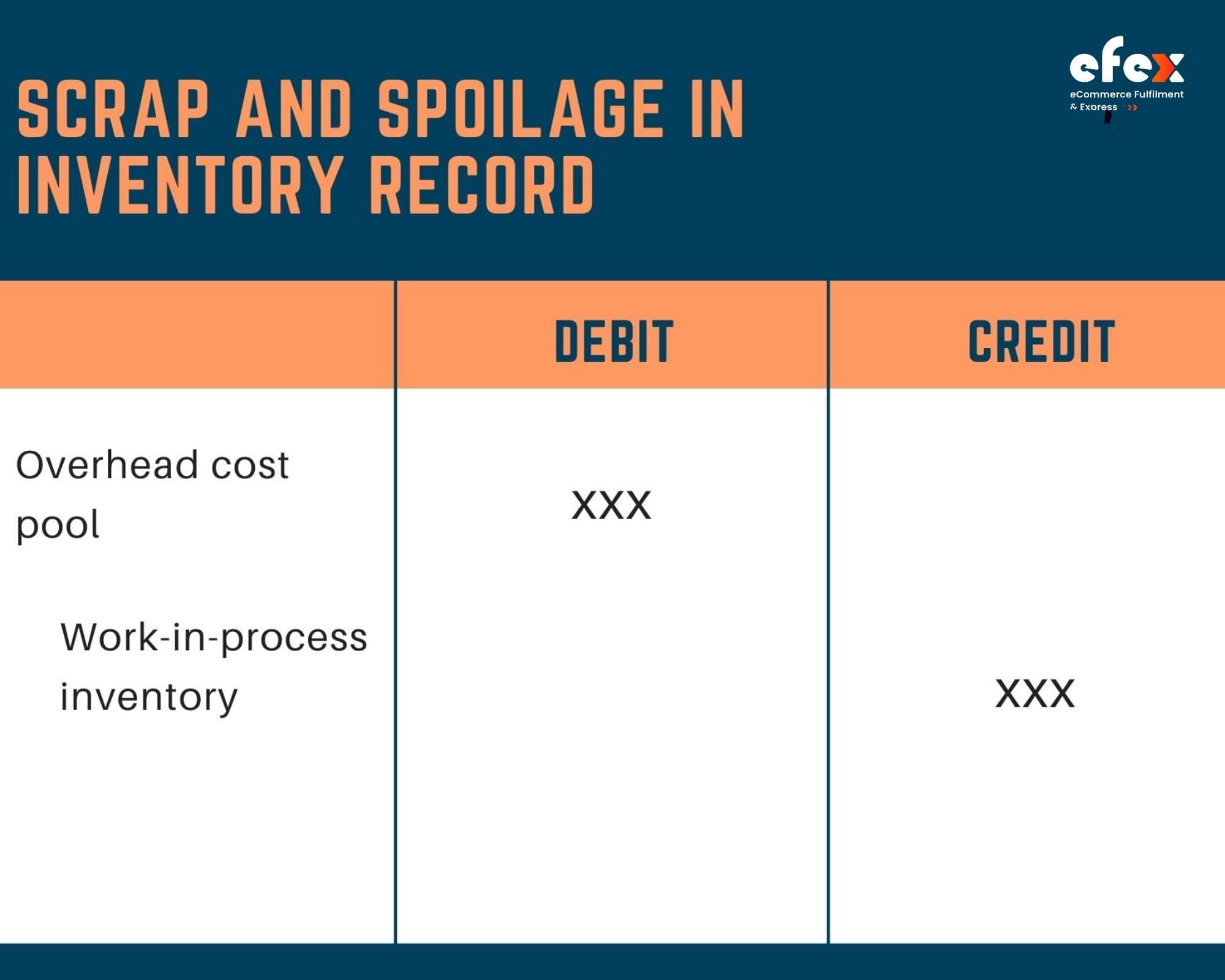

During the production process, a particular amount of scrap and spoiling will always occur, which is generally documented in the overhead expense pool, then assigned to inventories.

