More Helpful Content

Days inventory outstanding (DIO) is a measure of the time it takes for inventory to turn into cash. Gaining important knowledge about it will help you and your business recognize the problems the company is facing and give appropriate directions for the company to thrive. Let's dive into out article today!

Day Inventory Outstanding (DIO) is a keyword that refers to the average number of days a company holds inventory before selling it. The inventory date calculation shows how quickly a business can generate cash from inventory.

It is simultaneously a measure of liquidity as well as an indicator of a company's current financial performance. The date in the inventory is sometimes called the "inventory supply date", the "inventory date", or the "inventory period". Days of inventory, along with days of outstanding sales and days of outstanding payments (DPO), are components of the Cash Conversion Cycle (CCC) which is a formula that calculates how quickly a company turns an investment in inventory into cash.

DSO + DIO - DPO = Cash conversion cycle |

Therefore, CCC can be optimized (reduced) in three ways:

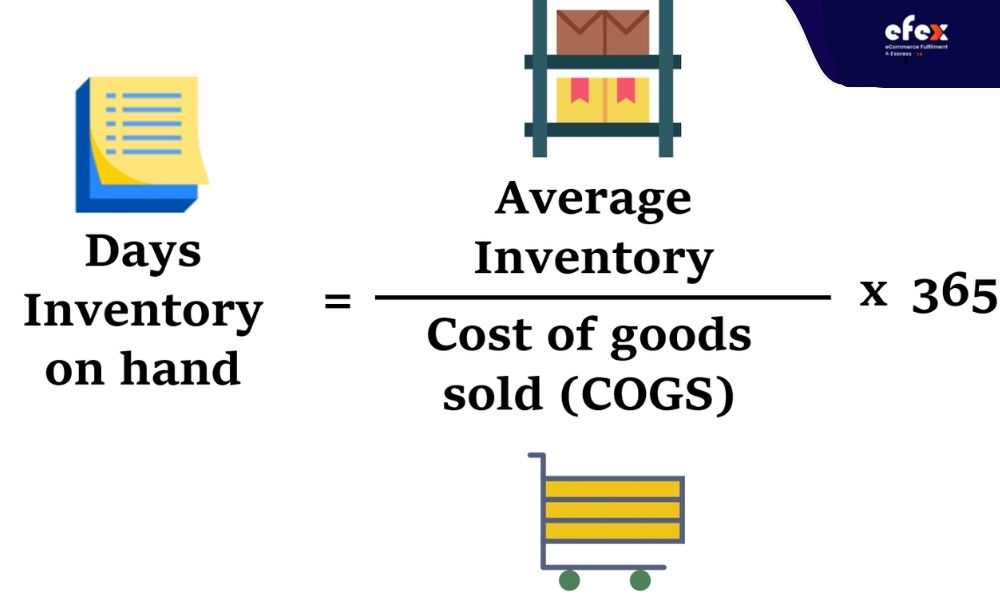

Days Inventory Outstanding are typically computed as follows:

DIO = average inventory/cost of goods sold multiplied by the number of days |

Average inventory – Companies can use the average value of inventory for the period or at the end of the reporting period to calculate the average inventory. Cost of goods sold – It is the cost that the business owner must spend to produce the products sold in the period, including labor, materials, and uses.

The number of days – The number of days is defined as the number of days in the period, which is 365 for a year or 90 for a quarter. The number of days inventory is sold will also let board members, management, and investors know that business owners have succeeded with their primary responsibility: turning inventory into cash. This assurance of confidence goes beyond simply improving the amount invested. Companies with reduced DSI or days of inventory supply are on track to include their inventory capacity. These are ideal businesses that people want to work for, buy or invest in.

For example, if a company averages $30,000 in inventory for a year and its cost of goods sold is $333,000, the DIO would be calculated as follows:

30,000 / 333,000 x 365 = DIO =(32.88 days) |

The inventory turnover ratio, which is related to DIO, estimates how many times a firm sells and replaces its inventory in a certain period of time. The following formula may be used to determine inventory turnover:

Inventory turnover is calculated by dividing the cost of products sold by the average inventory. So, for the corporation in the above example, inventory turnover would be computed as follows:

Inventory turnover = 333,000/30,000 = 11,1

DIO may alternatively be computed as follows: DIO = 1/inventory turnover multiplied by the number of days Consider the following as an example: 1/11,1 x 365 = DIO (32.88 days)

The typical DIO varies greatly amongst industry sectors. It may be feasible to derive certain inferences by comparing a company's DIO to that of other firms in the same industry. What is the difference between a high DIO and a low DIO?

A high inventory day ratio is something that no business owner wants. Because that shows the company's ability to convert inventory into revenue is still slow. The cause of this could be a lack of proper inventory management, which is not as efficient as it is with other companies in the industry.

If the DIO is high, the company's revenue is kept in inventory for a longer period of time, leaving the company's cash unused for more profitable purposes. Overstocking will also lead to high DIOs, resulting in higher inventory costs than necessary and a significant amount of obsolete goods that may never be sold.

If a company has a low DIO, this represents a quick or steady time to convert inventory to cash. At the same time, a low DIO ratio also means that the business owner can use working capital for other reasons or to pay off debt, helping the company perform better and have more opportunities for growth.

When a company's DIO is low, it's less likely that its stock is wiped out or obsolete.

However, a low DIO may indicate that the company will find it difficult to cope if market demand spikes. Because then, the inventory will run out faster and the business will have no more goods to supply to the market, leading to loss of customers. Conclusions can also be drawn by looking at how a company's DIO evolves over time. For example, a decrease in DIO may indicate that the company is selling faster in the past, but a larger DIO indicates that the process has slowed.

A lower DIO is often attempted by businesses instead of a larger DIO. DIO can be reduced by increasing the percentage of inventory that is converted to sales or by decreasing the value of inventory held. As a result, some techniques companies can use to reduce DIO rates include:

👉 Read More: Inventory Cost Methods: Formula and Example

However, high DIO is not really such a bad thing. Some businesses may consciously choose to keep a larger amount of inventory on hand, such as if customer demand is expected to increase sharply in the near term. That will make it difficult for businesses with low DIO levels. Another factor to consider is that some types of businesses may see product demand seasonally change, meaning the DIO may change during the year.

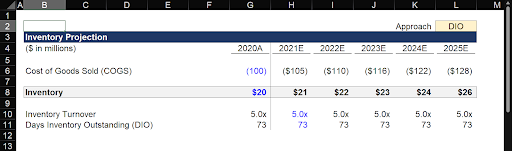

To have a complete Excel DIO spreadsheet, you need to define specific categories such as Inventory Forecast, Cost of Goods Sold (COGS), Inventory Turnover, and Days of Inventory (DIO). Then fill it in columns in Excel and use this inventory formula as mentioned above to calculate the total. You can refer to the Excel sample below:

👉 Read More: How To Create Inventory Management System In Excel

Days inventory outstanding (DIO) is an important parameter that any business if it wants to grow, you should not ignore. So, through the last article, you have got the most detailed information about the definition, the formula, and the importance of the number of days in stock for you to learn.