More Helpful Content

In contrast to the FIFO technique of inventory evaluation, the LIFO perpetual inventory method posits that the last expenditures expended to acquire items or direct supplies are the first costs charged against revenues. In other words, it presumes that the cost of items sold in a retailing firm or the cost of supplies provided to the production department in a manufacturing firm is the most recent purchase. As their name in the title, both the FIFO and LIFO approaches may be utilized in both perpetual and periodic inventory systems.

LIFO which stands for last-in, first-out is the cost flow assumption that businesses use to determine the value of their inventory. For the purchases and sales, this system also uses the running ledger tally. The only distinction to the FIFO perpetual method is that in this case, the last-placed inventory is sold first, therefore, the remaining inventory or the oldest one is the inventory acquired first.

The program deducts the closing expenses available at the time of sale from the COGS account first. The LIFO approach is an excellent strategy for displaying increasing COGS expenditures and lower net revenue. This strategy can be utilized in difficult circumstances to reduce tax payments.

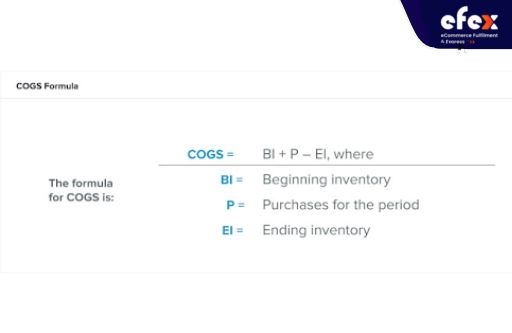

There are formulas that you can use to calculate the LIFO perpetual inventory method.

When you sell things in a perpetual inventory system, the expenditure account rises and the cost of sales increases. The Cost of Goods Sold are the direct expenses incurred during the manufacture of commodities over a certain time. These expenses include labor and supplies but exclude distribution and sales charges.

If you do not have a proper beginning inventory, calculate it as whatever inventory remains from the prior period. Months, quarters, or a calendar year might be used as the accounting period. The COGS in a perpetual system is rolling and updated after each transaction. However, you may compute it for a period using the COGS formula.

COGS = BI + P - EI

The ending inventory formula computes the value of items on hand at the end of the fiscal period. It is usually represented on the balance sheet at a lower cost or market value.

Ending Inventory Formula = Beginning Inventory + Purchases - Cost Of Goods Sold (COGS)

The LIFO approach is another popular method for determining goods inventory cost flows. The LIFO inventory costing approach generally distributes the last unit expenses that come into a firm to the first units that flow out of the organization. In this method, the cost of products sold is made up of the most recent unit expenses in a period.

Therefore, because the final unit costs are attributed to the cost of products sold, the closing merchandise inventory is made up of the period’s beginning unit costs. The LIFO approach presented in the following paragraphs is the LIFO perpetual inventory method since electronics have made the user of perpetual inventory records widely available.

If you want to understand clearly the calculation of the LIFO perpetual inventory method, let’s move to the next part which is the example of the LIFO perpetual inventory, there you will see how it is applied in a specific situation.

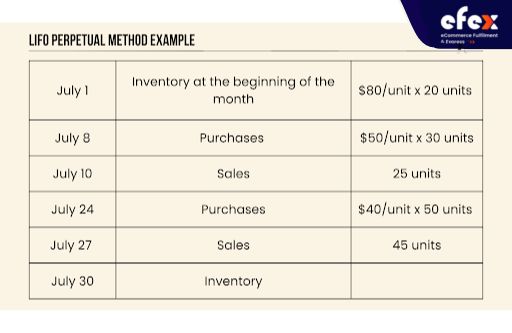

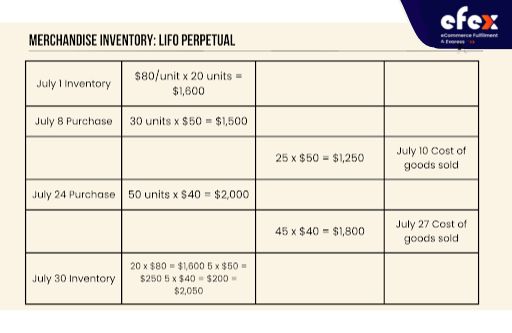

ICB records purchases and sales using a perpetual inventory, and its inventories are valued using the LIFO technique. The firm has given the following information concerning commodities and requests your assistance in calculating the cost of the goods sold and the cost of goods ending inventory.