Instead, pay the odd sum to the expense of things sold if these values are exceptional (therefore, they aren’t considered to be an asset). The first situation is represented by the following entry:

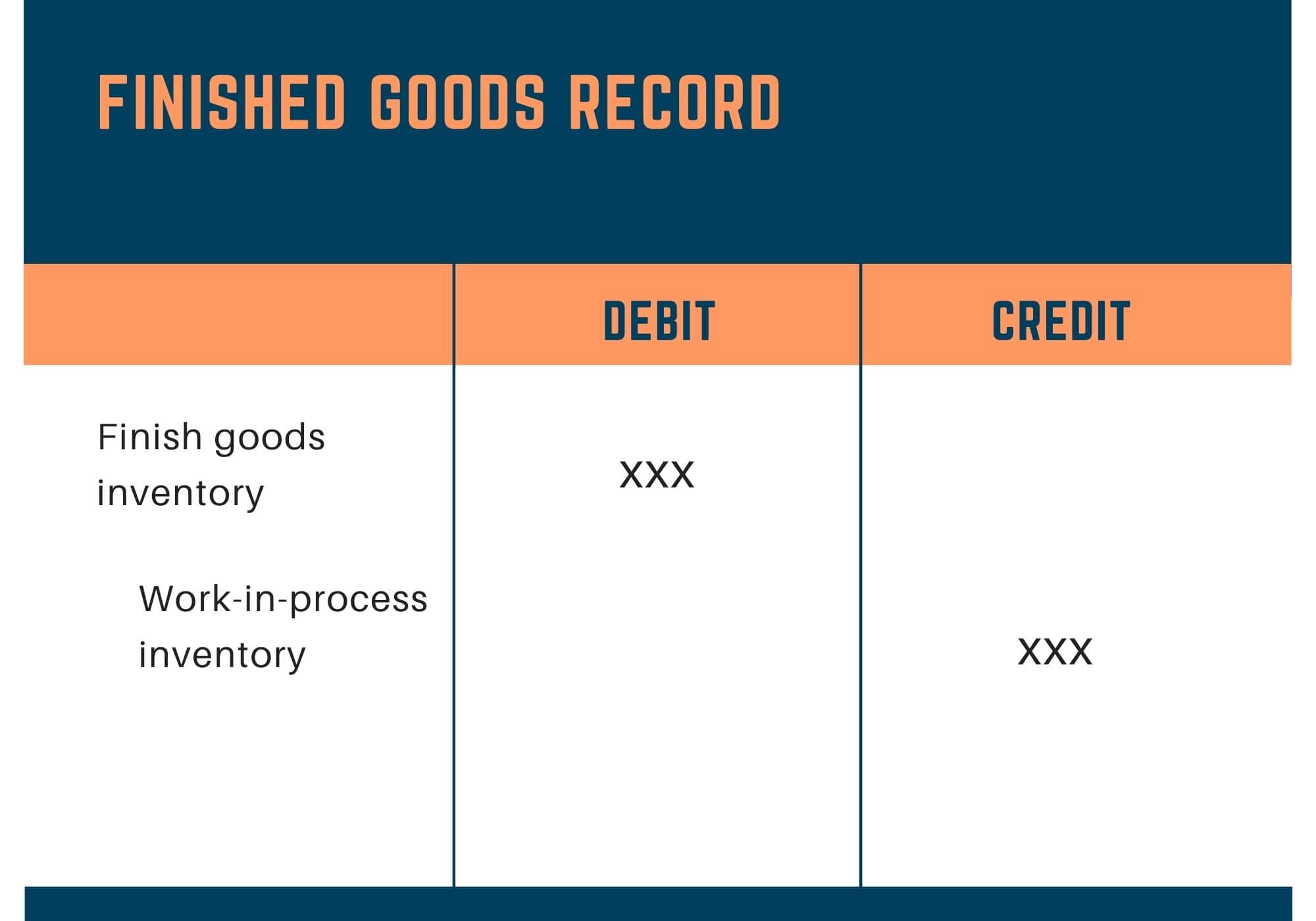

Enter the following entry to move the value of these materials into the completed products account when the manufacturing plant has changed the work-in-process to finished goods:

