More Helpful Content

Business owners often spend most of their time and brainpower looking for ways to increase revenue for their company. But that is not the only important thing. Besides the large expenses that are often carefully calculated, there are also hidden expenses that reduce profits. A good example is the inventory carrying cost. So, if you are a business owner and still don't understand what inventory carrying cost is and if there is a way to minimize it, read this article.

Unlike inventory holding cost, inventory carrying cost is the one incurred while goods are held for a period of time before being converted to working capital. this cost is usually expressed as a percentage of the total value of the inventory. Bookkeeping costs vary by product and sector, but they generally include the following costs:

Rent for storage space is easily measurable, but opportunity costs are not. Carrying costs are a considerable part of the supply chain, and they have a direct influence on your sales revenue and bottom line. If you utilize inventory management technology to monitor inventory carrying costs over time, you will have more detailed information to make informed decisions about:

Furthermore, keeping track of this fee guarantees that you don't incur significant losses as a result of retaining inventory for an extended period of time.

Carrying costs represent the fee of renting the warehouse, managing the warehouse, any loss of inventory due to theft or damage, wages for warehouse staff, and securing the inventory.

Carrying costs typically account for 15% to 30% of a company's total inventory value.

So this metric will be very important in assessing the business whether they are doing well or not. It helps business owners calculate how long to keep a product before it starts to incur additional costs or can no longer be sold. At the same time, with this data, you can also make business decisions about how much to buy to minimize losses and increase profits.

Shipping costs include a variety of fees associated with holding inventory. Here are some common expenses that you can refer to:

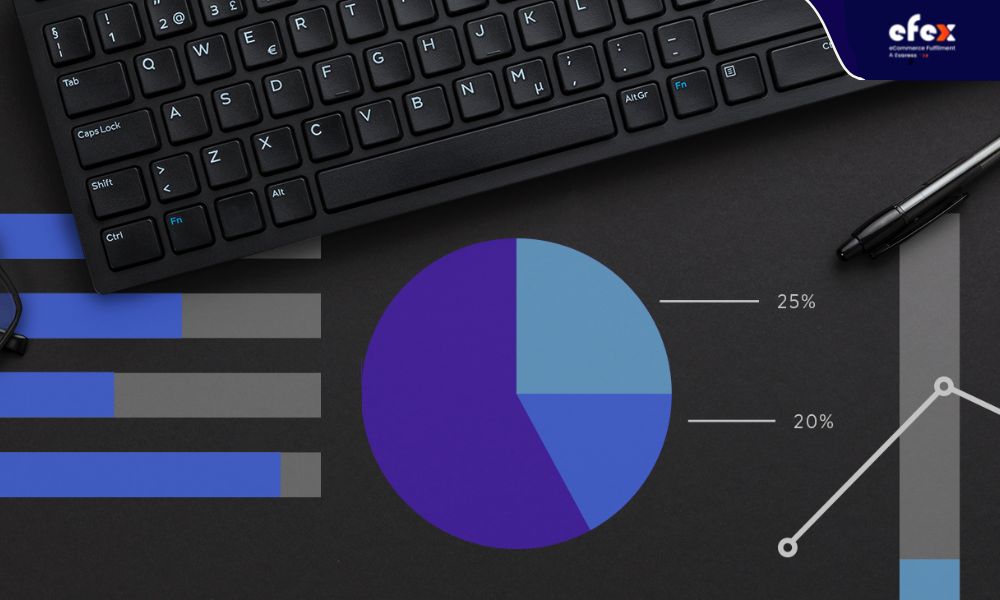

Capital expenditure accounted for the largest proportion, accounting for about 25% of carrying costs. The cost of capital includes the purchase price of raw materials or inventory, as well as any associated financing fees, loan administration, interest, and fees.

Inventory service fees are not related to inventory but are required to keep them at the warehouse. Insurance fees, taxes, software and hardware purchases, and inventory management are among the expenses. Higher inventory levels can lead to higher taxes and insurance premiums, but they may also be required to keep things moving to buyers.

Similarly, inventory management software is an ongoing expense that offers the opportunity to more closely monitor inventory activity and reduce inefficiencies. This category also includes inventory management methods such as manual counting and cyclic counting.

This is the wage paid to the people that work in the warehouse on a daily basis. Additionally, some specialized employees and workers may be required in the event of commodities needing expert handling for proper storage. In an electronics manufacturing warehouse, for instance, full-time specialists may be necessary. Alternatively, a quality assurance specialist at a food plant.

This cost represents the money obtained from the purchase of goods through storage. Potential cash sales remain unrealized as long as the product remains unsold. This amount is the opportunity cost the business incurs to store the goods. As a result, that cash can be converted to generate more interest income or invested for better returns. Therefore, it is important for a business to strike a balance between opportunity costs and carrying costs so that the latter do not overwhelm the former.

