More Helpful Content

Vietnam is now one of the emerging countries with open market policies that attract a large number of investors. According to evidence, the flow of FDI into Vietnam has expanded considerably in the last five years as a result of foreign investor investment. The procedure for founding a corporation in Vietnam is straightforward; nevertheless, there are some constraints for foreign-owned businesses.

Understanding the rules and procedures for starting a foreign-owned company in Vietnam is crucial. Our article on all steps of getting a Business Registration Certificate in Vietnam will make it easy for you to do it.

>> Learn more: Doing Business In Vietnam: Overview, Advantages And Challenges

In Vietnam, the two most popular types of legal entities are:

A limited liability company (LLC) can have anywhere from one to fifty members, often known as founders or owners. It's worth noting that in Vietnam, LLCs don't have stockholders. A JSC, on the other hand, must have at least three shareholders. The number of shareholders a JSC can have is unrestricted.

In most industries, Vietnam allows 100 percent foreign ownership of a company. Trading, manufacturing, information technology, and education are among them.

Some industries, however, have restrictions on foreign ownership. Advertising, logistics, and tourism are only a few examples. Foreign investors will need a Vietnamese joint venture partner in such circumstances. Most business lines are governed by World Trade Organization (WTO) accords that regulate foreign ownership. However, some business categories are not covered by WTO accords or local legislation.

In such circumstances, you will require permission from the relevant ministry.

In most business lines in Vietnam, there are no minimum capital requirements. It must, however, be sufficient to cover expenses until the company becomes self-sufficient. Your capital contribution will be evaluated by the Department of Planning and Investment to see if it is appropriate for your firm. Many enterprises start with a capital of USD 10,000.

However, based on our experience, a commercial service company can be started with just USD 3,000. It's worth noting that some business lines have low capital needs. These are some of them:

It's important to remember that your capital should outweigh your setup and equipment costs. The amount of your capital will be stated on your Business Certificate. This will necessitate changes to your company's papers.

A business address is required to start a business in Vietnam. Service-based businesses, such as consulting firms, can benefit from a virtual office location. Some company lines, however, require a physical facility or office. Manufacturing, restaurants, and retail business are just a few examples.

During the incorporation process, the Department of Planning and Investment may inspect the address. You can provide proof of your address by submitting papers. It must state that following incorporation, you will use the location for your business.

In Vietnam, every company must have at least one resident director. At the moment of incorporation, he or she does not need to be a resident of the United States. They will, however, require a Vietnamese address. Note that if the director is also a founder, a work visa is not required. He or she will need to seek a work permit exemption instead. A foreign national who is not the company's founder will require a work permit in Vietnam.

Vietnam is now one of the emerging countries with open market policies that attract a large number of investors. According to evidence, the flow of FDI into Vietnam has expanded considerably in the last five years as a result of foreign investor investment. As a result, we would like to share some important business registration information below:

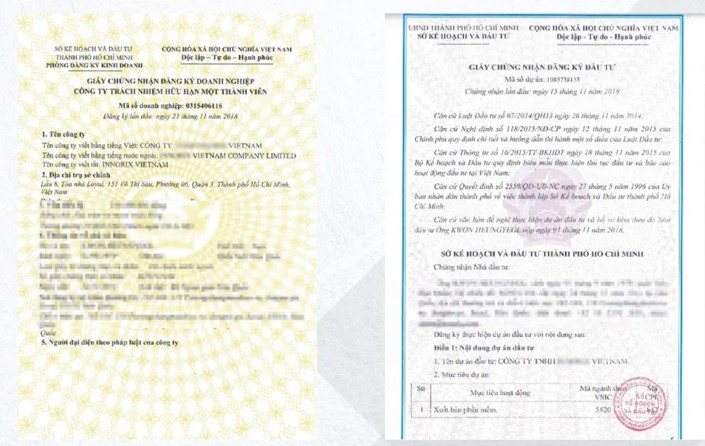

To begin, the investor must register with the National Foreign Investment Information System by stating online information about investment proposals. The investor must submit the application file for the Investment Registration Certificate to the Investment Registration Authority within 15 days after the date of online filing.

