More Helpful Content

The terminology around the phrase "inventory cost" can be a bit confusing, and what it means varies considerably depending on the source and the business involved. In this article, we'll spend most of our time focusing on the costs of actually having a specific amount of inventory, types of inventory, and methods for examining inventory costs.

Inventory costs include those costs associated with maintaining and storing inventory for a specified period of time. This cost is often divided into many different categories such as Ordering cost, Receiving cost, Holding cost, etc….. The cost of inventory is usually calculated as a percentage of the value of the inventory. They will vary depending on the product type and business sector, but they always tend to be high. In a company, numbering costs typically account for about 25% of the value of existing inventory. The assessment of inventory cost is very important because it has a direct impact on the management as well as the company's finances. The cost of inventory is useful because it shows how much profit can be made from inventory, where the company can make adjustments, how to reduce costs, how to deploy capital, and items or houses. The supplier needs to choose for the organization to create an advantage in the market.

Understanding the inventory cost formula will help to run the company more efficiently. This formula takes into account the value of the beginning inventory, the value of the ending inventory, and the cost of purchases for the period. Inventory cost is calculated by adding purchases to the beginning inventory and then subtracting the ending inventory.

For example, at the beginning of the quarter, the company valued inventory at $80,000. It spends $20,000 throughout the year. Inventories were valued at $35,000 at the end. During that period, the cost of inventory was ($80,000 + $20,000) - $35,000 = $65,000.

This basic formula takes into account all inventory costs associated with acquiring and maintaining products for sale and is responsible for determining revenue. Any change in inventory results in a change in reported earnings.

The most effective inventory calculation methods are:

Because of the way it works, this inventory valuation method is also known as the initial purchase method. The premise of this system is that things bought first will be things sold first, and so on. First in, first out (FIFO) technique ensures that there is no loss or gains on this account. This is the best way when product prices are constant, but what happens when conditions are bad or unstable?

During periods of inflation, the operating statement will show an increase in inventory profits, while during an inflationary period, the operating statement will show a decrease in profits. Both IFRS and GAAP support the first in first out technique, making it the best option for businesses seeking international or worldwide expansion.

Last in, last out, often referred to as the replacement cost method is an important method for valuing inventory. This strategy is based on the premise that things sold are the latest or most recently acquired. It is just a reversed strategy of first in first out. The strength of this approach is that it tries to balance gains and losses in both inflationary and deflationary periods. This is because raw materials are supplied at cost and are closely related to the current possible price. It has a real capital preservation ability.

This is why new requirements reduce profit margins due to high prices during periods of inflation, while during times of deflation the reduced margins are minimized due to the low cost of the last unit acquired by an organization. Because it does not represent actual inventory flows, companies that handle perishable items do not use LIFO in their final inventory valuation method. LIFO is recognized by GAAP as an inventory costing method, but IFRS is not. The reason for this is the difficulty of bookkeeping with LIFO, and the high cost of products sold, which can lead to low-profit margins and lower income taxes.

A specific inventory costing technique is used by organizations to allocate unit costs to each and every unit. After each item is sold, money is added to the books of the account. Because the cost of sold items fluctuates based on how shipping, production, and other related costs change over time, the unit price of each unit will also vary. This strategy is used for expensive and rare items such as yachts, artwork, high-end jewelry, etc. To employ this strategy, the organization must maintain detailed record-keeping and take care to ensure transparency in its work.

The average inventory cost method is a combination of the FIFO and LIFO methods. It does not use the first or last recorded cost in its calculations but uses the average unit cost. It is divided into:

Weighted Average Cost of Inventory - A business must calculate it accurately at the time of purchase when using the weighted average inventory cost approach. It evaluates both total cost and total volume in order to reduce or eliminate the impact of costs incurred before measurement.

Simple average inventory cost - Goods are not priced at their actual cost under the simple average inventory cost approach. The calculation method is different in that it seeks to obtain an estimate by dividing the total cost by the ratio number, which can result in a profit or loss.

Periodic Weighted Average Cost of Inventory - At the end of the period, the total cost of purchases is divided by the total amount purchased to arrive at the periodic weighted average cost of the inventory method. It is considered a premium alternative as it contains the full cost and total quantity.

- Read more: Periodic Inventory System Calculator - All Formula

Simple Average Periodic Inventory Cost - A simple average inventory valuation technique that periodically calculates the issue price at the end of a particular period by dividing the total value of materials by the updated prices regularly.

