More Helpful Content

Vietnam is one of the ideal places to do business and generate many profits if you want to go worldwide. The country's economy continues to grow rapidly, owing to free trade agreements (FTAs) and a more regulated business environment. To successfully start a business in Vietnam, especially for foreigners, it's crucial to have a deep understanding of the country's economic landscape and market entry strategies.

This article will cover everything you need to know about starting and expanding a business in Vietnam. Let's get started!

Vietnam has become one of Asia's most desirable investment destinations in recent years, particularly for international investors. The following are some of the major highlights of the Vietnamese business environment:

Vietnam also boasts a welcoming business environment that encourages foreigners to open business in Vietnam. Due to low labor costs, the country also enjoys a prominent position in the IT and industrial industries. In the section below, let’s learn all the steps to start a business in Vietnam.

Choosing the right market entry strategy is critical for businesses looking to start a business in Vietnam. Here are some common approaches you can consider:

| Strategy | Description | Advantages | Disadvantages |

| Joint Ventures | Partnering with a local company. | Access to local knowledge, networks, and resources. Easier navigation of regulations. Particularly useful in sectors with foreign ownership restrictions. | Potential for conflicts of interest, less control, complex negotiation and agreement processes. |

| Wholly-Owned Subsidiaries | Establishing a fully owned and controlled subsidiary. | Full control over operations and intellectual property. Potential for higher profits. Greater flexibility in decision-making. | Higher setup costs, greater risk, requires a deep understanding of local regulations and market conditions. |

| Representative Offices | Setting up an office for market research and liaison activities. | Low-risk option for market exploration. Lower setup costs compared to other options. Can build relationships with potential partners and customers. | Cannot generate revenue directly, limited activities allowed, may require upgrading to another structure for full operations. |

| Franchising | Granting a local entity the right to operate under your brand and business model. | Rapid expansion with lower capital investment. Leverage local partner's knowledge and resources. Brand recognition and established operating systems. | Quality control challenges, potential damage to brand reputation, dependence on franchisee's performance, and less control over operations. |

| Mergers and Acquisitions | Acquiring or merging with an existing Vietnamese company. | Instant market access, established networks and customer base, access to existing infrastructure and resources, and potentially quicker profitability. | Complex integration process, potential cultural clashes, high initial investment costs, potential for hidden liabilities. |

As shown in the table, it briefly compares different market entry strategies based on factors such as risk tolerance, investment capacity, and desired level of control. It's important to choose a plan that aligns with your long-term business goals and the specific characteristics of your industry and target market in Vietnam.

Regardless of the chosen entry strategy, you should conduct thorough market research, including:

We understand that starting a business in Vietnam can be quite challenging, especially when navigating the country's legal and regulatory requirements. This section provides guidance on the legal framework for selecting the right business structure in Vietnam.

| Feature | Limited Liability Company (LLC) | Joint Stock Company (JSC) | Branch Office | Representative Office |

| Ownership | 100% foreign ownership possible | Publicly listed possible | Extension of parent company | Extension of parent company |

| Liability | Limited to capital contribution | Limited to capital contribution | Parent company liable | Parent company liable |

| Capital Requirements | Varies depending on industry | Higher than LLC | Defined by parent company | Lower than other options |

| Tax Implications | Corporate Income Tax (CIT) | Corporate Income Tax (CIT) | CIT, subject to parent company's tax obligations | Limited tax obligations |

| Complexity | Relatively simple | More complex | Moderate | Simplest |

| Suitable for | Small to medium-sized enterprises, foreign investors | Larger enterprises, public listing | Specific sectors, established companies | Market research, liaison activities |

If you’re still in confused, we highly recommend these below resources to understand and start a business in Vietnam.

Launching a business in Vietnam requires navigating a specific regulatory landscape and obtaining the necessary licenses and permits. This process ensures compliance with local laws and allows your business to operate legally. Here's a breakdown of common requirements:

I understand that dealing with licenses and permits can be pretty overwhelming. It often involves filling out applications, gathering supporting documents, and waiting for reviews from the authorities. The process can be complex and time-consuming, so it's entirely understandable for seek professional guidance from legal and business consultants.