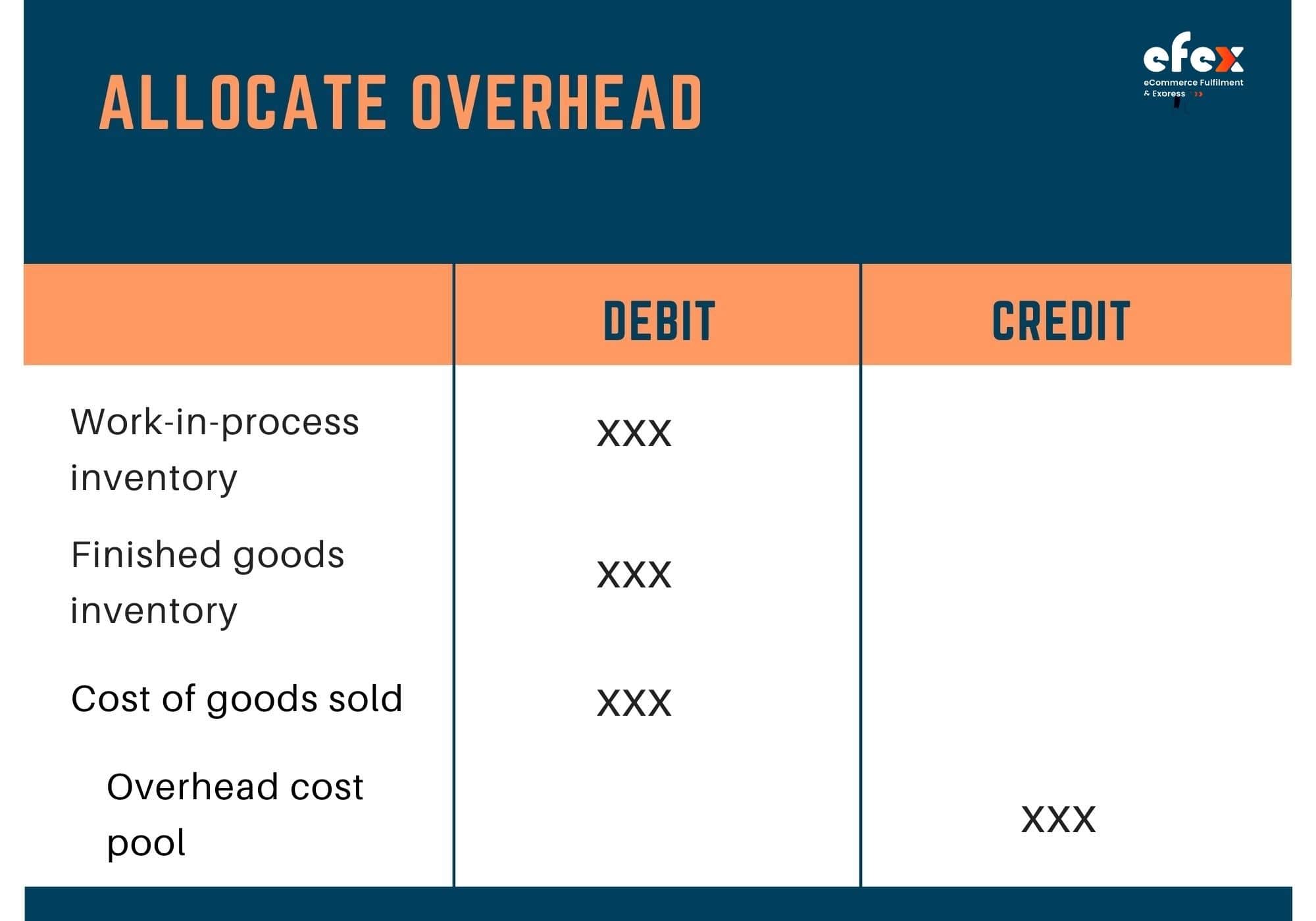

Allocate the whole overhead expense pool into work-in-process stock, final product inventory, and COGS at the conclusion of each reporting period, generally depending on their respective cost proportions or another readily supported assessment. In this case, we will have a journal entry as follows:

👉 Read More: Manufacturing Overhead Journal Entry

Production labor, such as production management wages and warehouse management wages, is likewise routed through an overhead cost pool before being assigned to inventories. This is commonly done by transferring the salary expense into a cost pool, with the following entry:

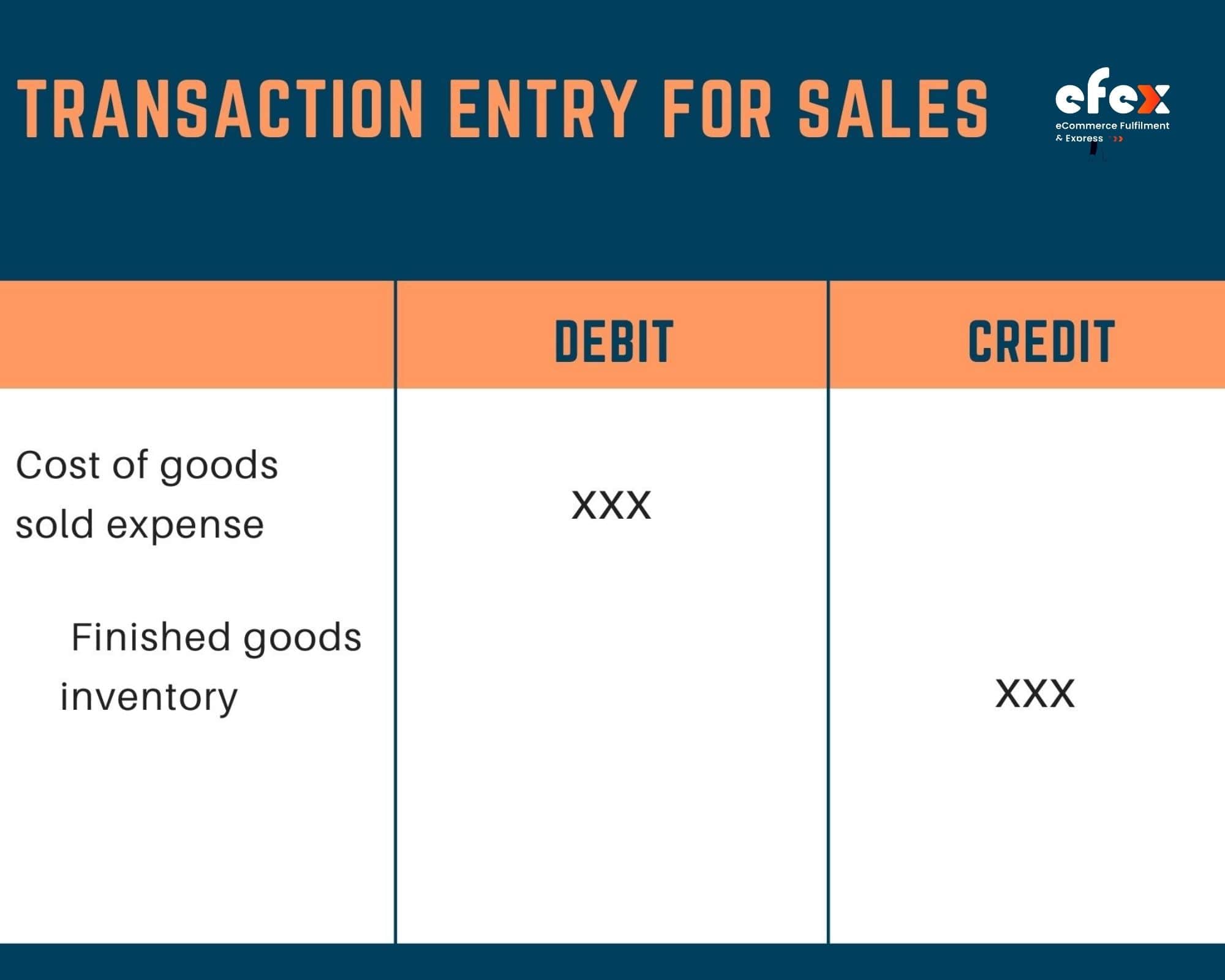

In a different entry for selling transactions, you can enter an offsetting and a sale rise in receivable accounts or cash. In a similar reporting period to the relevant COGS transaction, the entire period of a transaction for sale should be recorded.

The fundamental inventory transfer into the production procedure and out to the consumer as a deal has now been completed with journal entries. Adjustments for outdated inventory and the lower expense or market criterion are two more rare instances that occur frequently.

