More Helpful Content

Businesses are shifting from standard costing to activity-based costing (ABC) due to dissatisfaction with arbitrary allocations. Amid intense competition and shrinking margins, ABC offers a structured approach to assess expenses linked to specific activities. This method enhances cost analysis, aiding more informed decisions and efficient profitability management. To get understand deeply about it, just read through this article right now!

Activity-based costing or ABC is a way of allocating overhead expenses more precisely by attributing them to activities. Once costs have been given to activities, they may be assigned to cost objects that utilize those activities. The technology may be used to reduce overhead expenses in a targeted manner.

In a simpler explained way, activity-based costing is described as dividing production into basic activities, defining costs for those activities, and allocating those costs to products depending on the utilization of the activities. ABC works best in complicated environments with many equipment and goods, as well as tangled processes that are difficult to sort out.

It is less useful in a streamlined setting when manufacturing procedures are shortened and expenses are easily assigned.

👉 Read More: What Is Tracking Signal? Calculation And Example

Activity-based costing is commonly used in the manufacturing business because it improves the dependability of cost data, resulting in almost accurate prices and better categorizing of the expenses incurred by the business during the manufacturing process.

Target costing, product line profitability analysis, service pricing, product costing, and customer profitability analysis all employ this costing approach. The ABC is used to gain a better understanding of expenses, allowing businesses to develop a more suitable pricing approach. The cost pool total divided by the cost driver provides the cost driver rate in ABC. In activity-based costing, the cost driver is used to calculate the amount of overhead and indirect costs associated with a certain activity.

- Read More: Order Management System: Definition, Process And Value

- Read More: Order Management System For Ecommerce: Definition, Key Effect, Benefit

The ABC formula is as follows:

The ABC cost accounting method mainly depends on activities, which can be any events, units of work or tasks having a particular aim, like putting up manufacturing machines, creating items, delivering completed goods, or running equipment. Activities are considered cost objects because they use overhead resources.

An activity may be defined as any transaction or occurrence that is a cost driver in the activity-based costing system. An allocation basis is referred to as a cost driver, sometimes known as an activity driver. Machine setups, used electricity, quality check, maintenance requests, purchase orders, and production orders are all examples of cost drivers.

👉 Read More: What Is Rough-Cut Capacity Planning And Example?

There are two types of activity measures: transaction drivers, which count how often an activity happens, and duration drivers which count how long it takes to perform an activity. Unlike traditional cost assessment methods that use ts, like machine hours, or direct labor hours, to assign indirect or overhead costs to goods, the ABC approach identifies five broad categories of activity that are, to some degree, unconnected to the number of units produced. These are examples of unit-level activity, organization-sustaining activity, batch-level activity, customer-level activity, and product-level activity.

While an ABC system provides precise production cost information, it is challenging to install. That is why you should weigh the benefits and drawbacks before choosing if it is appropriate for your company.

When making your annual budget, you undoubtedly attempt to be as clear as possible about your incoming and departing funds. ABC can assist you in developing an accurate budget that details where your money is going and which goods are the most lucrative.

The activity-based costing approach demonstrates how you employ overhead expenses, which assists you in determining if particular tasks are required for production.

It also assists you in determining where you are squandering money. If you discover that some things are costing you more than they should, you can find alternative ways to conduct them. You can even eliminate stages and even goods completely.

Pricing items might be one of the most challenging commercial decisions to make. Failure to evaluate all of your costs may result in you setting your rates too low. Therefore, you may not have a good profit margin.

You may allocate costs to each action in the manufacturing process using an ABC system. This displays all of the costs associated with creating a certain product. You may use this information to determine pricing that more properly reflects the cost of producing the goods.

ABC is meant to track the cost of activities, allowing you to determine whether or not activity costs are in accordance with industry norms. If not, ABC is a great feedback mechanism for determining the ongoing costs of individual services while management works on cost reduction.

Though the majority of the expenditures expended for individual consumers are just product prices, there is an overhead component as well, like extremely high customer service levels, cooperative marketing partnerships, and product return handling.

An activity-based costing system may help you go through these extra expenditures and decide which clients are genuinely giving you a decent profit. This examination may lead to the rejection of certain unprofitable clients or to go a greater emphasis on those clients who provide the most income for the business.

A typical corporation sells its products through a range of distribution channels, including retail, the Internet, wholesalers, and mail order catalogs. The majority of the structural cost of holding a distribution channel is overhead, therefore, if you can determine which distribution channels are utilizing overhead, you may make decisions to change how distribution channels are being used, or even delete unproductive channels.

ABC gives a thorough perspective of every expense related to in-house product manufacturing, allowing you to determine exactly which costs will be avoided if an item is outsourced versus which costs will remain.