But, why does compliance matter?

Operating without the necessary licenses and permits can result in penalties, fines, and even business closure. So, it’s crucial to ensure compliance from the outset is crucial for building a sustainable and successful business in Vietnam.

To help you visualize the process more effectively, here's a table summarizing the key steps involved in registering your business in Vietnam:

| Step | Action | Required Documents | Estimated Processing Time |

| 1. Obtain IRC | Submit application to the Department of Planning and Investment (DPI) | Investment project details, capital investment, business plan, supporting documents | 15-45 days (depending on project) |

| 2. Obtain ERC | Submit application with company details, charter, legal representative info | Company details, charter, legal representative information, supporting documents | 3-5 working days |

| 3. Post-Registration | Register company seal, open bank account, register for tax & social insurance | Relevant documents for each procedure | Varies depending on the procedure |

| 4. Obtain Licenses | Apply for industry-specific licenses or permits | Varies depending on the specific license or permit | Varies depending on the license |

Take a look at this handy table that gives an easy-to-follow outline of the registration process. It shows what needs to be done at each stage, the documents you'll need, and how long each step might take. Understanding this process in advance will make it easier for you to get ready and go through the registration smoothly.

>> Learn more: Business Registration Certificate in Vietnam: All Detailed Steps

If you're considering launching a business in Vietnam, planning your finances carefully is crucial. Here are some important things to consider:

So, as you carefully consider these financial aspects and get advice from financial advisors and legal experts, you can set yourself up for a successful and sustainable business in Vietnam.

To expand your business in Vietnam, you need to focus on operational efficiency and targeted marketing strategies. This section focuses on these key areas to support your business expansion in Vietnam.

As you continue to grow your operations, it's important to focus on streamlining your processes and ensuring efficiency. This can be achieved by building strong relationships with reliable local suppliers and considering vertical integration to improve quality and reduce costs.

When starting a business in Vietnam as a foreigner, careful planning for Vietnam's complex logistics landscape is essential.

So, what should be involved here? Maintaining consistent quality control across all operations is crucial for brand reputation and customer satisfaction. You should also establish robust quality control processes, conduct regular audits and inspections, and invest in employee training programs to ensure adherence to standards and consistency in product or service delivery.

👉 For a complete solution that tackles operational complexities and optimizes your supply chain and logistics, EFEX can provide market entry and expansion services in Vietnam!

As your business grows, your systems need to adapt. You should make sure you have scalable systems in place, such as IT infrastructure, using business management software, and establishing standardized operating procedures (SOPs) for all key processes, will help ensure a smooth and efficient scaling process as your operations expand.

In Vietnam, it's all about embracing localized branding to really resonate with consumers. This means understanding the local culture and preferences, including language and dialects. Working with marketing service in Vietnam who specialize in localized branding can be super helpful in creating campaigns that truly connect with the audience.

👉 Read More: Vietnam Business Culture: All What You Need To Know

In addition to localized branding, having a strong digital marketing strategy is key to reaching a wider audience. You can engage with consumers on popular social media platforms like Facebook, Zalo, and TikTok, meeting them where they spend their time. Tailoring your SEO strategies for Vietnamese search engines will make your business easily discoverable online. Also, teaming up with local influencers can really help amplify your brand's reach and build trust with potential customers.

By strategically focusing on these operational and marketing considerations and using the full range of services to expand business in Vietnam, you can effectively position your business for sustainable growth and success in this dynamic market.

When starting a business in Vietnam, you will gain a lot of advantages. We've compiled a list of important points for you to consider.

