More Helpful Content

Variable manufacturing overhead might be difficult to analyze and budget for because of the change. Despite this, it is critical to evaluate overheads in order to minimize overpaying, appropriately establish pricing, forecast capital requirements, construct reserve accounts, and so on.

Manufacturers must incorporate variable overhead expenditures in addition to the total overhead necessary to boost future manufacturing capacity when calculating the total cost of manufacturing at the present level of output. The expenditures are then included in the calculations used to determine the product’s sales price.

It is critical because establishing minimum price levels guarantees the company’s financial performance. However, we should first understand what is the variable manufacturing overhead, since then we are able to calculate it.

Overhead implies the expenditures and expenses connected with manufacturing that are indirectly related to the manufacturing itself.

👉 Read More: What Is Fixed Manufacturing Overhead? Formula And Example

👉 Read More: What Is Manufacturing Overhead? Formula And Example

For example, costs of utilities, rent, administrator wages, raw materials, supplies, equipment supplies, replacement machine components, factory manager productivity bonuses, and so on.

Variable manufacturing overhead refers to the shifting production expenses associated with running a firm. Variable overhead expenditures change in proportion to manufacturing output. Variable overhead is distinct from typical overhead costs related to administrative chores and other set budgeting requirements.

👉 Read More: Probability Of A Stockout - Formula And Calculation

A clear example of variable manufacturing overhead is that it includes the purchase of manufacturing supplies and raw material, the payment of salaries connected with goods processing and delivery, and the payment of sales commissions to staff.

When more workers are necessary for factories owing to a rise in production, the expenses connected with the extra workers, in addition to additional hours spent for or overtime wages, are included in variable overhead costs.

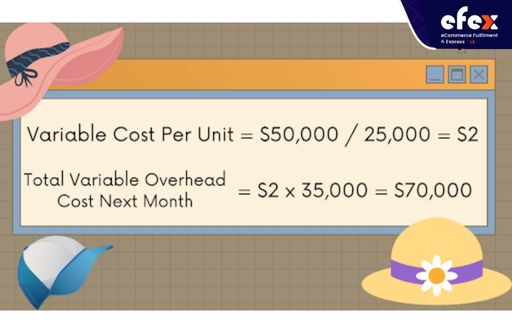

Assume a fashion firm has total variable overhead expenses of $50,000 each month while producing 25,000 hats. Therefore, the variable cost per unit is $2. Suppose the corporation improves its hat sales and needs to supply 35,000 hats the next month. Then the total variable overhead expenditures for the coming month climbed to $70,000 at $2 per unit.

👉 Read More: Manufacturing Overhead Journal Entry: Definition & Process

👉 Read More: What Is Variable Manufacturing Cost - Formula And Calculation

There are two types of variable manufacturing overhead costs, including variable and fixed. Normally, there is minimal fluctuation in overhead as the manufacturing of a specific product grows or decreases. As a result, it is known as a fixed cost. Wages for employees are typical fixed costs, as are building rent and tax responsibilities.

Variable overhead expenditures, on the other hand, fluctuate in response to changes in manufacturing output. It varies with the unit output of certain goods in the factory. Variable overhead costs are expenditures connected with functions like administrative activities, as opposed to generic overhead expenses, which have a set budgetary needs.

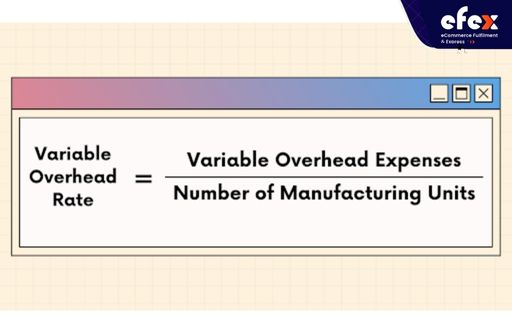

Since we are talking about the variable manufacturing overhead in this article, we will have the following formula for the variable overhead cost:

Variable manufacturing overhead costs are a type of expense that varies with output volumes. Variable manufacturing overhead is calculated and used by businesses to anticipate future costs and examine previous performance. If variable production costs are much higher than projected, the company will do a variance analysis to determine the root reason. When calculating the variable manufacturing overhead, you should consider the following factors.

Direct materials, direct labor, and manufacturing overhead are the three major elements of a product’s cost. Production overhead is a catch-all component that comprises all manufacturing expenditures apart from direct labor and materials that a company incurs. Some manufacturing overhead expenses are constant, meaning they do not fluctuate as output grows, while others are variable. The variable manufacturing overhead varies according to the quantity that the business manufactures.

