More Helpful Content

There are various costs connected with operating a manufacturing business, and understanding how to evaluate these costs will help guarantee your firm is as lucrative as possible. The variable manufacturing cost is a frequent expense that business owners may be required to understand the way to calculate. Understanding your company’s overall variable expenses is critical for a variety of reasons.

In this post, we will define the variable manufacturing cost, explain why it is crucial for your organization, provide you with the total variable manufacturing cost formula, and show you how to calculate it along with examples.

Variable costs are the total of all materials and labor necessary to manufacture one unit of the product. These expenses are directly related to a company’s production capacity and may rise or fall based on the amount it manufactures.

👉 Read More: What Is Fixed Manufacturing Overhead? Formula And Example

Variable costs, as opposed to fixed expenses, which remain constant regardless of manufacturing, can fluctuate substantially based on a business’s performance. Packing, sales commissions, labor connected with the production process, raw materials required to manufacture, and other costs tied directly to manufacturing are popular uses of variable costs.

Variable costs will fall as fewer items are produced. In contrast, when a firm’s product output grows, so do its variable costs.

It is worth noting that, along with variable and fixed costs, there is a third sort of cost known as “semi-variable expenses”. These expenses, which are dependent on a set volume of output, are mixed with both variable and fixed costs. When this manufacturing level is reached, the costs will shift from fixed to variable.

Variable manufacturing cost is important since understanding which of your expenditures are variable or fixed will help you make better judgments.

On the other side, being knowledgeable of various costs allows you to reduce them when necessary by cutting output.

Furthermore, variable expenses may be utilized to compare your company or a company in which you are interested in investing with other firms in the same sectors.

However, you should note that these types of comparisons are often only helpful when comparing firms in the same area.

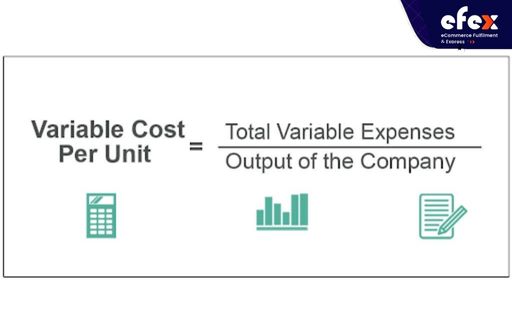

It represents the materials, labor, and other assets needed to manufacture your product. For example, if your firm sells tool kits for $100 but each kit costs $50 to produce, inspect, pack, and promote, your variable cost per unit would be $50.

The number of units produced, as you might think, is the total number of goods manufactured by your organization. Therefore, in the tool kit example, if you make and sell 500 tool kits, your total number of units produced is 500, with each carrying a $50 variable cost and a $50 potential profit.

To determine variable costs, multiply the cost of producing one unit of the product by the total number of items produced. This formula is as follows:

Variable costs get their name since they might rise and fall as you produce less or more of your goods. The more items you sell, the more revenue you will earn, but some of that money will be used to fund the manufacturing of further units. As a result, you will have to generate more products in order to make a profit.

👉 Read More: What Is Manufacturing Overhead? Formula And Example

👉 Read More: Manufacturing Overhead Budget: Example And Formula

Furthermore, since each unit necessitates a specific quantity of resources, a greater number of items will increase the variable costs required to generate them. Variable expenses, on the other hand, are seen as a necessary measure than an issue. They are used in a variety of bookkeeping duties, and your average variable cost and total variable cost are determined separately.

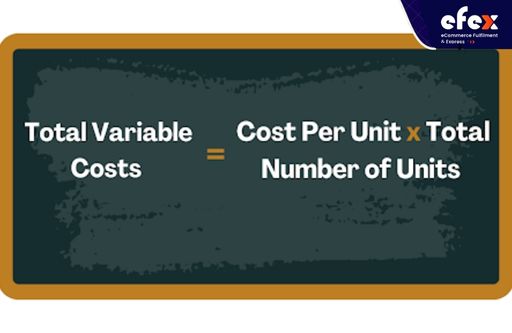

It is the sum of all variable expenses connected with every product. It is calculated by multiplying the cost of producing one unit of your goods by the number of goods you have produced.

For instance, if one unit of your goods is $100 and you create 50 units, your total variable cost would be then $100 x 50 = $500.

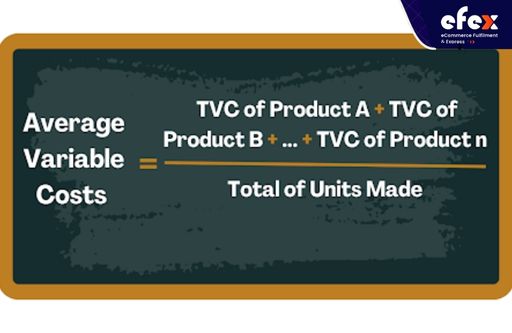

The average variable cost is calculated by dividing your total variable cost by the number of units produced. You may compute it using the formula below.

Whereas total variable cost illustrates how much money you spend to produce each unit of your goods, you may also need to pay for items with variable costs that vary by unit. This is where the average variable cost is important to consider. For instance, if you own a product with the yellow tag for 20 units and a product with the green tag for 35 units, your variable costs are $100 per unit and $50 per unit, respectively. These two variable expenses are reduced to a single manageable value by your average variable cost.

According to the earlier example, you may calculate your average variable cost by adding the total variable cost of the product with the yellow tag which is $100 x 20 = $2,000, and the total variable cost of the product with the green tag which is $50 x 35 = $1,750. Next, divide the total number of units manufactured which is 20 + 35 = 55.

Finally, your average variable cost would be ($2,000 + $1,750) / 55 = $68 for each unit.