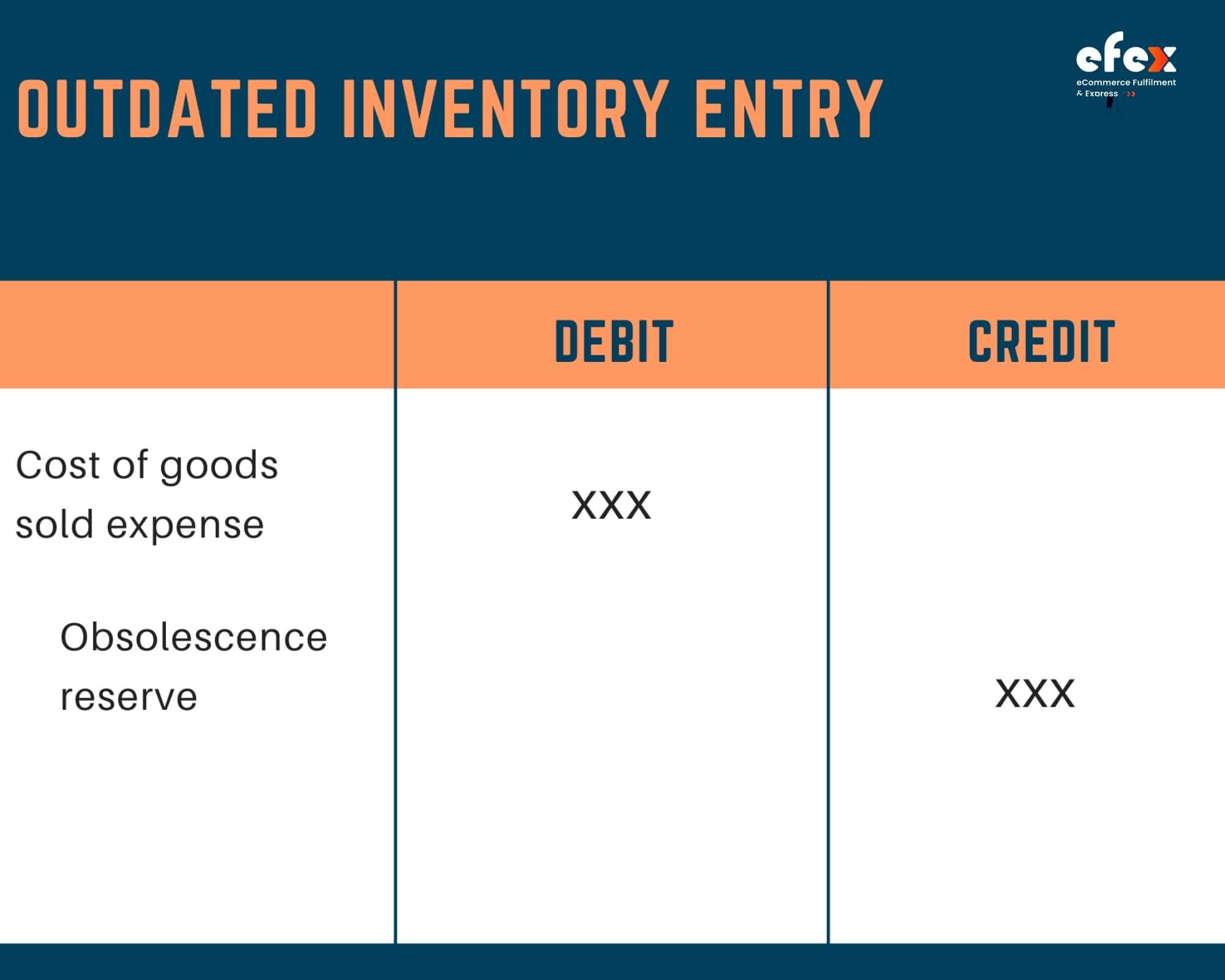

Because outdated inventory is probable to appear on a frequent basis, it is advised that a small amount be charged to the cost of items sold and a reserve account for unsold goods be created using the following entry:

When you discover and label outdated items, you must credit the relevant stock account and afterward debit the expiration reserve account. This technique allocates obsolescence costs to expenses in little amounts over time instead of in big amounts just when outdated inventory is identified.

