More Helpful Content

Cross-border transactions selling products and delivering services by foreign suppliers to Vietnamese purchasers have become a significant problem in terms of the tax consequences as international commerce between Vietnam and other nations has grown.

The taxation system of the Socialist Republic of Vietnam has experienced various changes, is constantly changing, and has grown more in line with international norms and practices. For international businesses conducting business in Vietnam, there are a variety of taxes must be considered.

If you are a foreign business, let’s stay with us until the end of this blog to gain fundamental knowledge about Vietnam withholding tax to help you do your businesses in Vietnam easier.

In Vietnam, a foreign contractor tax (FCT) is a type of tax that is levied on foreign contractors, corporations, or persons who conduct business and earn revenue in Vietnam. FCT is not a distinct tax, but rather a combination of personal income tax (PIT) or corporate income tax (CIT) and value-added tax (VAT) on payments made to foreign contractors.

Foreign contractors are liable for FCT for services provided in Vietnam, with the exception of pure supply of products and services performed and consumed outside of Vietnam, and other services are undertaken totally outside of Vietnam. For example, instance training, promotion, repairs, advertising, etc.

- Read More: The Best Fulfillment Service in Vietnam

- Read More: Best warehouse service in Viet Nam

There are some payments that are subject to FCT, including:

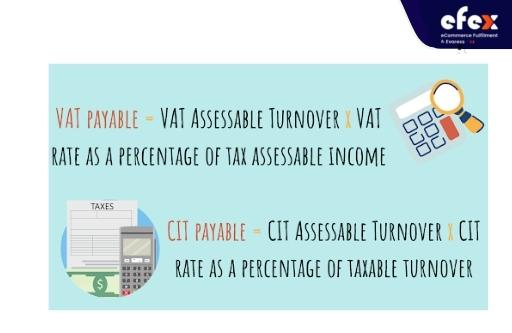

Besides, foreign contractors who use the Vietnamese accounting system may seek to be deduction-method VAT payers. If the overseas contractors' financial statements are good, they will pay CIT on genuine earnings, but not otherwise. For direct or non-deduction-method overseas contractors, the contractual party will withhold VAT and CIT at presumed rates.

Depending on the circumstances of the contract, different costs are indicated. The FCT rate for CIT ranges from 0.1% to 10%. In addition to VAT, the FCT rate might range from 2% to 5%. The contracting party’s VAT withheld is an admissible input credit on its VAT return. A foreign contractor may pay taxes in the three following ways:

The FCT on interest payments made to a foreign lender is 5%. Interest on loans made before 1999 may be excluded from FCT. Where a suitable double tax agreement (DTA) or inter-government agreement (IGA) applies, offshore loans issued by a certain government or semi-governmental organizations may be excluded from the interest FCT. Interest on bonds (excluding tax-exempt bonds) and certificates of deposit are subject to a 5% FCT. The sale of bonds and certificates of deposit is subject to a 0.1% deemed tax on the total sales proceeds.

>> Learn more: Business Registration Certificate in Vietnam: All Detailed Steps

FCT is levied on management fees and head office charges/services at the appropriate service rates.

A lessee in Vietnam is obligated to withhold tax from payments made to an overseas lessor. If it is an operational lease, the rental charge is subject to 5% VAT and 5% CIT. if it is a financing lease, the interest amount will be free from VAT and subject to a 5% CIT.

A distinct section in Circular 80/2021 provides information on claiming tax treaty advantages, including the processes for submission. Furthermore, a formal review and approval process has now been implemented.

The tax authorities have 30 days after receiving appropriate documents to evaluate and assess treaty claims. The tax authority must make a decision approving the amount of tax eligible for exemption or reduction, or notify taxpayers in writing of any rejection of the application. This deadline can be extended by 10 days if the tax authority has to undertake more research to validate the position. This might eliminate the existing confusion in applying for foreign corporations’ tax treaty benefits.

According to Clause 1, Article 25 of Circular 111/2013/TT-BTC, personal income tax deduction refers to income-paying organizations and individuals deducting the payable tax amount from the taxpayer’s income first when paying income. You can consult the following PIT deduction conditions.

>> Learn more: Vietnam Tax Rate: List Of Tax Rates In Vietnam And Why Need To Pay

>> Learn more: Vietnam Tax Identification Number Format and Meaning

Although there are many deductions situations, there are two common cases related to salary, wages, and remuneration.

According to Point i, Clause 1, Article 25 of Circular No. 111/2013/TT-BTC, organizations and individuals that pay wages, remunerations, and other expenses to resident individuals do not sign labor contracts or sign contracts under three months with a total income of 2 million VND per time or more, the tax must be deducted at the rate of 10% of income before paying to individuals.

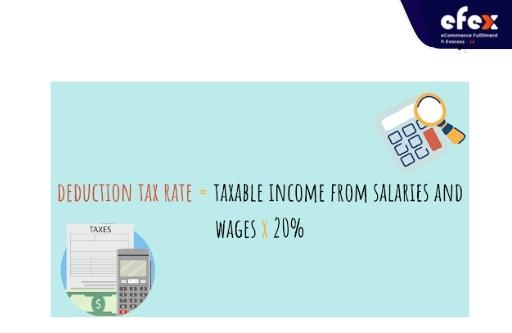

According to Point a, Clause 1, Article 25 of Circular 111/2013//TT-BTC, this 20% deduction rate is for non-resident individuals that are working in Vietnam. Taxable income from wages and salaries of non-resident individuals is determined as taxable personal income from salaries and wages of resident individuals.

Pursuant to Point i, Clause 1, Article 25 of Circular 111/2013/tt-BTC, an individual is entitled to make commitment 02 to not be deducted 10% of personal income tax if he or she fully meets the following conditions:

Luckily, the Vietnamese General Department of Taxation seems to begin to recognize the struggles that foreign contractors have to face with Vietnam withholding tax when doing business in Vietnam. As a result, in order to foster global cooperation and attract foreign investors, they have attempted to reduce the volume of paperwork by publishing regulations, providing guidance on the implementation of Double Tax Agreements (DTAs) from the center to provincial tax departments, and simplifying the administrative procedure for taxpayers.