More Helpful Content

The tax system in Vietnam is a major driver of the investment attractiveness into Vietnam. Recent changes have aimed to provide a reduced tax incidence, robust investment incentives, and efficient tax compliance. Businesses must register for tax identification numbers in order to comply with tax rules in Vietnam.

Vietnam tax ID is used to identify tax liabilities and comply with applicable regulations. Tax code registration certificates are used to issue these codes, and tax and customs officials evaluate the applications.

We'll go over what a Vietnam tax identification number is and its format in this post.

A tax identification number (or tax code) is a series of numbers coded according to unified rules.

These encoded numbers are designated to each entity or individual that pays taxes, charges, fees, and other revenues in accordance with the terms of laws and ordinances on taxes, charges, and fees (hereinafter generally described as tax laws), including import and export taxes. Each tax-paying business or individual is identified by a specific tax identification number, which is administered consistently across the country.

All businesses and individuals who file taxes to customs offices and tax offices in accordance with tax laws (except for subjects exclusively liable to pay housing tax, land-use levy, agricultural land-use tax, tax on transferring of land ownership, and individuals submitting registration fees).

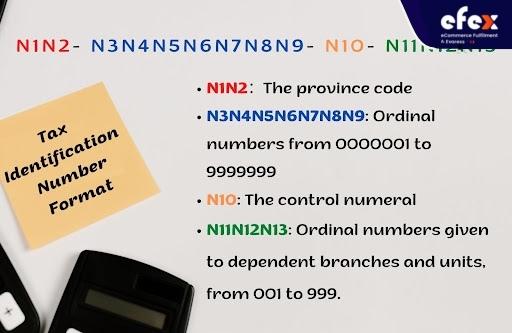

A tax code is made up of a series of numbers that are classified into the following elements:

Here are the details of each element in the Vietnam tax identification number format:

Independent tax-paying companies, individuals, as well as principal units are given the ten numbers N1 to N10.

A single tax-paying entity or individual will be assigned a single tax code to use during the life of its operations, from its inception to its demise. The taxpayer has to use his or her tax code to declare and pay all types of taxes due, including taxes for various business lines or manufacturing and commercial activities carried out in separate geographical locations. The presence of a tax-paying entity or individual is linked to a tax identification number. A tax code that has been issued cannot be transferred to any tax-paying entity of business or individual.

Taxpaying businesses and individuals will lose their use of the tax code when they cease to exist. The tax identification numbers of businesses and organizations that cease to exist must be closed and not used again. Those who are the owners of private businesses, business individuals, or owners of business households will maintain their tax codes for the rest of their lives and will not change. If such individuals stop doing business but subsequently resume it, they must continue to utilize the previously issued tax identification numbers. A tax registrant can only receive a single tax identification number from the tax office once.

>> Learn more: Vietnam Tax Rate: List Of Tax Rates In Vietnam And Why Need To Pay

>> Learn more: Vietnam Withholding Tax: Detail Information

All tax-paying organizations and people will be assigned ten-digit tax identification numbers N1N2-N3N4N5N6N7N8N9-N10, except in the instances indicated below, where 13-digit tax identification numbers will be assigned.

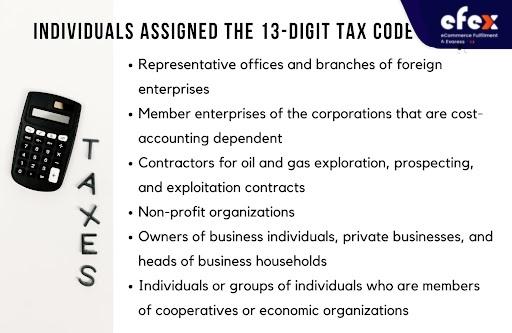

The following individuals will be assigned the 13-digit tax identification numbers N1N2-N3N4N5N6N7N8N9-N10-N11N12N13:

Apart from the 10-digit tax code, these entities will be given 13-digit tax codes to submit tax declarations and transactions for their businesses or stores to tax offices that handle and collect taxes directly from such establishments and stores.

The above-mentioned entities and individuals will be considered to be "dependent units" from now on. The term "managing units" refers to units that have dependent units. Dependent units will be assigned 13-digit tax identification numbers, whether they practice independent or dependent cost accounting. Dependent units that are controlled by operating units but register and file taxes directly to tax offices must be declared in the lists of dependent groups by their managing units (who have ten-digit tax codes).

Tax offices will then award them 13-digit tax identification numbers. If the management of units can not make extra declarations on behalf of their dependent units, such units will be required to make direct declarations and registrations at tax offices in order to get tax codes. These units will get letters with 10-digit tax identification numbers to be used in tax declaration and payment.

Grant of tax identification numbers certification

Taxpaying business entities and individuals who have finished the procedures for obtaining a tax identification number will be recognized as having received one by tax offices in the form of a tax registration certificate (excluding those who are liable to file income tax on high income).

Individuals who have completed the processes for registering tax identification numbers and are required to file income tax on high income will be issued cards of personal tax identification numbers.

Tax offices will provide tax identification number notices to taxpayers who are not qualified for tax registration certificates.

So, in this post, we've covered the fundamentals of the Vietnam tax identification number, including its definition and format. Foreign-invested businesses functioning under Vietnamese law are subject to the same tax duties as domestic businesses. As a result, if you are considering starting a business in Vietnam, remember to equip yourself with a thorough understanding of tax regulations to avoid any legal issues.