The expiry date is a term for unsolvable inventory that can increase the costs of inventory carrying. Products become obsolete when their value declines to the point of being written off. To reduce obsolete inventory, organizations often unload while the product is still in use, for example as a gift, at a large discount, or sold to a liquidator. Otherwise, you will have to lose money to solve it. This happens if regular inspections are not completed, organizations may be keeping obsolete goods in stock, incurring additional costs, and taking up warehouse space. Therefore, it is important that products are disposed of immediately before they become obsolete.

To protect inventory- an important asset of a warehouse, many businesses have invested in insurance. Then, even if a fire or flood destroys a warehouse or store, not everything is lost. However, the larger the inventory, the higher the insurance costs. Similarly, the more goods you have on hand, the greater your taxes will be. By storing merchandise or only the highest-performing commodities in the warehouse, a business may save money on both insurance and taxes.

Property taxes, building upkeep, transportation, cleaning, and equipment depreciation are all examples of administrative expenditures. In general, a firm with greater inventory has more administrative costs, partly because it requires a larger building.

Labor and the quantity of "touches" a product takes, from placing it in a storage bin to generating a shipping label, account for a significant part of the proceeds spent on the handling of materials. However, equipment, machinery, and product damage after you acquire control are all included in this expenditure category. If a corporation holds fewer products in its facility, it may not require as much equipment or machinery, or it may utilize them less frequently, reducing the need for maintenance and repair.

Shrinkage occurs when inventory is lost after it arrives at your warehouse but has not yet been sold to customers. Shrinkage of inventory can be caused by damage during transportation, theft, errors, or fraud in bookkeeping. Like all inventory carrying costs, the more inventory a business has, the more likely it is to lose money due to downsizing. To prevent shrinkage, a business can detect and fire employees accused of shoplifting, talk to suppliers about common causes of damaged items, and take action.

If a company is only concerned with moving excess inventory, it cannot learn and apply new strategies to add a new feature or product sought by customers to increase sales. Businesses can then get stuck in this cycle if they keep too much inventory. Therefore, businesses should optimize stocks to free up resources and invest in research and development.

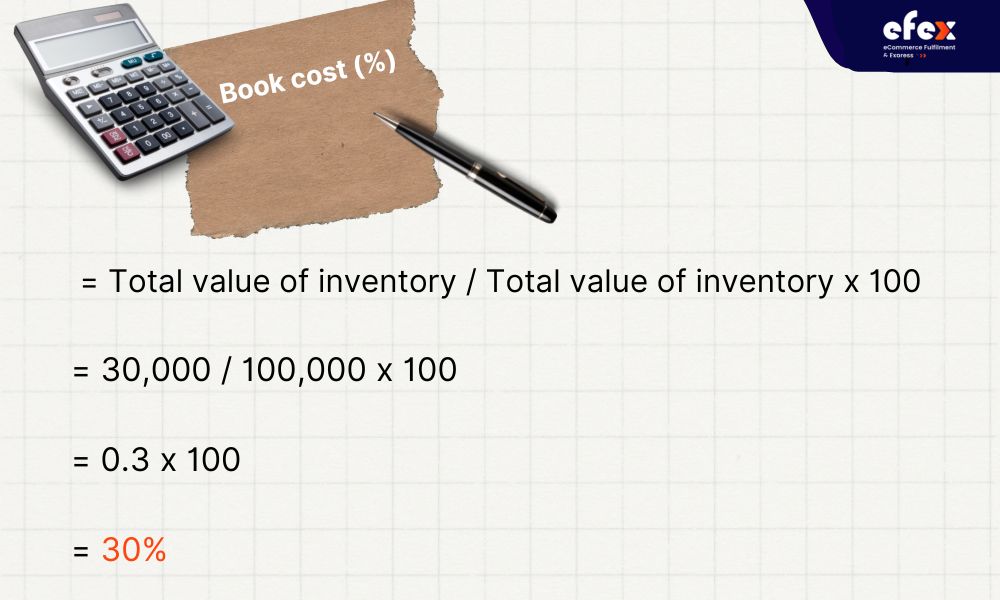

Calculating the % of cost inventory carrying for all businesses is a very important task to determine the profitability of their inventory. Bookkeeping costs are always expressed as a percentage of the total value of the inventory. They are calculated by dividing the total amount of inventory by the entire value of the inventory and multiplying the result by 100.

| Carrying cost (percentage) = Inventory holding total / Total inventory value x 100 |

The total inventory sum is just the total of all four carrying cost components. Inventory holding costs are calculated as follows:

| Inventory service costs + Inventory risk costs + Capital costs + Storage costs |