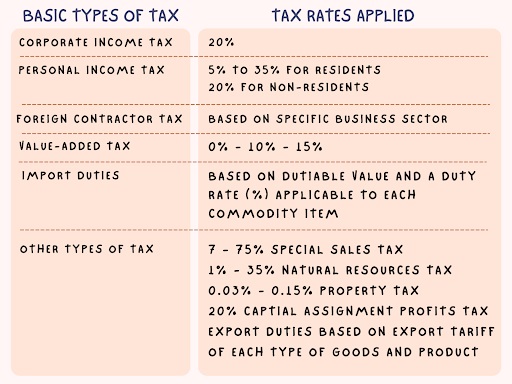

To start a business in Vietnam, you need to be familiar with the following taxes that apply to business operations and investments in Vietnam: Noticeably, there are several tax benefits available for doing business in Vietnam. Depending on the sector, location, and size of the project, new investment projects may be eligible for tax breaks. Furthermore, if you undertake expansion projects, you will be eligible for CIT incentives if certain criteria are met.

Vietnam's economy is booming, with a projected GDP growth of nearly 6% in 2024. This growth is fueled by robust exports, a resilient service sector, and a large population of nearly 97 million with increasing purchasing power. Foreign direct investment (FDI) is expected to reach US$40 billion, reflecting strong investor confidence in Vietnam's strategic location, favorable trade agreements like the EVFTA, and government policies fostering a pro-business environment.

Despite global uncertainties, Vietnam demonstrates economic resilience, maintaining low unemployment (2.27%) and manageable inflation (around 4.32%). The diversified economy, with contributions from industry, construction, and a growing service sector, provides ample opportunities across various sectors. These factors, combined with a youthful and increasingly affluent population, solidify Vietnam's position as a high-growth market with unlimited potential for business expansion in Southeast Asia.

Vietnam offers a compelling proposition for foreign businesses seeking cost-effective labor and a dynamic workforce. With average manufacturing labor costs around $1.25 per hour after a planned 6% minimum wage increase in July 2024, Vietnam remains significantly more competitive than its regional counterparts. This is coupled with a young and growing workforce of 52.5 million, with a large proportion under 30 years old, offering a dynamic and adaptable talent pool.

Despite a low overall unemployment rate of 2.27%, the youth unemployment rate presents an opportunity for businesses seeking young professionals and recent graduates. Average monthly incomes for contracted workers are around $295, further enhancing Vietnam's attractiveness for cost-conscious businesses. The government's commitment to improving labor conditions and productivity through minimum wage increases and reforms solidifies Vietnam's position as a strategic choice for foreign businesses seeking to expand in Southeast Asia.

Vietnam is actively cultivating a pro-business environment through continuous improvements to its legal and administrative framework. The Law on Enterprise 2020 provides a comprehensive legal foundation for businesses, while updates to the Investment Law streamline the FDI process. These efforts are reflected in Vietnam's improved World Bank Doing Business ranking, now at 70th out of 190 economies.

Administrative reforms, like Decree 25/2024, simplify investment procedures, and government support, including tax incentives, encourage FDI in key industries. The push for digital transformation, with new regulations on digital signatures and electronic transactions, further streamlines business operations. These initiatives, coupled with the upcoming Social Insurance Law and investment promotion programs, solidify Vietnam's commitment to attracting and supporting foreign businesses.

Vietnam is strategically located in the center of the ASEAN region. Furthermore, it is one of Southeast Asia's most promising economies. The Pacific Ocean, China Thailand, Cambodia, and Laos all share borders with Vietnam. This creates ideal conditions for international shipping and trade in Vietnam. Notably, the shift in China's supply chains is also beneficial to Vietnam's market. Southern China's manufacturing hub — one of the world's greatest economies and commerce centers – is nearby. Vietnam has become a desirable destination for investors seeking access to China's supply chains as a result of its proximity.

Vietnam has actively joined free trade agreements in the global economy. With a number of significant trading partners, the government inked 15 free trade agreements. Vietnam has also established diplomatic ties with 190 nations throughout the world. These FTAs have surely piqued foreign investors' interest in entering the Vietnamese market.

Vietnam's manufacturing sector is booming, contributing over 20% to the nation's GDP and attracting significant foreign investment. In 2023 alone, the sector drew USD 23.5 billion in FDI, a testament to its competitive advantages. With strong growth in manufacturing output, fueled by rising export demand, particularly in electronics, Vietnam's strategic location, and robust infrastructure, including industrial parks and economic zones, make it a prime manufacturing hub.