This technique is similar to the FIFO method, but with some additions and changes. The specified minimum amount of inventory must be maintained on a regular basis and must be carried forward at the end of each fiscal year at actual cost. Most companies keep a minimum amount of inventory on hand, which will be released in the event of an emergency. The base inventory costing method is most commonly used in industries where a variety of raw materials are used. This strategy aids in reducing sudden and significant fluctuations in gross profit.

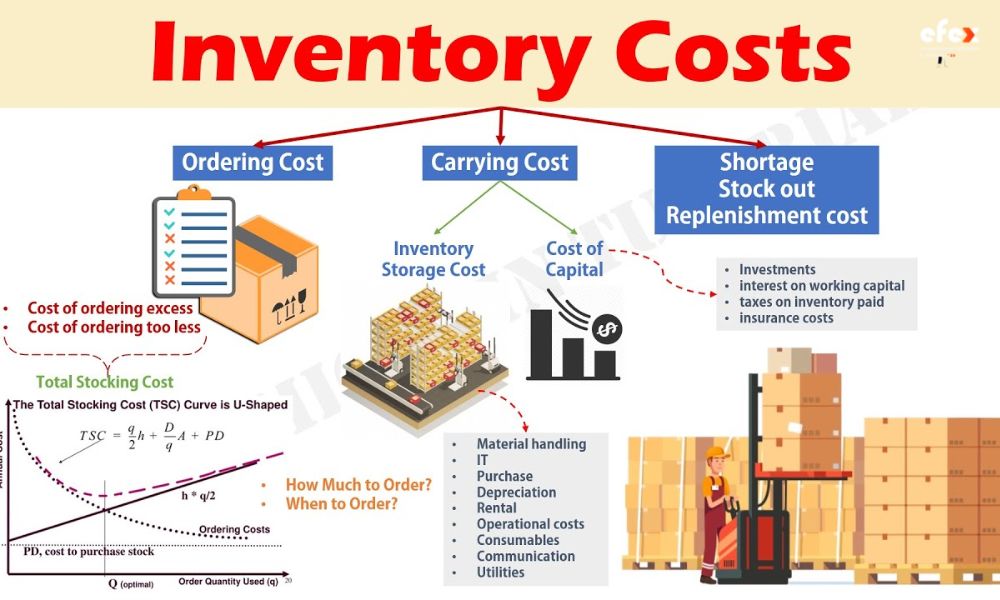

Ordering costs (also known as setup costs, especially among manufacturers) or inventory holding costs include the costs incurred each time you place an order. These costs can be divided into the following categories:

Receipt costs include unloading at the warehouse and inspecting the product to ensure it is correct and free of errors.

Clerical costs include invoice processing, communication, and accounting costs. These things will help you to have bases and evidence later to make the business more transparent.

These are technologies used by major enterprises, particularly retailers, to dramatically lower the expenses of the ordering process.

The costs of transporting products to a warehouse or retailer these prices vary greatly between sectors and products.

These expenditures are likely to be inconsistent, but they represent significant expenses for the company.

These are the expenses associated with keeping goods before they are sold. They are also known as carrying costs. Inventory finance expenses - this encompasses everything linked to the inventory investment, including expenditures such as working capital interest. Depending on the business, financing charges might be complicated The opportunity cost of the money spent in inventory is calculated by taking into account the lost alternatives to tying up money in inventory, such as investing in mutual funds or in term deposits Storage space expenses – these are costs associated with the location of the goods and will vary by location.

It represents the amount you have to pay for your own storage or rent if you are not the owner of the warehouse. Then there are the costs of maintaining the facilities, such as lighting, ventilation, and heating. This also includes property taxes and depreciation Inventory service charges - this includes the cost of actual handling of the items, as well as security, insurance, and IT software if needed.

Cost cycle counting or inventory control are two other examples Inventory risk cost - an important cost is a shrinkage, i.e. the loss of items between the time they are purchased from a supplier and the time they are sold for any reason, including supplier fraud, shipping problems, theft, or damage in transit or storage. Another prominent example is deadstock

These charges, also known as stock-out costs, arise when a company's inventory runs out for any cause.

For sellers, it may be necessary to pay extra to get supplies on time or switch suppliers when stock runs out.

When a company is producing goods as well as selling them, it suddenly has to stop because of some problem. However, you still have to pay for things like factory overhead even if there's nothing to produce or staff idleness.

In business, the most important factor is undoubtedly the customer. Customers who are not satisfied with the service that the business provides will cause their reputation to be reduced, leading to losses in the future.

Because perishable inventory material can decay or deteriorate if not sold quickly, inventory control is critical to preventing spoiling. Perishability is a challenge for numerous businesses, including food and beverage, healthcare, and cosmetics, all of which are influenced by product expiry and use-by dates. Spoilage not only costs money, but it also means you don't get a return on your investment.

