More Helpful Content

Most governments rely on taxes as their major source of revenue. This money is used to build and maintain public infrastructures, such as roads and bridges, as well as to support public services like schools, hospitals, emergency services, and social programs. That is why every country has its own tax system with different tax rates and Vietnam is no exception.

Determining the application of the Vietnam tax rate is not easy, especially for foreigners who are working in Vietnam entails interpreting several laws. Following that, international employees must compute their exact liabilities as well as any appropriate deductions. Let’s consult this most basic information about the tax rate in Vietnam in the below part.

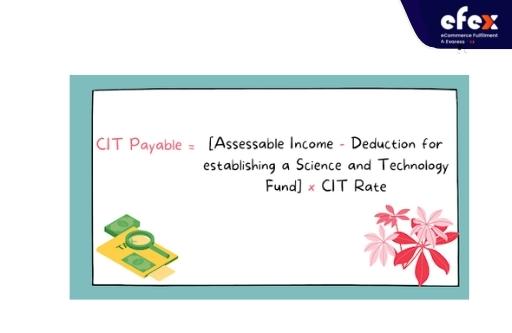

CIT Payable = [Assessable Income - Deduction for establishing a Science and Technology Fund] x CIT Rate

Vietnam’s standard CIT rate for businesses in Vietnam is 20% on assessable income. Tax rates for the oil and gas industry, and also other extractive sectors, can range from 32% to 50%. In case of deducting, your expenses must:

Affiliate transactions, often known as transfer pricing, are firms with an affiliate connection that “consciously alter prices” for the prices of products and services bought and sold between associated businesses.

Entities can be excluded from the documentation requirements under Transfer Pricing law if and only if one of the following conditions are met:

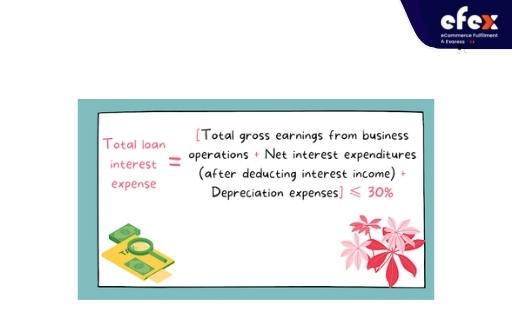

Total loan interest expenditure for a tax period (after subtracting interest from deposits and loans) that qualifies as tax-deductible for determining CIT for enterprises subject to Transfer Pricing requirements cannot exceed 30% of the total gross earnings from business operations plus the net interest expenditures (after deducting interest income) plus depreciation expenses.

If a registered branch or subsidiary in Vietnam sells products or services, the subsidiary must pay both corporate income tax (CIT) and value-added tax (VAT). The situation changes if a foreign provider sells the products and services rather than a Vietnamese affiliate. Because the foreign corporation has no physical presence in Vietnam, it is not directly liable for local taxes such as CIT and VAT. Thus, the FCWT system was developed making the foreign entity accountable to tax itself.

>> Learn more: Vietnam Withholding Tax: Detail Information

The FCWT is made up of two parts which are CIT and VAT. A clearance system is frequently used to gather it. This indicates that the Vietnamese contracting party will deduct a portion of the invoice to pay the Vietnamese tax authority. The foreign party is then paid a net sum and is not required to register with the Vietnamese tax authorities.

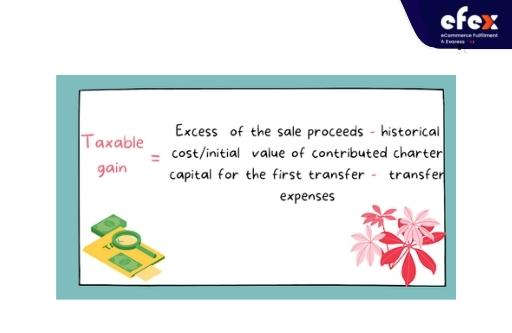

Capital gains tax refers to the income from the transfer of a company in Vietnam that is subject to CIT with a tax rate of 20% in most cases and it is not a separate tax.

However, there has been a movement to tax, not just the transfer of an interest in Vietnamese businesses, but also the transfer of an interest in Vietnamese companies’ foreign parents directly or indirectly. Securities transfers by a foreign entity, like bonds, shares of public joint-stock corporations, etc., are subject to CIT on a presumed basis at 0.1% of the total sales proceeds. On the other hand, gains earned by a resident entity through the transfer of securities are taxed at a rate of 20%.