👉 Read More: Journal Entry For Obsolete Inventory: Example And Calculation

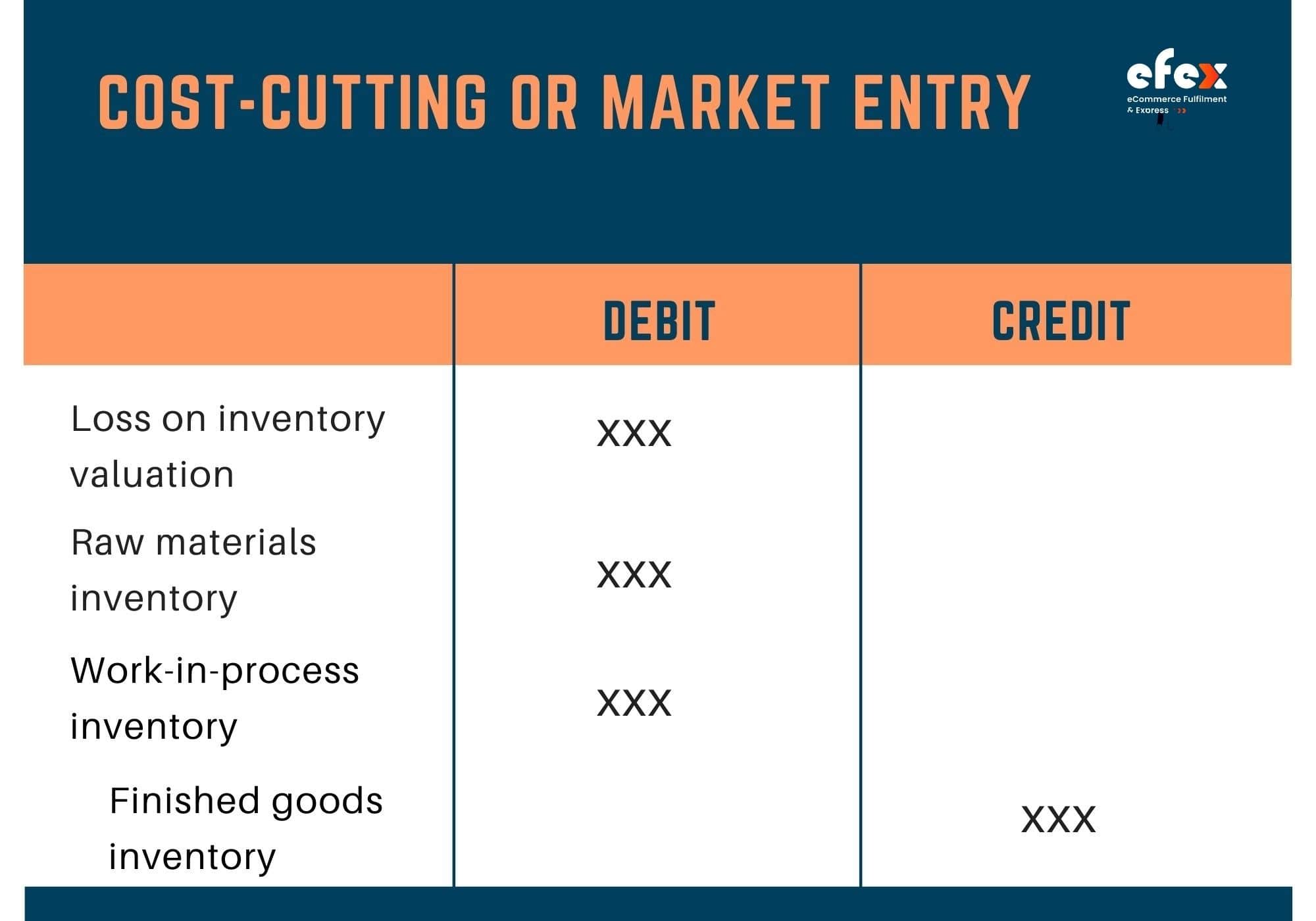

You should test inventory on a regular basis to notice if the cost price of every inventory commodity is less than the lower cost or the cost of the market.

Therefore, to account for the reduced recorded cost, you may have to reduce the carrying value of the inventory item to its market price as well as pay the deficit on the stock valuation charge. The related entry is as follows:

Inventory journal entries are seldom meant to be reversing entries, or entries that reverse automatically in the following accounting period. Rather, the vast majority of entries are one-time occurrences.

Depending on the type of the production system as well as the commodities being manufactured and sold, more entries may be required in addition to those listed above.

Inventory journal entries are records in your accounting ledger that assist you to keep track of your inventory transactions.

There are various types of journal entries that can help you organize your financial spending and earnings vary based on the type of inventory as well as how much your company carries.

Some companies, for example, utilize a periodic inventory accounting system, while others utilize a perpetual inventory accounting system.

Periodic inventory systems are far less comprehensive and time-consuming, making them ideal for firms with low inventory levels. Electronic perpetual systems are common. They're detailed and time-consuming to set up and maintain.

👉 Read More: Perpetual Inventory System Journal Entry: Example, Calculation

Making inventory journal entries is an important part of good bookkeeping. It can not only assist you in tracking your costs and profits, but it can also assist you in balancing your books and generating financial reports that enable you to assess your company's progress and opportunities for development.

Although several applications exist to help you keep track of your inventory transactions digitally, some accountants or company owners may prefer to maintain a printed record. Investigating several inventory journal entry alternatives might assist you in selecting the best one for your company's needs.

The perpetual system and the periodic system are two methods or systems for accounting for inventories. Similarly, the business enters journal entries for inventory purchases using one of the two systems.

Consider the following scenario.

ABC Ltd. receives the merchandise it purchased on credit from one of its suppliers on December 12, 2021. The company ABC Ltd. uses the perpetual inventory method and purchases $5,000 in inventory. What is the buy transaction's journal entry?

What is the journal entry for the inventory purchase if ABC Ltd. utilizes the periodic inventory method instead?

ABC Ltd. can make the following journal entry for inventory purchase on December 12, 2021, using the perpetual system:

Account | Debit | Credit |

Inventory | 5,000 |

|

Accounts payable |

| 5,000 |

In this scenario, the $5,000 will be added to the inventory account's balance. Similarly, on December 12, 2021, the business can verify the inventory balances after adding $5,000 to the transaction.

On December 12, 2021, the company can evaluate and verify the inventory by comparing the inventory in the account record to the actual inventory count. This is a significant benefit of the perpetual inventory system since the business may check any discrepancies between the actual count and the account record right away.

If ABC Ltd. instead adopts the periodic inventory system, the journal entry for inventory purchase on December 12, 2021, could look like this:

Account | Debit | Credit |

Inventory | 5,000 |

|

Accounts payable |

| 5,000 |

The $5,000 purchase does not increase the inventory balance in this journal entry, but it will be used in the cost of goods sold calculation. Only the physical count of inventory at the conclusion of the period will be used to calculate inventory balances.

As a result, unlike in the perpetual system, the corporation will not be able to verify how much inventory balance there is immediately after adding $5,000 on December 12, 2021.

