More Helpful Content

The survey states that over 46% of small businesses in the US either don't track their inventories or do so manually. Unfortunately, the majority of firms are unsure about whether they should manage their inventory carefully. Upon realizing this, they are then faced with the decision of whether to use a periodic inventory system, perpetual inventory system, ABC analysis, LIFO, FIFO, EOQ, Just in time and so on.

You might read more about the various inventory management techniques, and depending on the type and size of your company, its budget, employees, as well as warehouse operations, you can select any one of them. In our other post, we've explained to you the Perpetual inventory system calculator. In this post, let's learn more about the Periodic inventory system calculator

The methodology to determine the cost of sales is as previously mentioned in the perpetual inventory method: Beginning inventory costs are calculated as Beginning inventory plus Purchases. COGS is the sum of the costs for both beginning and ending inventories.

Let's use an example to better grasp this. A corporation named ABC started with $200,000 in inventory, spent $100,000 on acquisitions, and discovered $50,000 in inventory after a physical inventory count.

The formula used to determine the cost of goods sold is: $250,000 COGS =200,000 BI + $100,000 P– $50,000 EI Your COGS is the element in the periodic inventory that will let you know how effectively you control your inventory.

- Read More: Order Management System: Definition, Process And Value

- Read More: Order Management System For Ecommerce: Definition, Key Effect, Benefit

In terms of mathematics, periodic inventory systems' cost flow assumptions are comparable to perpetual inventory systems. Because there isn't a constant record of transactions in periodic inventory, computations are done differently.

As a result, purchases are included in the ledger tally, and transactions are really not continuously updated. The effectiveness of your inventory management methods and abilities will eventually be determined by the ending inventory as well as COGS, which are determined using cost flow assumptions.

The periodic inventory system uses three different types of cost flow assumptions: LIFO, FIFO, and WAC. Let's examine each one in turn.

According to this cost flow assumption method, you can determine the worth of your ending inventory by assuming that the items you bought first will be the ones that sell first. Therefore, the stock that is still available is made up of recent acquisitions. Businesses start by manually counting the goods while conducting a periodic FIFO inventory.

The usage of the FIFO approach in a periodic inventory system is explained very clearly in the example given below: The Sunshine Company has a system of recurring inventories. To determine the number of units included in ending inventory at the conclusion of each accounting period, the business performs a physical count.

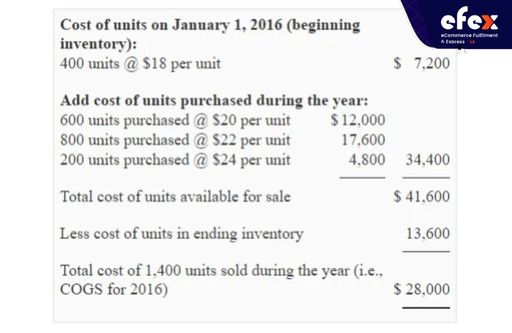

The value of ending inventory is then calculated using the first-in, first-out technique by the company. The following information is provided regarding the initial inventory balance and purchases completed in 2016:

The physical inventory showed that 600 units were available as of December 31, 2016. Required: Using the first-in, first-out (FIFO) approach, calculate the following:

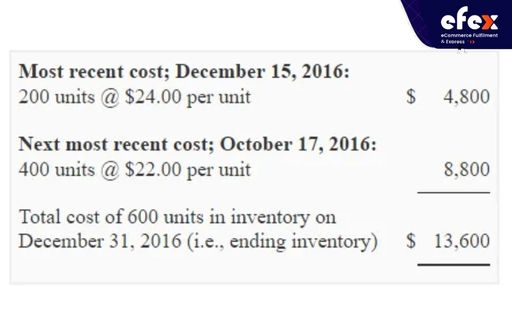

The units still in stock, if the FIFO approach is applied, indicate the most recent costs expended to buy the inventory. Thus, the following formula would be used to determine the value of 600 units for December 31:

Either the earliest cost technique or the periodic inventory calculation approach can be used to determine the COGS The following equation would be used to calculate the COGS:

COGS = unit cost in beginning inventory + unit cost bought during the period – unit cost in ending inventory

- Read More: What Is The Procurement Cycle? Process And Example

- Read More: 13 Stages Of Procurement Cycle With Detail Instructor

- Read More: 10 Steps Of The Procurement Cycle

According to the LIFO cost flow assumption technique, inventory is moved so that the most recent purchases are made first. Similar to FIFO's periodic inventory approach, LIFO's calculation starts with an inventory physical count.