You may evaluate the margins of various goods, product lines, and whole subsidiaries with optimal overhead allocation from an activity-based costing system. This may be quite helpful in choosing where to deploy firm resources in order to generate the highest profits.

The price of the product is truly determined by what people are willing to pay, but the marketer should be aware of the product’s cost in order to prevent selling things that will lose the firm’s money on each sale. Activity-based costing is excellent at calculating which overhead expenses should be included in this minimal cost, due to the circumstances within which items are sold.

It is typically relatively simple to classify overhead expenses at the plant-wide level, allowing you to compare manufacturing costs between various facilities. This may result in the reallocation of manufacturing activity to facilities with reduced overhead costs, as well as the closure of abnormally high-cost facilities.

Low-volume products typically have a significant amount of overhead and other startup costs. These extra expenses are not recorded in a traditional costing system but are assigned to items in an activity-based costing system.

Therefore, the increasing costs of low-volume items are better understood. This might result in increased prices for these items, their abolition, or a greater emphasis on lowering their related overhead and other startup expenses.

The easiest way to understand activity-based costing is to walk through its numerous processes. They are listed below.

The first stage in activity-based costing is to determine the expenses we wish to distribute. This is the most important phase in the process because we do not want to squander time with an overly broad project scope.

For instance, if we wish to calculate the total cost of a distribution channel, we will determine advertising and warehousing expenses associated with that channel but will exclude research expenditures because they are associated with products rather than channels.

In general, the scope of an activity-based costing project should be kept relatively restricted in order to make the project more manageable and cost-effective.

Instead of directly supporting a firm’s goods or services, create cost pools for expenditures expanded to provide services to other portions of the organization.

Secondary cost pools often comprise computer services, administrative wages, and other related expenditures. These expenditures are eventually allocated to other cost pools that have a more direct relationship with products and services.

Depending on the circumstances of the expenses and how they will be assigned, there may be multiple of these secondary cost pools. It can aid in avoiding a large number of cost pools, hence reducing the activity-based costing system’s complexity.

Establish a number of cost pools for costs that are more closely related to the production of commodities. Because expenses tend to arise at this level, it is highly typical to establish different cost pools for each line of products. These expenses might include R&D, advertisement, procurement, and distribution.

Alternatively, you may explore establishing cost pools for each distribution channel or facility. If your manufacturing batches vary substantially in length, consider defining cost pools at the batch level so that you may apportion expenses appropriately depending on batch size.

Use an information management system to gather information on the activity drivers that are used to shift costs from secondary cost pools to primary cost pools and from primary cost pools to cost objects. Accumulating activity driver information can be costly, therefore, choosing activity drivers for which information is already being gathered wherever possible. If you have a selection of activity drivers, choose the one with the lowest related data gathering cost.

👉 Read More: What Is Period Order Quantity? Formula And Example

Utilize activity drivers to allocate expenditures from secondary cost pools to major cost pools.

To assign the contents of each major cost pool to cost objects, you need to use an activity driver. Each expense pool will have its own activity driver. To get the cost per unit of activity, simply divide the cost in each cost pool by the total amount of activity in the activity driver. The cost per unit is then assigned to the cost objects depending on their utilization of the activity driver.

Change the activity-based system’s outcomes into reports for management consumption. For instance, if the system was initially intended to collect overhead information by geographical sales location, then report on revenues made in each area, all direct expenditures, and the overhead produced from the activity-based costing system.

This provides management with a complete cost picture of the outcomes provided by each location, as well as the sources of the profits made by the area.

When presented with an ABC report, the most typical management approach is to limit the number of activity drivers utilized by each cost object. As a result, the quantity of overhead consumed should be reduced. Furthermore, it might be beneficial for the manager to monitor management’s activities in response to ABC reports.

If management is no longer working, it may be essential to close down the activity-based costing reporting system. Thus, the firm incurs a reporting expense while receiving no advantage from any steps to improve operations.

Activity Based Costing Formula = Cost Pool Total / Cost Driver

The activity-based costing formula may be described using the basic principles listed below.

To better grasp it, let’s look at some easy to sophisticated instances.

