More Helpful Content

Traditional costing vs activity-based costing are two separate methods used in the accounting sector to assign indirect (or overhead) expenses to goods. Both techniques calculate production-related overhead expenses and then allocate these expenses to goods using a rate of cost-driver. In general, these two approaches' complexity and accuracy differ from one another.

Traditional costing is simple and often allocates overhead expenses to items based on an arbitrary average rate. ABC is more complicated and efficient than conventional costing.

With this approach, indirect costs are first allocated to activities and subsequently, based on how the products use the activities, to products. Let's discuss more the difference between traditional costing and activity-based costing in the post below

According to the number of manufacturing resources used, traditional costing allocates factory overhead to goods. With this approach, overhead is often calculated based on the amount of direct labor time used or the amount of machine time consumed.

👉 Read More: Activity-Based Costing Calculation With Example

When indirect expenses are little in comparison to direct costs, traditional costing is the best option. The traditional cost method includes the following phases:

The optimal time to employ traditional costing is when a business's overhead is minimal in comparison to its direct expenses of manufacturing.

When the production quantity is high, it provides relatively accurate cost numbers, and variations in overhead expenses do not significantly affect the calculation of production costs. Implementing conventional costing techniques is not costly. Because it is more straightforward and understandable to outsiders, conventional costing is typically used by businesses for external reporting.

👉 Read More: Procurement Process Flow: Effective Flow And Benefit

Nevertheless, since the application of overhead burden rates is discretionary and applied uniformly to the expense of all goods, it does not provide managers with a realistic view of product costs. The expenses of overhead operations are not assigned to the goods that really use them. For businesses that only produce a small number of different items, the traditional cost technique works best.

The ABC refers to a costing method that places an emphasis on the actions carried out to manufacture products. Costs will be first linked to activities, then to goods, according to the ABC method of costing.

The ABC technique was developed by accountants to address the accuracy issues brought on by the conventional costing methodology. For managers to distinguish between earnings that were truly lucrative and those that weren't, more precise costing methods were required.

Traditional costing and ABC costing differ fundamentally in that ABC approaches to increase the number of indirect cost pools which might be assigned to certain items. The traditional model uses a single pool of a company's overall overhead expenses to distribute equally among all goods. The most accurate method is activity-based costing, but it is also the most complex and expensive to execute. Instead of companies that provide services, it is more appropriate for enterprises that make items and have large overhead costs.

👉 Read More: Seasonality Index: Formula And Calculation

An activity-based approach is used by businesses that produce a wide range of items because it provides more precise costs for each item. It is simpler to locate places where money is being spent on unsuccessful items when overhead costs are allocated based on activity. It is difficult to choose between traditional costing and activity-based costing. Your decision should be based on the information's intended use and audience. Managers want to utilize an activity-based accounting system and require precise product costs.

Although this technology is more expensive, it offers greater information that will allow managers to ultimately make more effective decisions. Businesses still apply the traditional costing technique for external reporting; however, it is getting outdated as the public demands more precise data on companies.

Suppose that there are two different types of bouncing balls produced by the Busy Ball Company, one of which has a hollow center while the other has a solid one. The balls are produced using the same machinery in several batches. The equipment is maintained, cleaned, and set up correctly for the following run between batches.

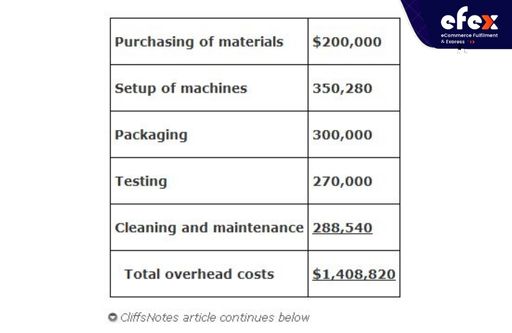

The solid center balls are supplied in packages of one, whereas the hollow center balls are presented in packages of two. Busy Ball anticipates producing 2,000,000 solid center balls and 1,000,000 hollow center balls during the year. The following is how the overhead expenses were divided among the activity pools:

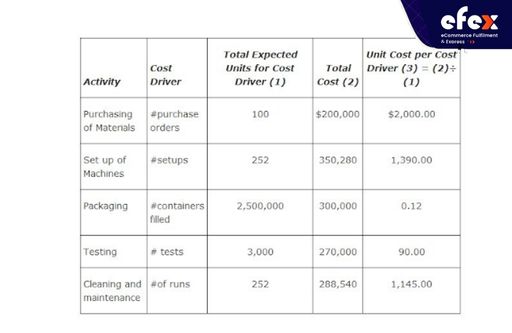

The accountants and product managers have determined the cost drivers by analysis of the activity pools, calculated the expected total units for every product, and computed the unit cost for every cost driver.