Following receipt of the application, the investor is given an online account to access the National Foreign Investment Information System to track the application's processing and results. If a successful investment registration certificate is obtained, the investment registration agency will issue a code to the investment project through this account; if the application form is rejected, the investment registration agency must notify the investor in writing and explain the reason.

Some below documents should be prepared in the dossier for the company registration procedure:

To authorize Viet An Law Firm to undertake the business establishment service, a legal service providing contract (Authorization contract) was signed. Within 3–5 days of submitting the application dossier through the National Business Registration Portal to the Business Registration Authority, the business registration agency will provide an enterprise registration certificate.

You must make public notice on the website in accordance with the regulations and procedures within 30 days of receiving your Business Registration Certificate.

Retailing is the sale of goods to other individuals, households, and organizations for consumption, according to Decree 09/2018/ N-CP, which regulates goods trading and activities directly related to the sale and purchase of goods by foreign investors and economic organizations with foreign investment capital in Vietnam.

As a result, there is no requirement for the investor to issue a business license to export, import, or wholesale commodities (not belonging to the categories of goods: oil, rice, lubricant, sugar; books; video items; magazines and newspapers). When retailing items and setting up goods in retail outlets, investors must provide business licenses.

>> Learn more: Everything about business license in Vietnam you need to know

The company's tax number is the same as the business license certificate number. All businesses must use an internet system to pay their taxes. Companies can also use this system to send tax declarations and reports. Businesses must obtain an electronic signature in order to gain access to this system.

>> Learn more: Vietnam Tax Identification Number Format and Meaning

>> Learn more: Vietnam Tax Rate: List Of Tax Rates In Vietnam And Why Need To Pay

>> Learn more: Vietnam Withholding Tax: Detail Information

You have 90 days after receiving the BRC to make the capital contribution. Fines will be imposed if this is not done.

In Vietnam, forming a business takes around a month. Depending on the field, certain businesses may need to apply for sublicenses. The registration process will take longer in such instances. Sublicenses are required in the following business lines:

Certain enterprises require additional permits to operate. Cosmetics companies, for example, must register their items before selling or distributing them. This could take anywhere from a few weeks to several months to complete.

In Vietnam, corporate compliance entails the following:

Due to foreign ownership restrictions, international investors may be unable to start a business in some instances. Some form a partnership with a local nominee to carry out their desired business ideas. Some overseas investors utilize nominee corporations to get around industry limitations. The Vietnamese government, on the other hand, is cracking down on nominee firms. With the new Investment Law, the government would impose harsher penalties on nominee firms.

In January 2021, it will take effect. Conducting business through a special purpose vehicle is a safer option. It would enable you to secure and govern your investment without having to establish a corporation in Vietnam.

In some circumstances, forming a business in Vietnam is unnecessary. There are other options for breaking into the Vietnamese market.

A foreign parent company's representative office in Vietnam can act on its behalf. A representative office cannot produce revenue on its own, but it can assist the parent company with responsibilities. It's a way to break into the Vietnamese market without forming a business.

You can hire staff in Vietnam without creating a corporation or a representative office if you have an employer of record. We will put your staff on our payroll as your official employer. We'll also make sure that we're following all of the local labor regulations.

Certain certificates and approvals are required before items can be imported into Vietnam. Business operations will be delayed if you wait for this paperwork before importing your items. You can instantly begin importing items into Vietnam through a registered importer. In this article, we have provided you with some fundamental legal information on how to get Business Registration Certificate in Vietnam.

>> Learn more: Business In Vietnam for Indians: Potential And Opportunities

For more detailed assistance with the company registration service in vietnam, including compliance, special purpose vehicles, and other market entry options, contact Efex service to ensure a smooth and successful venture in this promising business landscape.