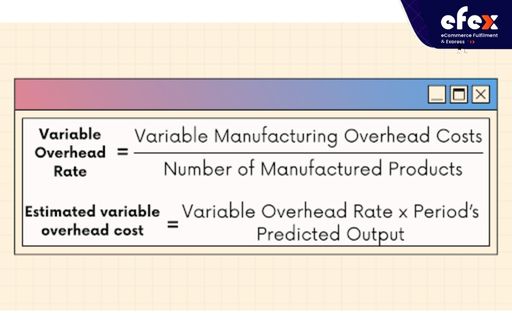

A company will normally generate a standard or expected variable manufacturing overhead for the entire year before production starts. Accountants arrive at this number by reviewing past data and calculating how much variable overhead expenditure the firm incurs per unit generated.

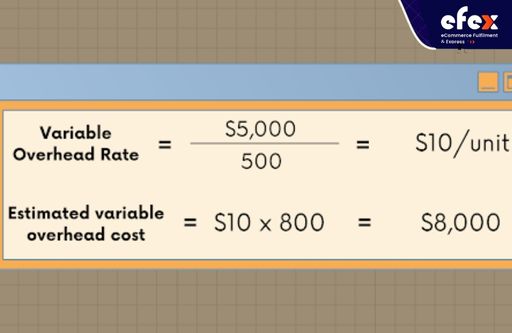

For instance, if the firm’s variable overhead expenses are normally $5,000 while producing 500 units, the conventional variable overhead rate is $5,000 / 500 = $10 for each unit. Then they multiply the rate by the period’s predicted output to determine the estimated variable overhead expenditure.

If the company expects to manufacture 800 units during the following period at a standard cost of $10 for each unit, the expected variable expense would be $8,000.

Following the completion of the manufacturing cycle, the company examines expenses and calculates the real variable manufacturing overhead. Accountants achieve this by determining how much variable manufacturing overhead was really paid during the time. They must be cautious to figure out how much overhead is used in manufacturing instead of the value of products acquired when making this computation.

Assume if the firm spent $1,000 on machine supplies but only utilized $600 during the period, the accountant then only included $600 in the variable expenditure estimate.

Variance refers to the distinction between standard and actual variable manufacturing overhead. If the variance is considerable, the company will look into what caused it. Variations in variable production overhead are classed as either expenditure or effectiveness. When the manufacturer purchases things at a higher pace than projected, unfavorable expenditure variances develop.

A spending variation may occur, for instance, if the cost of a kilowatt of energy increased or if a consumer had to spend more on machine supplies than normal. When the manufacturer utilizes more variable overhead for each unit than predicted, unfavorable effectiveness variances arise.

Variable overhead examples involve production materials, utilities used to power the equipment and the facility, wages for those who handle and ship the merchandise, the raw ingredients, and employee sales commissions.

Variable overhead expenses may include remuneration for additional personnel hired as output increases. Extra hours compensated for increased output would be a variable cost.

Utility costs for the types of equipment, gas, water, and electric power variate according to manufacturing capacity, new product launch, production cycles for current goods, and seasonal variations. Materials and equipment upkeep are two more things that may be included in indirect cost expenditures.

To assess the entire cost of manufacturing at the present levels, manufacturers must incorporate variable overhead charges, in addition to the overall overhead necessary to enhance manufacturing capacity in the future. The computations are used to calculate the lowest possible pricing levels for items in order to guarantee profitability.

The monthly cost of power for a production facility, for instance, will fluctuate based on production capacity. If additional shifts were added to satisfy product demand, the equipment and facilities would almost certainly consume more energy. Therefore, variable overhead charges must be incorporated into the cost per unit computation to ensure correct pricing. Despite increased output often raising variable overhead, improvements can arise as output grows.

👉 Read More: Manufacturing Overhead Budget: Example And Formula

Also, when manufacturing ramps up, price savings on bigger purchases of raw materials can cut the direct cost per unit. For example, if a firm’s production line is 100,000 units and its price per unit is $5, increasing the production rate to 50,000 units can reduce the direct cost to 75 cents. If the producer keeps the current selling pricing, the cost reduction of 25 cents per unit

👉 Read More: Order Management System: Definition, Process And Value

👉 Read More: Order Management System For Ecommerce: Definition, Key Effect, Benefit

Variable manufacturing overhead might be difficult to analyze and budget for as a result of the change. Despite this, it is critical to evaluate overheads in order to minimize overpaying, appropriately establish pricing, forecast capital requirements, construct reserve accounts, and so on.

Maintaining a good handle on variable overhead is beneficial in assisting firms in appropriately setting future product pricing in order to prevent overpaying, which can eat into profit margins.