To figure up your carrying cost, do the following:

👉 Read More: Inventory Cost Flow Assumptions: Definition and Example

👉 Read More: Inventory Cost Methods: Formula and Example

👉 Read More: Inventory Cost: Types, Formula, And Example

Motorcycle dealer owns stock of all its bike models. His total merchandise is worth $100,000. His total inventory is $30,000 (including risk costs, inventory maintenance costs, capital costs, and storage costs). His inventory carrying cost percentage is as below:

The motorcycle retailer's shipping costs are 30% of his entire inventory value. Therefore, carrying costs allow you to calculate your profit against the costs incurred from the inventory you hold. This expense ensures that you do not suffer significant losses when keeping the goods for a long time. Carrying cost inventory should always be kept to a maximum of 20% - 30% of total inventory value.

When you check your goods on a regular basis, you will have the most detailed information and overview of the status of your inventory. In addition, this will reduce the number of items that customers want to buy. You also tell your customers that they can rely on you to receive their goods whenever they want to buy from your business. This is a good feeling for your company and a great first impression for your consumers.

Keeping inventory allows your business to buy raw materials or goods in bulk while also managing logistics. For example, if you buy in bulk, the organization will sell it to you for the best possible price, providing you with a substantial discount. In addition, shipping costs will be reduced as sellers can offer shipping to bulk buyers as a means of retaining and attracting buyers. Thus, you can see that saving money by buying in bulk is one of the most effective ways.

The success of any business is determined by its ability to sell goods on time to customers. Likewise, satisfy their needs. In addition, if consumers are satisfied with the service you provide, they will be happy and come back to buy again next time. As you know, happy consumers will tell others about how quickly you sell to them. From there, you will get new customers and help build your company with the old experiences of customers,.

Everything in life, in general, has a time. For example, there are four seasons: summer, winter, spring, and autumn. Each different season will have an impact on the supply and purchasing of goods in different industries in one way or another. So, as a business, you must be aware of changing seasons to know whether to expand or import less inventory to minimize losses. Knowing when to buy is one of the main reasons a business has inventory.

In business, money is really crucial. As a result, managing your cash is critical if you want to stay in business. When you receive low-cost bids from consumers, it suggests your company's cash flow is constrained. Always keep a reserve of operating capital on hand. The sole advantage is that if you buy at a low cost, you will be able to offer at a cheap cost to your clients.

Understanding when and how much to replenish items is a simple way to ensure that you don't enter more than you can sell or don't have enough to satisfy customer purchases. You can use the market demand forecasting tool to more effectively establish your reordering points. Check past sales data, taking into account the season, region, and channel that customers buy most often. According to a survey, 46% of SMEs look at data from previous months to better understand how their current sales model is performing. You can also consult with organizations with similar strategies and sales cycles to your business on how to get the correct reordering score.

Minimum order quantities (MOQs) enable wholesalers to profit from scale economies; the more they order, the lower the price of each unit. However, this might be difficult for the wholesaler. Larger wholesalers have controlled cash flow and surplus resources, making it simple to place orders for a large manufacturing run. When cash flow is often unstable, small and medium businesses have 3 options:

For SMEs, the best option is negotiation. You may not be able to pay for the number of items specified in the MOQ.

You can reduce your ability to grow your business if you invest large amounts of money in stockpiling inventory. You will often be attracted to large discounts when buying goods in bulk. Vendors often actively offer promotions and free discounts on certain products if you buy in larger quantities than your business can sell. The deal sounds tempting, but if the goods you buy can't get off the shelves, it's a disaster. Since you will incur deadstock, that is the price paid for the items in stock. With that money, you can try to import potential new items or test out new advertising campaigns that help upgrade your sales strategy. Therefore, do not make it difficult for your business to manage goods in stock because of ineffective discounts.

You are stuck with unsold goods because you accepted an attractive offer from a supplier. Here are some simple methods to help your business overcome this deadlock:

But it would be better than spending extra money storing goods that don't create any value.

Reducing lead times is one of the innovative techniques to reduce inventory holding costs. Let's say you can get your item shipped to your warehouse in six days, not the usual nine. With shorter delivery times, you'll sell more efficiently. Avoid the situation of not having enough goods because the goods have not arrived at the warehouse. With more shipments, you won't need as much storage space anymore. From there, you can reduce the number of orders per order and reduce shipping costs. If you can maintain a good relationship with the supplier. Give an offer that you will often enter large quantities for long periods of time. This means that the supplier will benefit from this.

👉 Read More: Inventory Reduction: Benefits, Formula, and Strategies

When companies are looking to make more profits. What is important for business owners to do is how to efficiently manage inventory and ways to reduce the inventory carrying cost. This will help them predict and make decisions in line with market needs.