It's important to remember that the purchase account is exclusively for inventories. As a result, any equipment or office supply purchases should never be recorded in the purchase account. Otherwise, there will be an error in the cost of goods sold estimate at the end of the period.

After inventory exits the raw materials stage of a manufacturing process, It is transferred to work-in-process stock and documented in the appropriate account.

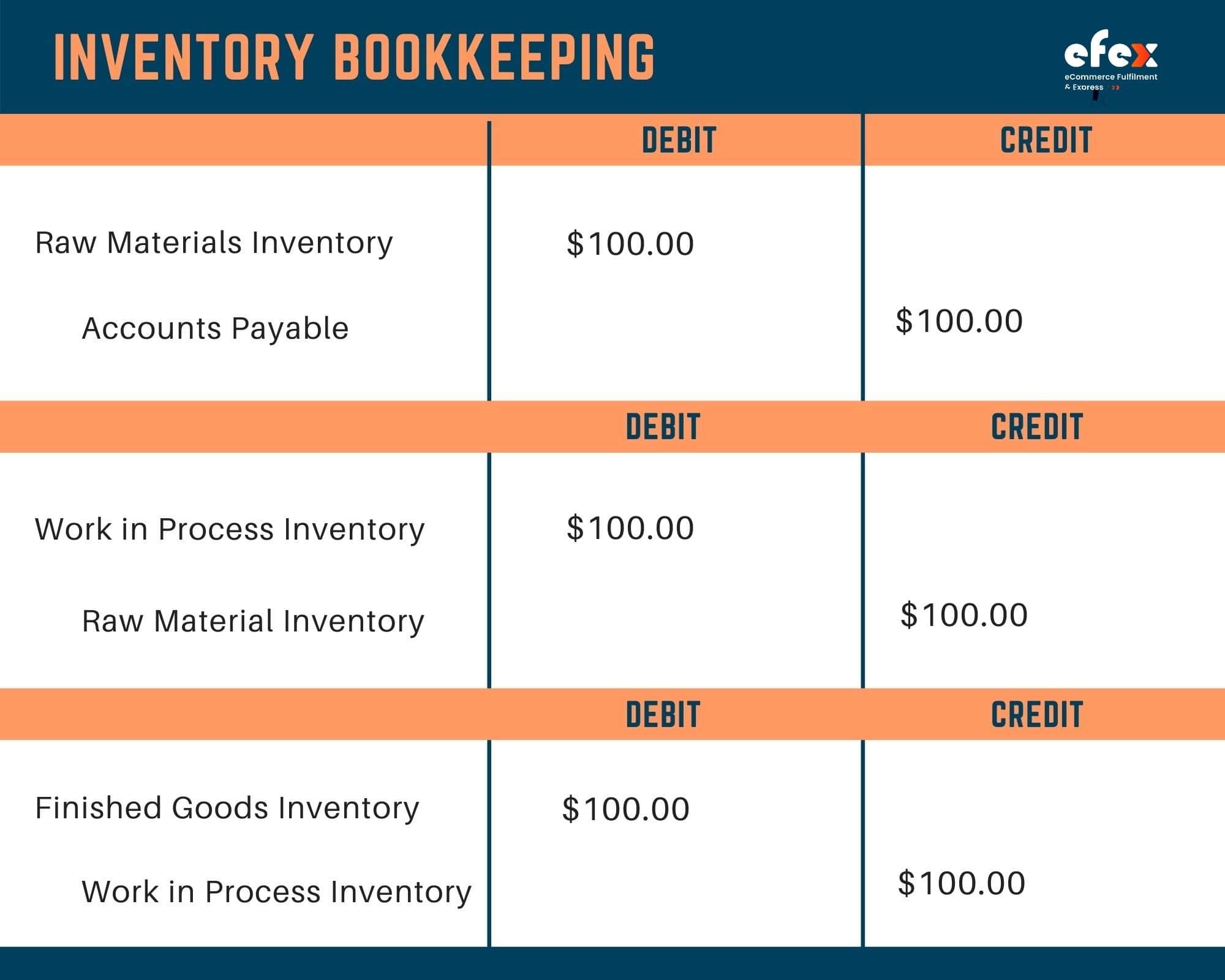

Finished items are the last stage of the manufacturing process. The last item in the image below depicts an accounting journal entry used to track stock as it transitions from work-in-process to final goods and is available for sale.

For all of the items that you make, a bookkeeper typically records this data in the available ledger's inventory journals.

An accounting journal means to be a thorough record of a company's financial activities. These transactions are given in chronological sequence, by amount, impacted accounts, and the direction in which those accounts are involved.

Depending on the size and type of the organization, each transaction might be assigned a reference number and a note explaining the activity.