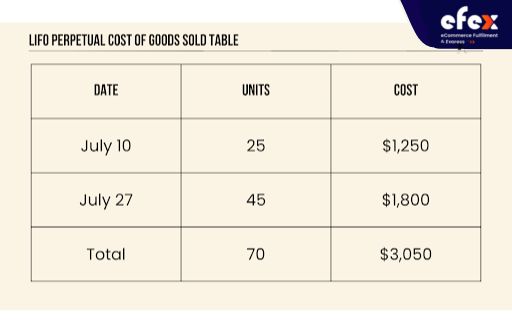

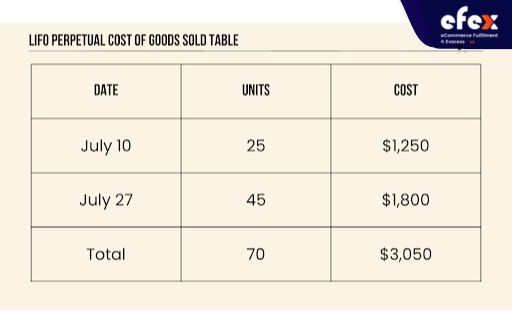

Consider the above table, in which a business sold 25 units of product on July 10. The cost of products sold for the 25 units would be determined using the LIFO perpetual technique as follows.

| Units | Unit Cost | Total |

| 25 | $50 from the 30 units purchased on July | 25 x $50 = $1,250 |

Similarly, the cost of goods sold for the 45 units sold would be determined as follows using the LIFO perpetual technique.

| Units | Unit Cost | Total |

| 45 | $40 from the 50 units purchased on July 24 | 45 x $40 = $1,800 |

According to the foregoing estimates, the LIFO perpetual technique would result in a July cost of goods sold of $3,050 for 70 units.

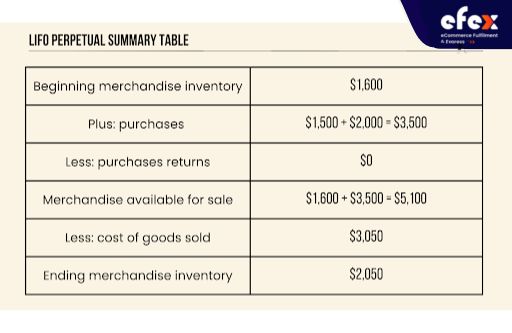

The cost of the business’s 30 units of goods inventory on hand on July 30 would be determined using the LIFO perpetual technique as follows

Since the LIFO perpetual method gives the last unit costs that come into a firm to the first units that flow out of the business, the ending inventory units of which did not flow out must be allocated the costs of the first units that came into the company. The summary of the components of product inventory may be used to assess the appropriateness of the cost of goods sold and ending inventory calculations.

Once the business’s cost of goods sold is known, the cost of its closing product inventory may be computed by subtracting it from the cost of goods sold.

A perpetual inventory system modifies the inventory level on a continual basis, necessitating real-time recording of stock products from buy to sell. Small businesses can adopt the less expensive periodic technique, in which the inventory quantity changes immediately after an inventory count. The LIFO method assumes that the most recently added item to inventory is the first one to be sold.

To track a LIFO transaction, the accounting entries are credit accounts payable or cash and debit inventory. For instance, if a fashion shop purchases 100 shirts for $15 each, inventory is debited, and accounts payable is credited by 100 x $15 = $1,500 apiece. If the store purchases 100 more shirts at $20 apiece just a couple of days later, it debits inventories and credits accounts payable by 100 x $20 = $2,000. The LIFO approach anticipates that the $20 shirts will be the first to sell.

To monitor a transaction, begin by crediting sales and debiting accounts receivable or cash, then debiting the cost of goods sold and crediting inventories. Keep going with the above instance, if the store sells 50 units at $40 per shirt, LIFO believes that these shirts are from its latest $20 lot, resulting in a cost of products sold of 50 x $20 = $1000. The store credits sales while debiting accounts receivable by 50 x $40 = $2000 and it debits the cost of products sold while crediting stock by $100. Following this trade, the inventory contains 100 15$ shirts and 100 - 50 = 50 $20 shirts.

Businesses buy and sell products at varying prices, which affects the expenses on several levels. Because sales are made from the top layer through under LIFO, the older layers stay in closing inventory.

Staying with the above instance, if the fashion store sells an extra 70 shirts at $45 apiece, LIFO believes the merchant sells the 50 remaining $20 first, followed by 100 - 70 = 20 shirts from the $15 lot.

As a result, the cost of products sold is 50 x $20 + 20 x $15 = $1,300. The shopkeeper credits sales and debits accounts receivable by 50 x $45 for a total of $2,250. He or she also deducts $1,300 from the cost of items sold and credits $1,300 to inventory. Following this purchase, the inventory now contains 50 - 20 = 30 $15 shirts and 0 $20 shirts. If the store buys 50 more shirts at $25 each, LIFO predicts that future sales will arrive from this stock layer first.

👉 Read More: Fifo Perpetual Inventory Method: Formula And Example

Since it shows larger COGS expenditure and a smaller net income, a LIFO system may be ideal for firms that do not want to pay as much in taxes. As a result, because companies are taxed on profit, your organization has a lesser tax burden in a LIFO system. According to the Internal Revenue Service, businesses can use the LIFO perpetual inventory method in their tax accounting even if they use the FIFO perpetual inventory method in their financial statements. Hope you have a good time with Efex.