Yellow Star Ltd is contemplating switching from the old costing approach to the BC-based costing technique, and the following information is available. Determine the new overhead rates for the firm using the ABC costing method.

| Activity | Budget Cost | Cost Driver | Cost |

| Machine Set-up | 500000 | No of machine setups | 300 |

| Inspection | 150000 | Inspection hours | 8000 |

Given example data of example 1

There are two activities planned. The first one is a machine setup operation, while the second one is an inspection activity. As the number of machine setups rises in the driver’s regions, so does the cost, and therefore, as the number of inspecting hours increases, so does the inspection cost. As a result, we must allocate those expenses depending on their cost drivers. We will use this formula:

Cost pool total / Cost Driver

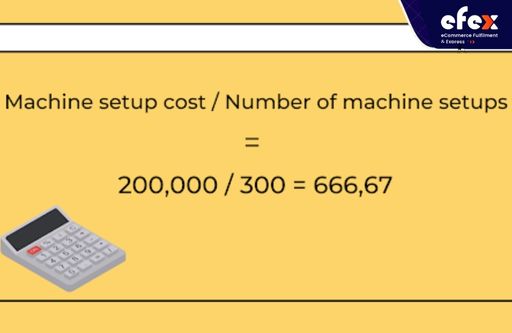

Then we can calculate the machine setup cost by:

Machine Setup Cost / Number Of Machine Setups = 200,000 / 300 = 666,67

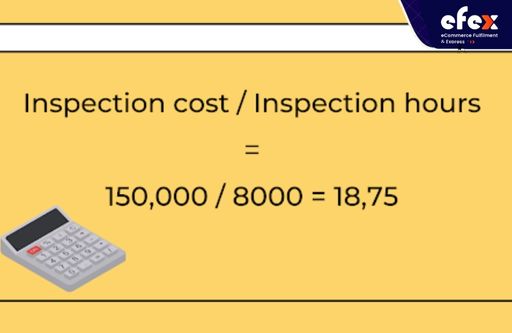

We can also calculate the inspection cost by:

Inspection Cost / Inspection Hours = 150,000 / 8000 = 18,75

The following information relates to LK Ltd’s various operations and their associated expenditures. You must compute the overhead rate for each task.

| Activity Cost Pool | Estimated Overhead | Cost Driver | Expected Activity | ||

| Standard | Speciality | Total | |||

| Purchasing | 200,000 | Number of purchases orders | 90 | 110 | 200 |

| Production steps | 300,500 | Number of setups | 60 | 250 | 310 |

| Inspection | 150,000 | Inspection hours | 400 | 600 | 1000 |

| Assembling | 70,000 | Assembly hours | 900 | 900 | 1800 |

| Machine maintenance | 500,000 | Machine hours | 6000 | 4000 | 10000 |

Given example data of example 2

Using this activity-based costing method, we have:

Cost pool total / Cost driver

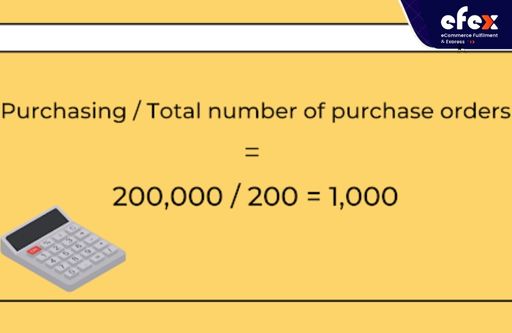

To arrive at varied rates, the overall cost of each activity pool is split by its cost driver. Based on the above formula, we can then calculate the overhead rate for the purchasing activity by:

Purchasing / Total number of purchase orders = 200,000 / 200 = 1,000

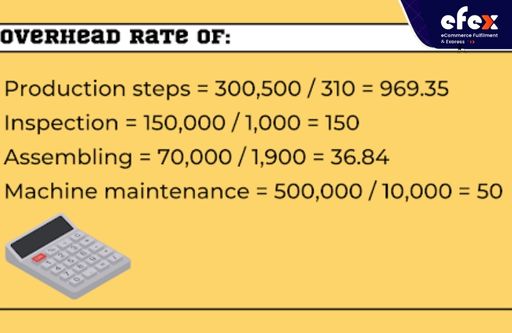

Similarly, we can use the formula to calculate all the cost pool activities, and we will have the following results: Overhead Rate Of:

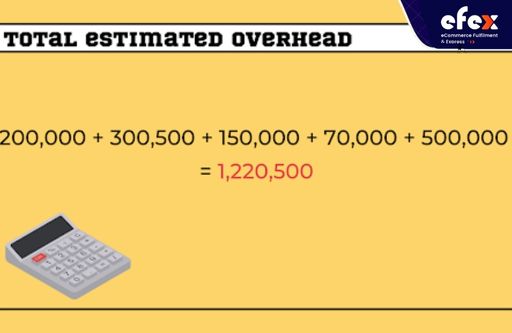

Then the total estimated overhead will be:

200,000 + 300,500 + 150,000 + 70,000 + 500,000 = 1,220,500

Beauty Inc., which is a cosmeceuticals manufacturing firm is thinking about transitioning from its old cost approach to a newly established system by their production head. It is activity-based costing in order for the two products, AHA serum and BHA serum, to be marketed at a fair price and remain competitive in the market.