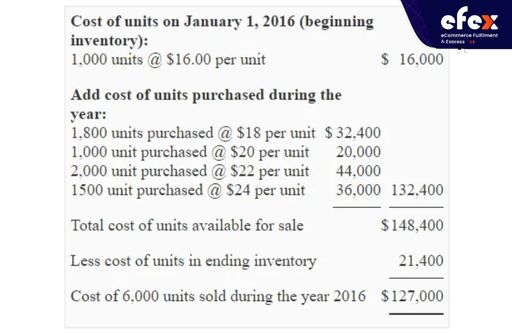

Consider the example periodic inventory calculation with LIFO in calculating COGS for a retailer provided below. The following information regarding sales and purchases of a product made in 2016 has been provided by a trading company. Inventory started on Jan. 01 with 1,000 units for $16 each.

On December 31, 2016, 1,300 units were identified in inventory, per a physical count. The business tracks stock purchases and sales using a periodic inventory system. Required: Calculate: Using the last-in, first-out (LIFO) cost flow assumption.

Value of ending inventory: Given that the corporation uses a LIFO periodic system, the ending inventory cost for the 1,300 units will be calculated based on the earliest purchase expenses. Below are the calculations:

There are two ways to calculate it, which are described below: Using the formula method, we would subtract the ending inventory cost from the total unit cost that was offered for sale during the timeframe to arrive at the COGS The cost of initial inventory combined with the price of every unit bought throughout the year equals the total unit cost that is currently on the market. It can be written as one of the following equations or formulae.

COGS = price of units for sale – unit cost in ending inventory Or COGS= [unit cost in beginning inventory + unit cost purchased over the period] – Unit cost in ending inventory

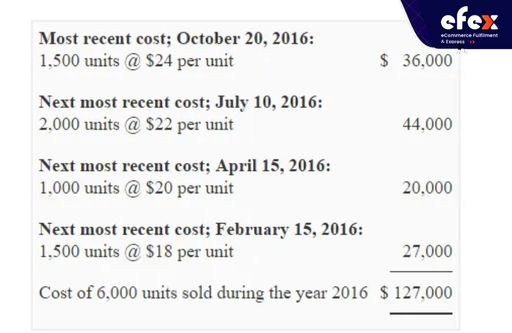

Recent cost method: Using the latest costs expended to purchase units, we calculated the total amount of units sold during the entire year and then allocated a cost to each unit. Below are the computations:

The total quantity of units that are sold during the whole year = Units in the starting inventory + Units bought during the whole year – Units in the ending inventory And here’s the final result:

By averaging the newest and oldest stock, WAC determines the value of inventory. The WAC calculation formula is

WAC = (P+BI)units for sold

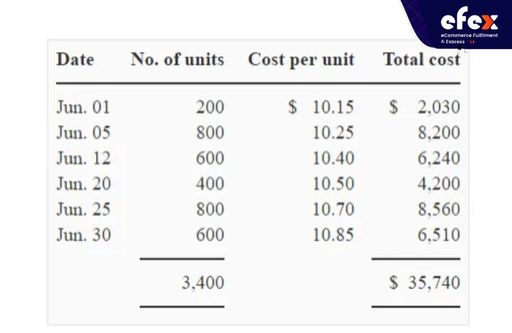

Here is a WAC example for figuring up a trading company's ending inventory and COGS. The Meta business is a trading firm that buys and sells only one item, item A. For the month of June 2013, the company's sales and acquisitions of product X are as follows.

Assuming the Meta company employs a periodic inventory system, calculate inventory cost as of June 30, 2013, with the WAC technique. Units for sale:

WAC per unit = $10.51176 = $35,740 : 3,400 units

Units in ending inventory = Units for sale – Units sold during the month = 3,400 – 2,500 = 900 COGS = $10.51176 x 2,500 units = $26,279.40 Ending inventory cost: $10.51176 x 900 units = $9,460.60

You have just read a thorough explanation of periodic inventory methods on our page. Now it's up to you to decide which periodic inventory system calculator works best for your company. Hope you have a good time with Efex.