VAT is a consumption tax applied on products and services at each level of the supply chain where value is added, from the initial manufacturing through the point of sale. The amount of VAT paid by the consumer is dependent on the cost of the product less any materials expenses that have already been taxed at a previous step. In Vietnam, the standard VAT rate is 10%. Certain commodities have a 5% lower VAT rate, as have a variety of exempt items and services, along with imports.

| VAT rate | Type | Kinds of goods and services |

| 15% | Higher | Luxury products |

| 10% | Standard | Other taxable products and services |

| 5% | Reduced | Basic foodstuff, transportation, medical equipment, agricultural output, and services |

| 0% | Zero | Constructing overseas, exports and related services, fertilizers, agricultural equipment, animal feed |

Different VAT rates in Vietnam

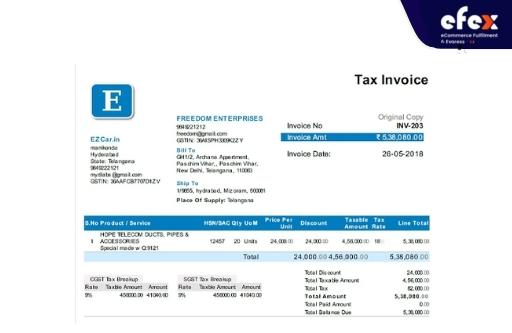

There are two types of the invoice that are used in Vietnam, including tax invoice and e-invoice.

Currently, businesses in Vietnam can use ordered invoices, self-printed invoices, or electricity bills. Invoices must have all the required contents and be registered or notified to the local tax authority.

>> Learn more: Vietnam Tax Identification Number Format and Meaning

From July 2022, companies in Vietnam will be required to use electronic invoices (e-invoices). Hence, enterprises should plan for the regulation’s implementation and conform with the legal framework established by Vietnamese authorities.

E-invoice consists of two types which are e-invoice with the tax authority’s verification code and one without the tax authority’s verification code. E-invoices without tax verification codes can be used by companies in the power, petroleum, telecommunications, credit finance, e-commerce, supermarkets, transportation, insurance, and trade sectors. Furthermore, firms that trade directly with tax authorities electronically or have the requisite technical infrastructure, accounting software, and e-invoice software are exempt from using e-invoices with verification codes.

While e-invoices with tax verification codes must be used by “high tax risk businesses” for a period of 12 months. These businesses are those with less than 15 billion dongs in equity and particular characteristics, such as:

However, if a company lacks the requisite infrastructure to execute e-invoicing, it can continue to utilize current invoices, but it must send invoice information in From 3 by Decree 123, along with VAT returns.

Special Sales Tax is an excise tax levied on the makers and importers of commodities, as well as the suppliers of services classified as subject to SST.

When SST-exempt items are sold to a related party, the SST taxable price cannot be less than 93% of the related party’s average selling price to independent consumers.

| Products And Services | SST Rate |

| Automobiles (≤ 24 seats) | 10 - 150% |

| Cigars and cigarettes | 75% |

| Votive Papers | 70% |

| Spirits/Wines (ABV ≥ 20%) | 65% |

| Beer | 65% |

| Playing cards | 40% |

| Discos and Dancing Venues | 40% |

| Playing cards | 40% |

| Spirits/Wines (ABV < 20%) | 35% |

| Casinos and Electronic Games | 35% |

| Entertainment with gambling | 30% |

| Airplanes | 30% |

| Boats | 30% |

| Massage and Karaoke | 30% |

| Motorcycles (>153cm³) | 20% |

| Golf | 20% |

| Lotteries | 15% |

| Air-conditioners (≤ 90,000 BTU) | 10% |

| Petrol | 7 - 10% |

Different Special tax rates in Vietnam

NRT is payable by enterprises that utilize natural resources in Vietnam, such as petroleum, natural gas, natural seafood, minerals, forest products, natural bird’s nests, and natural water.

However, natural water utilized for agriculture, forestry, fishery, salt industries, and seawater for cooling may be excluded from NRT if specific requirements are met. The tax rates vary according to the natural resource utilized, ranging from 1% to 40%, and are applied to the production output at a defined taxable value per unit. There are several ways of calculating the taxable value of resources, including circumstances when the commercial worth of the resources cannot be ascertained

Whether you are an individual buyer or a company, real estate in Vietnam is subject to certain taxes. Land users and even Foreign Investment Entities are required to pay an annual non-agriculture land use tax ranging from 0.03% to 0.15% of the land price per square meter, which is determined by the state every 5 years.

The revenue from the sale of real estate in Vietnam must be computed individually to be declared and taxed. Any profits on the sale of real estate are considered taxable non-employment personal income and are taxed at the rate of 2% of the sales proceeds. On the other hand, losses from the sale of real estate may be adjusted against earnings from other business operations and carried forward by taxpayers for a maximum of 5 years.