| Activity Cost Pool | Estimated Overhead | Cost driver | Expected activity | ||

| AHA serum | BHA serum | Total | |||

| Purchasing | 80,000 | Number of purchases orders | 500 | 600 | 1,000 |

| Material handling | 95,000 | Number of purchase receipts | 600 | 1,000 | 1,600 |

| Production steps | 110,000 | Number of setups | 400 | 800 | 1,200 |

| Inspection | 60,000 | Inspection hours | 2,000 | 3,000 | 5,000 |

| Assembling | 30,000 | Assembly hours | 5,000 | 5,000 | 10,000 |

| Machine maintenance | 200,000 | Machine hours | 30,000 | 30,000 | 60,000 |

Given example data of example 3

You must calculate a product-based total by using the activity-based costing formula. Applying the ABC method to the example, we have:

Cost pool total / Cost driver

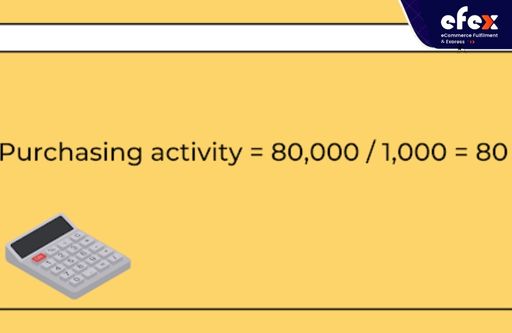

To arrive at varied rates, the overall cost of each activity pool is split by its cost driver. We have the overhead rate for the purchasing activity:

Purchasing Activity = 80,000 / 1,000 = 80

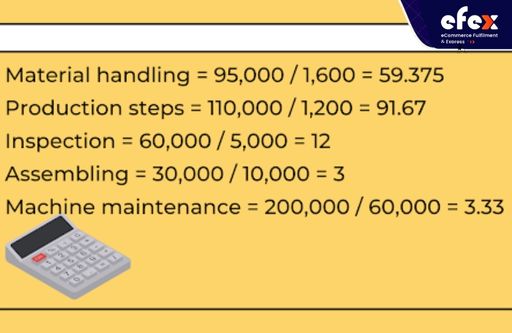

We then continue to calculate the ABC cost formula for all cost pool activities in the same way.

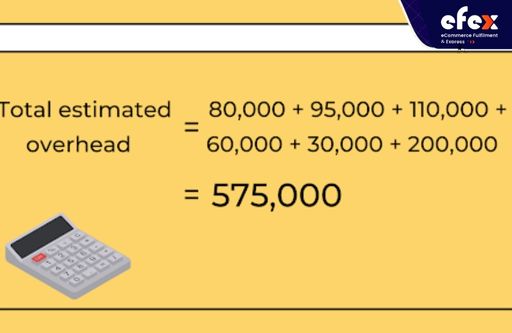

We will have the total estimated overhead:

Total Estimated Overhead = 80,000 + 95,000 + 110,000 + 60,000 + 30,000 + 200,000 = 575,000

After arriving at various rates, we must now calculate the overall cost of the product at the product level. All you need to do is just multiply the various overhead rates determined above by their actual cost drivers. We will have the following calculation:

(AHA serum x overhead rate) + (BHA serum x overhead rate)

Here is the result:

| AHA serum | BHA serum | Overhead Rate | AHA serum | BHA serum | Total | |

| Purchasing | 500 | 600 | 80 | 40,000 | 48,000 | 88,000 |

| Material Handling | 600 | 1,000 | 59.375 | 35,625 | 59,375 | 95,000 |

| Production Steps | 400 | 800 | 91.67 | 36,668 | 73,336 | 110,004 |

| Inspection | 2,000 | 3,000 | 12 | 24,000 | 36,000 | 60,000 |

| Assembling | 5,000 | 5,000 | 3 | 15,000 | 15,000 | 30,000 |

| Machine Maintenance | 30,000 | 30,000 | 3.33 | 99,900 | 99,900 | 199,800 |

| Total | 251,193 | 331,611 | 582,804 | |||

👉 Read More: What Is Planned Order Receipt? Calculation And Example

The advantages of activity-based costing are particularly visible when cost accounting information is difficult to interpret owing to the existence of several product lines, machines utilized to produce different goods, numerous machine settings, and etc.

You can understand as it is likely to use in complicated production environments. If a corporation does not function in such an environment, it may invest much in an ABC system only to discover that the associated data is not particularly useful.

Hope you have a good time with Efex.