More Helpful Content

Understanding the perpetual inventory system calculator will help in keeping track of inventory more efficiently. So, why don’t learn more about it? Let us walk you through the 4 formulas below. One technique for keeping track of the number of products in stock is the perpetual inventory system. Stock marketing benefits from perpetual inventory.

A company uses computerized systems for tracking to continuously record the inventory in this type of value inventory. Such stock management techniques can help small companies succeed. That’s why mastering a perpetual inventory system calculator is very important. In this post, we will provide you with a perpetual inventory system calculator along with its formula and explanation.

The level of inventory to purchase to meet demand and lower rising inventory holding costs is determined using the Economic Order Quantity (or EOQ) model. With the help of perpetual inventory accounting, you can quickly calculate EOQ because you will have a better understanding of your inventory flow.

EOQ = √(2SD/H) Where,

- Read More: Order Management System: Definition, Process And Value

- Read More: Order Management System For Ecommerce: Definition, Key Effect, Benefit

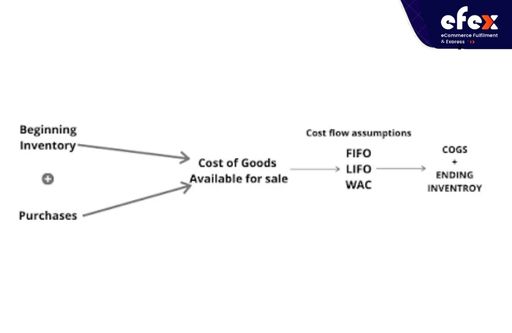

The COGS, standing for the cost of goods sold (also knowns as the cost of sales), is continuously calculated using the perpetual inventory approach.

The cost of sales rises when the product is sold. It includes all of the money used to purchase items, as well as labor and material expenditures.

BI + P - EI = COGS

In which,

COGS is computed in a perpetual inventory system after each sale; however, you can also calculate it over a set period of time using this formula.

The perpetual inventory system uses a slightly modified formula to compute gross profit. When preparing accounting paperwork and reports, you might need to estimate the final inventory for a specific period in order to compute gross profit.

The gross profit method's computation might appear like this if you wanted to calculate the ending inventory out from the current month.

Gross profit = Revenue - COGS

You should be aware of

This way, you can calculate your expected ending inventory as well as your profit margin.

Cost flow assumption is an inventory accounting technique that determines COGS as well as the value of ending inventory using the actual value of the goods from the starting inventory time frame and the costs incurred when buying additional inventory throughout that period. Three assumptions for cost flow include LIFO, FIFO, and WAC (or Weighted Average Cost).

First in, first out (or FIFO) is a technique of inventory accounting that ensures that the product acquired first should be sold firstly, ensuring that the inventory left over is always the most current stock. Sales are recorded in the ledger as they occur for FIFO - the perpetual cost flow model. To analyze the stocks, a cost flow calculation has been used.

The balance is a cumulative total of the price of sold units as well as the total number of units, which is the main distinction in the ledger between a perpetual inventory technique and a periodic system. When the inventory that was sold appears, the total unit cost is passed out to the balances.

Throughout its tenure with the company, the stock the company purchased will retain its original value. When a business is attempting to demonstrate its enormous potential for generating big revenues, the FIFO approach should be implemented. Fewer COGS investments and a greater bottom line are shown by FIFO.

- Read More: Periodic Inventory System Calculator: All Formula

- Read More: What Is The Procurement Cycle? Process And Example

- Read More: 13 Stages Of Procurement Cycle With Detail Instructor

The cost flow model is known as Last in First Out (or LIFO) is what companies use to determine the value of the inventory. For acquiring and sales, this system also utilizes the running ledger tally.

The only difference is that in this case, the stock that was last in line gets sold first, so the oldest stock is what is left over. The program initially deducts from the COGS account the closing expenses that are present at the time of the transaction. A smart strategy to demonstrate rising COGS costs and decreased net income is to use the LIFO method. In difficult circumstances, this technique can be utilized to lower tax obligations.

>> Learn more: Perpetual Inventory Using LIFO

The average cost of products sold for the current inventory is known as the weighted average cost (or WAC). For a perpetual inventory system, the WAC is calculated in a different method. Every time a sale or purchase occurs in WAC, a standard average price is assigned to each inventory item. Because with a perpetual inventory system, items vary in real-time, the calculation that takes a certain period into account cannot be found.

You've made the decision to open a modest convenience shop in your community. You must choose between a periodic inventory system and a perpetual inventory system during the initial setup process. Select the system that is best for your business, and then conduct research to support your choice. We've provided a list of the perpetual inventory system calculator above in an effort to make your business operations more efficient. Hope you have a good time with Efex.