The EPT is an indirect tax that applies to the production and importation of certain environmentally harmful items, the most significant of which are petroleum and coal. The tax is determined as an absolute amount based on the number of items purchased.

| Goods | Unit | Tax Rate (VND) |

| Petroleum, oil, grease | liter/kg | 1,000 - 4,000 |

| Coal | ton | 15,000 - 30,000 |

| Hydro-chloro-fluoro-carbon (HCFC) solution | kg | 5,000 |

| Plastic bag | kg | 50,000 |

| Limited-use chemicals | kg | 500 - 1,000 |

EPT rates for some special goods In November 2020, the National Assembly implemented different environmental legislation, which will go into action on January 1, 2022. However, the EPT rates which are mentioned above will not be affected.

The export and import tax is an indirect tax charged on items that are permitted to be exported or imported across Vietnamese borders, including exports from the domestic market into the non-tariff zone into the domestic market. Owners of exports and imports are taxpayers and declarers.

Individual income tax which is also known as personal income tax is a tax applied on a person’s earnings, salaries, dividends, interest, and other income earned during the year. The tax is usually levied by the state where the money is earned.

| Monthly Taxable Income (VND) | PIT Rate For Employment Income | PIT Rate For Non-Tax Resident |

| 0 - 5,000,000 | 5% | 20% |

| 5,000,000 - 10,000,000 | 10% | |

| 10,000,000 - 18,000,000 | 15% | |

| 18,000,000 - 32,000,000 | 20% | |

| 32,000,000 - 52,000,000 | 25% | |

| 52,000,000 - 80,000,000 | 30% | |

| > 80,000,000 | 35% |

PIT rates in Vietnam table

| Types of taxable income | Tax Resident Rate | Non-Tax Resident Rate |

| Business income | 0.5% - 5% | 1% - 5% |

| Non-bank interest / dividends | 5% | 5% |

| Sale of shares | 0.1% of sales proceeds | 0.1% of sales proceeds |

| Capital transfers | 20% of the net gain | 0.1% of sales proceeds |

| Sales of real estate | 2% of sales proceeds | 2% of sales proceeds |

| Income from copyright, franchising, or royalties | 5% | 5% |

| Income from prizes, inheritances, or gifts | 10% | 10% |

PIT rates for other income table

Before December 1, 2018, social insurance contributions ware applied to Vietnamese individuals only. But after December 1, 2018, there was a change to SI contributions that was the foreign individuals working in Vietnam under work permission, license, or practicing certificate and having labor contracts with an undefined or defined duration of 1 year above were able to have social insurance contributions.

| Social Insurance Contributions | Employee Rate | Employer Rate | Effective Date For Foreigner |

| Sickness, maternity | 0% | 3% | December 1, 2018 |

| Occupational diseases and accidents | 0% | 0,5% | December 1, 2018 |

| Retirement and death | 8% | 14% | January 1, 2022 |

| Total | 8% | 17,5% |

Social insurance contributions rates for employee and employer in Vietnam table

Businesses that meet certain conditions and operate in industries that have a high risk of accidents and occupational diseases can apply for a lower employer’s contribution rate of 0,3% instead of the current 0,5% rate on salary subject to social insurance contribution. This works for both Vietnamese and foreign employees.

Compulsory health insurance contributions apply to both Vietnamese and international workers working under Vietnam labor contracts. The health insurance contribution rate is 4,5% of the income subject to health insurance contribution, with the employer contributing 3% and the employee contributing 1,5%. Income, some allowances, and other recurring payments are all liable to health insurance contributions. However, this is limited to 20 times the base salary for health insurance contributions.

Compulsory unemployment insurance contributions only apply to Vietnamese citizens. Both employer and employee will have to contribute 1% of the income subject to unemployment insurance contribution. Similar to health insurance contributions, salary, some allowances, and other recurring payments are all liable to unemployment insurance contributions. However, instead of being limited to 20 times the base salary like HI contributions, it is limited to 20 times the minimum regional wages for unemployment insurance contributions.

Various other fees and taxes apply in Vietnam, including license fees and registration fees which are also known as registration fees. They are the fees for the transfer of certain types of property subject to registration.

>> Learn more: Everything about business license in Vietnam You need to know

>> Learn more: Business Registration Certificate in Vietnam: All Detailed Steps

The calendar year is the regular tax year in Vietnam. However, different accounting year-ends might be utilized with the agreement of the authorities. Before conducting a tax inspection, the tax authority will send a specific notice about the time and scope of tax inspection to the businesses or individuals that are inspected.

There are extensive regulations in place that outline the consequences of numerous tax offenses. These range from small administrative fines to tax penalties that are multiples of the excess tax levied. For violations, a penalty of 20% of the understated tax amount will be applied. While late payment interest which is 0,03% per day will be applied to late payment of taxes. Once understand the Vietnam tax system clearly, individuals can benefit from consulting with an in-country tax professional to optimize their tax exposure, while companies may be able to establish more competitive wage packages with the assistance of an advisor.