More Helpful Content

To set up a business in Vietnam, applying for a business license in Vietnam is essential. Nowadays, doing it has also become easier when cumbersome procedures have been eliminated. But don't let that stop you from looking at these administrative procedures. Because most likely it will take up a lot of your time in identifying papers and methods. If you don't specify the type of business license, you will face the risk of it not being right for your type of business.

Below are the types of business licenses in Vietnam that you need to know to be sure of the necessary procedures.

To determine the right type of business license, you first need to understand what your company's business type is. In Vietnam, there are 5 main types of enterprises.

Business cooperation is a type of enterprise that attracts investment capital from foreign traders. Because it gives them the ability to invest in huge projects in Vietnam. More than that, they also receive countless revenue from those projects. Here, the partners of the company will be jointly and severally legal according to the contractual agreement between the two parties for the debt and interest.

This type of business partnership will bring independence to the parties in many aspects such as personnel or tax. A business contract must be approved in writing by the competent authority to establish certain business cooperation. The maximum business term is 50 years. The parties may transfer their shares to a third party during the business term with the priority right of the other parties in the contract.

>> Learn more: Vietnam Tax Rate: List Of Tax Rates In Vietnam And Why Need To Pay

>> Learn more: Vietnam Withholding Tax: Detail Information

The form of joint venture investment is not too strange in Vietnam. Joint venture companies between foreign enterprises and domestic partners are always in the form of limited liability companies. For this type of business, the foreign partner must have at least 30% of the legal capital of that company. To establish a joint venture company, it is necessary to obtain the approbation of a competent authority. The application file for an establishment license includes:

To be able to set it up, you need to take note of the name of the company. The name of the company must be in Vietnamese or at least both Vietnamese and English. Up to now, the state still favors this type of joint venture company. According to the Law on Foreign Investment in Vietnam, joint venture companies are not required to have a minimum capital.

The joint venture term is limited to a maximum of 50 years and can be extended for up to 70 years from the date of application. During that time, the parties may transfer their shares to a third party who has priority over the parties to the joint venture contract.

According to current regulations, when an investor enters Vietnam to establish an economic organization, they must have an investment project and carry out registration procedures for an investment registration certificate.

>> Learn more: Business registration certificate in Vietnam

After completing this procedure, the investor will carry out the procedures for registering the establishment of an enterprise by the law on enterprises, corresponding to each form of the organizational model of economic organizations. Papers and documents to establish a company with 100% foreign capital include:

In order to establish a foreign company in Vietnam, the foreign company must first be established legally in accordance with foreign laws and participate in international treaties to which Vietnam is a contracting party.

Second, a foreign company must have been operating for at least 5 years before establishing a branch in Vietnam.

Third, the activities of branches of foreign companies must not contravene the provisions of Vietnamese law, and must not contravene international treaties to which Vietnam is a contracting party.

After being granted an establishment license in Vietnam, when operating a branch, it must comply with the provisions of Vietnamese law on financial reporting, annual tax reporting as well as regulations on employment.

- Read More: E-Commerce Logistics Vietnam Overview

- Read More: Logistic Vietnam: Overview of Vietnam’s Development in 2022

Components of the application file for the establishment of a branch of a foreign company in Vietnam include:

A representative office is a dependent unit of the enterprise, which has the task of representing by authorization the interests of the enterprise and protecting those interests. The organization and operation of a representative office must comply with the provisions of the law.

Thus, a representative office is not allowed to conduct business directly, is not allowed to sign economic contracts with the seal of the representative office, but is still allowed to sign contracts under the authorization of the open enterprise. That representative office will stamp the business. Representative offices include representative offices of domestic enterprises and representative offices of foreign traders.

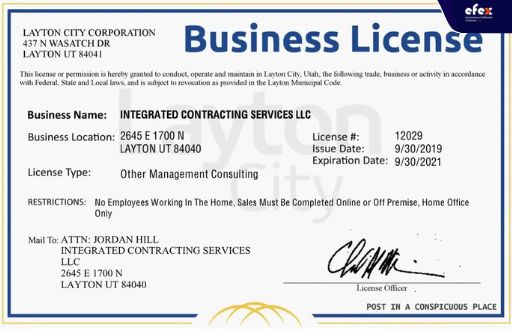

According to the law in Vietnam, currently, there are several common types of business licenses as follows:

Here are some common risks in the business license process that you need to be aware of:

Above is all you need to note about the Business license in Vietnam. In this article, you are provided with some information about common types of businesses and business licenses in Vietnam.

Potential risks associated with improper business licensing underscore the significance of seeking professional assistance to ensure compliance with Vietnamese laws and regulations. Ensuring accurate business name selection, transparent capital structure, and comprehensive compliance procedures are imperative for a smooth and legally sound business setup process.

Sellers and retailers looking to tap into the promising Vietnamese market can leverage our Sell in Vietnam service, which offers comprehensive support for navigating the complexities of business registration. By partnering with us, sellers can access a seamless and efficient process, allowing them to focus on their core business activities and capitalize on the abundant opportunities presented by Vietnam's burgeoning e-commerce sector. Don't miss out on the chance to establish a successful venture in Vietnam - partner with us today for expert guidance and hassle-free business registration services.