When you spend $100 on resources to create your items, you will credit the accounts payable and debit the raw materials inventory.

$100 is deducted from the finished products inventory account once the task is done.

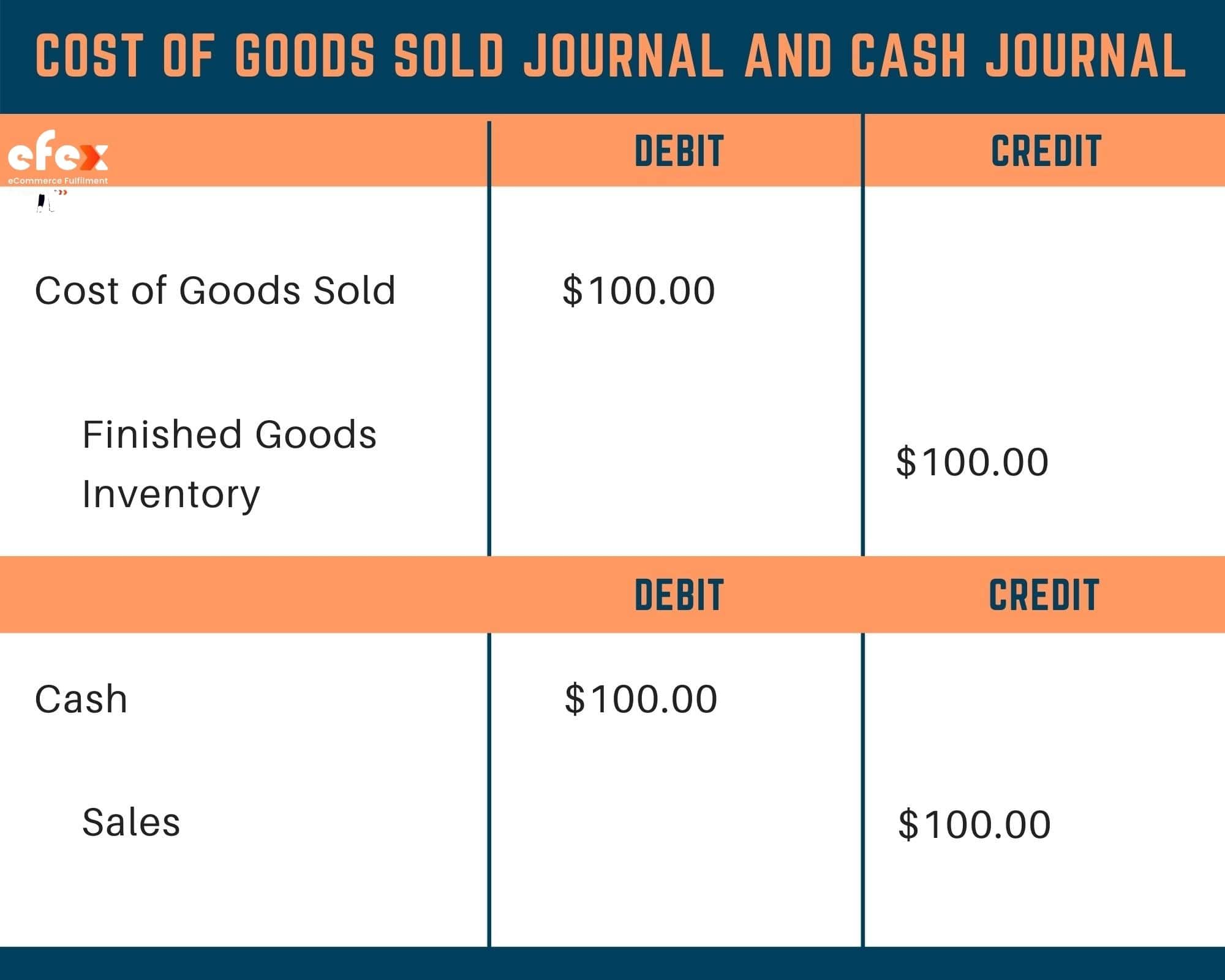

When a product is ready for sale, it is moved from completed product inventory to product inventory. You deduct the COGS and credit the completed product inventory. The products are moved from the stock to costs with this operation.

When you sell the $100 product for cash, you should make an accounting entry for the financial transaction and credit the sales revenue account. This transaction moves $100 from costs to income, completing the item's inventory bookkeeping procedure.

Inventory has a financial value even before you use it, thus it's recorded as an asset on your balance sheet. However, if it becomes old, out of date, or damaged, or if the market price for that type of good falls, it can quickly lose its value. It is also costly to store.

Inventory journal entries assist you in determining the worth and expenses of your inventory and tracking your inventory transactions. It might also assist you in determining where you make the most money in your company.