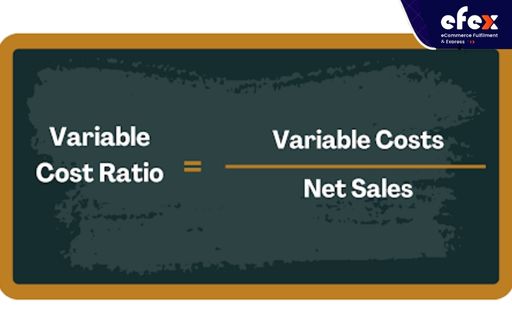

Businesses can use the variable cost ratio to determine the link between variable expenses and net sales. Determining this ratio allows business owners to manage both rising revenue and rising manufacturing expenses, allowing the firm to continue to develop steadily. Use the following formula to compute the variable cost ratio:

Let us take it into action. If you sell a bag for $100 (net sales), but it costs $10 to make (variable costs), divide $10 by $100 to get 0.1. Multiplying by 100 yields a variable cost ratio of 10%. This implies that for every item sold, you will receive a 90% return, with 10% heading toward variable expenditures.

Let’s read through the two below specific examples to understand better the calculation of the variable cost.

Consider the case of a corporation called CozyHome Company, which manufactures wooden tables in Arizona State in the U.S. The company’s initial production cost was being reviewed by top management.

As a result, the chief accountant submitted the following information, which was validated by the company’s Finance Director. Using the information provided, you can compute the total variable cost of manufacturing for the firm.

Particulars | Value |

Cost per meter of wood | $10 |

Direct labor cost per hour | $15 |

Length of wood required (meters) | 5,000,000 |

Number of man hours required (hours) | 500,000 |

Variable manufacturing overhead | $800,000 |

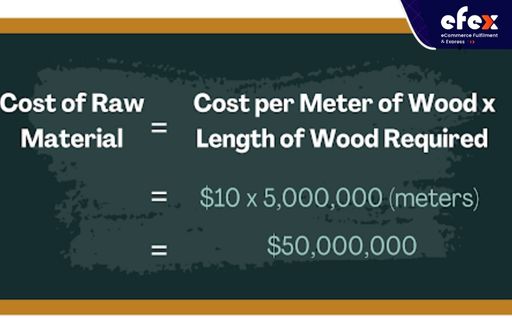

We then have the formula and the result of the cost of raw materials:

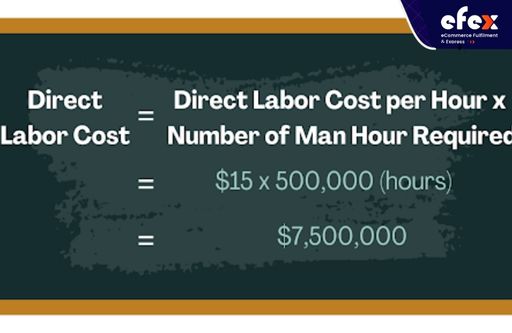

Next, we will calculate the direct labor cost by using the following formula:

Finally, we will have the total variable cost which is calculated as follow:

Let’s consider the case of BH Corporation, a producer of gloves. The firm secured an $8,000,000 order for 300,000 gloves recently. According to the most recent annual report, the following accounting data is available:

Particulars | Value |

Cost of raw material per glove | $7 |

Direct labor cost per hour | $14 |

Man hours required per glove (hours) | 1 |

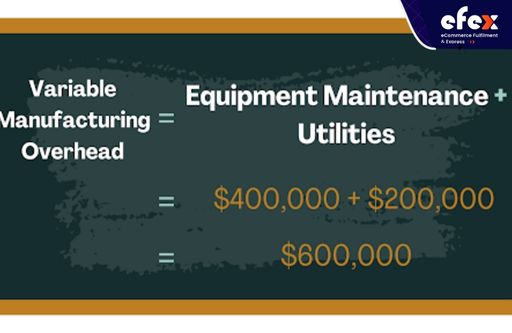

Equipment maintenance | $400,000 |

Utilities | $200,000 |

Number of gloves | 300,000 |

Similar to example 1, we can calculate whether the order is a lucrative proposition for the firm depending on the information provided in the table. First, we will calculate the cost of raw material, which is:

Then, we will have the direct labor cost which is calculated:

Next, using the following formula to determine the variable manufacturing overhead:

Finally, we will determine the total variable cost by using this formula:

As a result, the total variable cost of manufacturing which is $6,900,000 is less than the contract size which is $8,000,000, allowing XYZ Corporation to approve the order.

👉 Read More: Manufacturing Overhead Journal Entry: Definition & Process

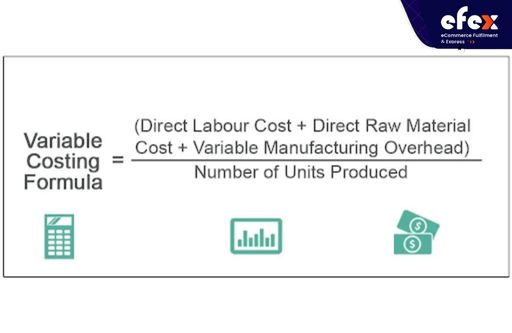

The formula of the variable manufacturing cost is determined in the 5 steps below:

While the words variable costs, variable cost ratio, total variable costs, and the average variable costs may appear complex on the surface, they are simple ways to reflect the changing nature of expenses to create new things as your firm expands. It is feasible to better plan for changing market dynamics and decrease the effects of variable expenses on your bottom line by knowing the nature of these charges, how the variable manufacturing cost formula is calculated, and also how they influence your current and expected income.