Waste or deterioration of inventory is not only a problem caused by poor inventory control, but also has a negative impact on the environment. According to statistics, for the US, about 200 billion dollars is spent growing, processing, and transporting food that is never consumed. Inventory control is definitely your way to prevent waste and spoilage.

With the right inventory management system, you can enhance your work efficiency, gain insights into the life of your inventory, and access real-time inventory data. With this technology, employees can also manage inventory more efficiently, and make sure not a single item is left in stock. In supermarkets and FMCG industries, items with a short shelf life are displayed at the front of the shelf so they can be sold faster. Products that are about to expire are often heavily discounted to minimize losses.

Rent, lighting, security, maintenance, and other utility bills are all billed for storage space. In addition, it is also an advantage for employees who have the role of maintaining an organized, clean and secure warehouse space such as cleaning staff and security guards. While these costs can be relatively high, they are still necessary as they will keep you in the best possible condition.

They effectively insure against the risk that the product may lose value during its shelf life. This is especially important in retail and the industry has perishable products. The first risk is shrinkage, which means the loss of products between the time they are purchased from the supplier and the point where the actual inventory is stored. Causes of this problem can be mentioned as errors in administrative reports, lost goods, theft, and fraud on the supplier's side.

These include IT hardware, insurance, and applications (including RFID devices), but also physical processing with associated human resources, management, and more. Inventory control and cycle counting costs would also fall under this category. Finally, although they are a separate category, taxes may also be included here. When using a Third-Party Logistics Provider (3PL), charges may be included in the storage space fee.

Opportunity cost represents what you lose by choosing to partner with two or more suppliers. When you make a decision, you believe that the outcome will be better for you even though you will incur some other losses. As an investor, opportunity cost implies that your investment decisions will always result in current and future losses or gains.

It is the most significant component of carrying inventory expenses. It comprises everything associated with the investment, including working capital interest and the opportunity cost of money invested in inventories (rather than treasuries, mutual funds, etc.). Depending on the business, determining capital expenses might be more or less challenging.

Some fundamental guidelines may be stated: it is critical to recognize the portion of the business that is funded externally against the portion that is financed internally, and it is also critical to analyze the risk of inventory in one's firm.

To understand more about inventory carrying costs, consider the case of a product importer. When he brings the products into his country, they are first unloaded at a dock. Before they are shipped to the company's warehouse, they have to go through a lot of customs clearance. Assume that items are held at customs due to an error in the documentation. As everyone knows, it costs customs to hold these products until they are processed, and these fees add up over time. The costs also depend on the value of the items being stored and the volume.

We can figure out the difference by comparing the additional fees the company owner incurs for these items with the interest charged by the business owner, which is a case in point. typical and unnoticed. The dock serves as a warehouse, and the cost of customs charges can be equivalent to the profit revenue the company makes on the original value of the product. While customs fines are still apparent, the only difference is that the profit a company loses on inventory is never included.

Using an inventory management system is the best way to track your business's inventory costs. This system will give you detailed real-time reports for all the costs of each item that is present on your warehouse shelves. Understanding the key characteristics of a good accounting system will help you keep these expenses under control.

As a small business owner, you must realize that you have to take many actions to keep these expenses under control. All these expenditures cannot be fully accounted for in a single report. The way inventory is maintained on a daily basis should include checks and balances to ensure that costs are always optimized.

For example, if a company does not maintain minimum order quantities over an extended period of time for items in its inventory, the company runs the risk of continually ordering inventory at the wrong time and at the wrong time. quantity. As a result, inventory carrying costs will rise. The longer a company holds onto its stocks, the more interest it loses in them.

Another important component is stock aging reports, which provide a thorough understanding of which inventory has been laying for the longest period. This report, when analyzed on a regular basis, may give us a clear grasp of which inventory to store in our warehouses and the quantity of these inventories.

👉 Read More: Inventory Cost Methods: Formula and Example

Let's stress once again that accurately measuring the things listed above to get the full picture of inventory cost is difficult to work, but can be an incredibly financially rewarding and decisive influence on the organization. However, there is still room for improvement, especially when considering the carrying costs. For example, goods in your warehouse are not likely to have the same shipping costs (even if they are of the same type or in the same warehouse).

The difference occurs due to different sales volumes, rotation, product volume, etc. More accurately determining the carrying costs of the products in your inventory will help you focus on the products that are most relevant, eliminate those that are less profitable, and so on.