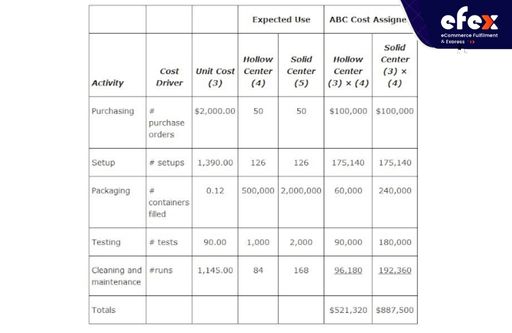

The table below shows the activity subdivided by product.

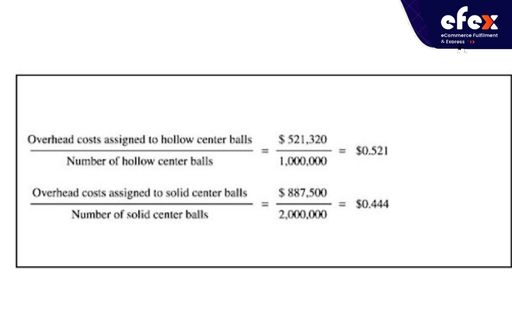

The costs associated with each item are divided by the number of units produced to determine the overhead costs per unit under ABC. A hollow center ball costs $0.52 in this scenario, while a solid center ball costs $0.44 per unit.

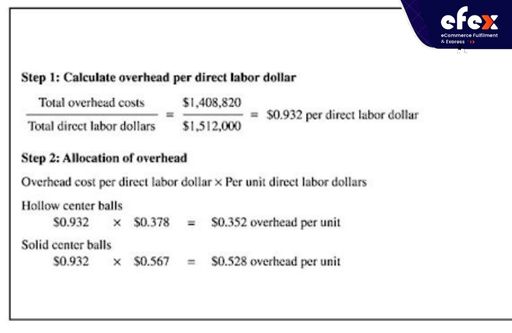

The total expenses for all balls will be divided by all of the direct labor costs for all balls to arrive at the per-unit cost using the traditional methodology of distributing overhead based on the direct labor dollars.

A projected $1,512,000 will be spent on direct labor for the entire year, of which $378,000 will go toward hollow center balls and $1,134,000 will go toward solid center balls. The direct labour expenses per unit for hollow centre balls are $0.38= $378,000/1,000,000 as well as $0.57= $1,134,000/2,000,000 for solid centre balls. Ball production costs are determined in two processes as follows:

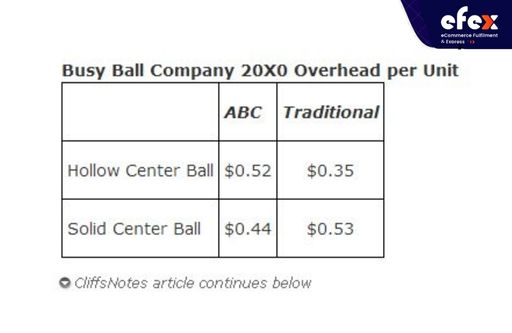

When the overhead per unit is estimated using the ABC approach and the traditional method, the results are frequently substantially different:

In this scenario, the overhead cost to the hollow ball applying ABC is $0.52, which is significantly more than the $0.35 determined using the traditional model. Making decisions regarding price and manufacturing can be done more accurately with the $0.52 cost.

According to the ABC approach and the traditional way, the overhead for the solid center ball is $0.44 per unit and $0.53 per unit, respectively. The old technique solely considers direct labor dollars for determining cost allocation, thus an item with the high direct labor dollars receives a larger share of the overhead expenses than an item with low direct labor dollars.

When direct labor dollars are utilized to allocate overhead, the amount of orders, setups, and testing that the product actually undergoes has no bearing on how the overhead expenses are distributed.

If overhead costs are not generated at the same level as direct labor costs, ABC offers a technique to allocate expenditures more precisely. The costing system gets more complicated as there are more activities listed. For complicated ABC systems, computers are required. To keep the pricing system reasonable, some businesses restrict the amount of actions operated. While this method could lead to some arbitrary allocations, employing ABC does provide managers with a more precise cost estimate to utilize when making choices.

In a nutshell, the ABC method paints a more accurate picture of how expenses behave. Businesses that don't care how much it really costs to produce a product may be happy with the traditional costing approach. Others, however, base their pricing on costs and must calculate them quite precisely.

The adoption of activity-based costing, which is seen as a contemporary form of absorption costing and is intended to offer more accurate product costs, has been extremely beneficial to the latter organizations. Have you already got clearly the difference between traditional costing and activity-based costing?

If you still have any questions, don’t hesitate to contact us. We will help you with any problems related to costing methods. Hope you have good time with EFEX - eCommerce Fulfillment & Express.