Competitive labor costs, averaging USD 1.25 per hour, a youthful and skilled workforce, and supportive government policies further enhance Vietnam's appeal. Trade agreements like the EVFTA and CPTPP facilitate access to global markets, while the ongoing transition to high-productivity manufacturing through technology investments ensures future competitiveness. Despite challenges, the outlook for Vietnam's manufacturing sector remains bright, offering ample opportunities for businesses seeking growth in Southeast Asia.

Let’s go through some risks of doing business in Vietnam below:

The Vietnamese government sets strict rules for what types of businesses can be held entirely by foreigners. Businesses that engage in activities that do not come under the recognized categories for foreign ownership will need to form a Vietnamese joint venture. Furthermore, if there are no WTO agreements or local regulations governing foreign ownership of a specialized or distinctive line of business, ministry-level authorization will be necessary to launch that business in Vietnam.

The process of forming a corporation in Vietnam includes a number of procedures. The process will take from around one to four months, regardless of the type of business being executed. The first stage, which might take up to a month, is to apply for and receive an Investment Registration Certificate. The firm will subsequently require a Certificate of Business Registration, which will take another week to complete. Finally, depending on the type of business being launched, the corporation may be required to obtain extra permits.

Most corporate organizations in Vietnam pay a standard corporate income tax rate of 20%. However, the tax rate in Vietnam is quite high in some business categories. For example, depending on the location and circumstances of the projects, you may be subject to tax rates of 32% and 50% if you work in the exploration and mining of oil, gas, and other natural resources.

For indirect investment in Vietnam, you'll need to convert your foreign cash into VND. Overall, all transactions, payments, quotes, advertisements, and other types of communication should be conducted in Vietnamese currency. Foreign currency inflows into Vietnam, on the other hand, have been more open, with few limitations. Similarly, relocating to another country has become less difficult. Providing you plan to work in Vietnam, you can move your earnings abroad if you clear all financial obligations to the Vietnamese government.

To start a business in Vietnam, you'll need to meet a number of conditions. Consider the requirement for paid-up capital. In most cases, your initial investment in Vietnam should be at least $10,000 USD. The capital amount can also be lower or larger depending on the type of business. The process of obtaining a license might be difficult.

Particularly if you're involved in some conditional sector operations as defined in Appendix 4 of Law on Investment No. 67/2014/QH13. You'll need to submit other documents, such as a certificate of company qualification, professional liability insurance, and so on.

👉 Read More: 10 Big Potential Ideas For Small Bussiness In Vietnam

Vietnam offers diverse investment opportunities across various sectors. Some of the most promising industries include:

The business registration process in Vietnam generally takes several weeks to a few months, depending on the complexity of the business and the required licenses and permits. Key steps include obtaining an Investment Registration Certificate (IRC), an Enterprise Registration Certificate (ERC), and any industry-specific licenses.

Vietnam offers various tax incentives to attract foreign investment, including:

It's important to consult with legal and tax professionals to determine the specific incentives applicable to your investment.

Yes, foreigners can start a business in Vietnam. The government actively encourages foreign investment and offers various options for foreign business ownership, including:

The specific requirements and regulations for foreign business ownership vary depending on the chosen industry and business structure.

When you start a business in Vietnam, it presents both exciting opportunities and unique challenges. By thoroughly understanding the market, navigating the legal landscape, and implementing effective growth strategies, businesses can position themselves for success in this dynamic economy. Remember, flexibility and adaptability are key in Vietnam's ever-changing business environment!

To facilitate seamless sell in Vietnam, Efex service serves as a crucial ally, offering a range of tailored solutions designed to streamline the process and maximize growth potential. By leveraging Efex's expertise in market analysis, regulatory compliance, and strategic planning, businesses can navigate the complexities of the Vietnamese market with confidence and efficiency, ensuring a smooth and successful entry into the dynamic business landscape of Vietnam.