More Helpful Content

Manufacturing overhead budget is an unavoidable cost of doing business. These continuous charges are legitimate production expenses that should be factored into your production budget. While analyzing these costs and adhering to a suitable budget may help you establish how effectively your firm is running and perhaps assist cut future overhead costs.

In today’s article, we are going to explain to you the manufacturing overhead budget in detail along with the related topic of this budget.

A manufacturing overhead budget includes all costs apart from labor and raw materials that a production business or department will incur throughout a financial year. These ongoing costs are legitimate manufacturing expenses that should be factored into your manufacturing budget.

👉 Read More: What Is Fixed Manufacturing Overhead? Formula And Example

👉 Read More: What Is Manufacturing Overhead? Formula And Example

👉 Read More: Manufacturing Overhead Journal Entry: Definition & Process

The sum of all expenditures in the budget is changed to a unit-based overhead allocation, which is then used to calculate the cost of finishing completed products inventory and is then mentioned on the budgetary accounting records. This budget information is one of the most vital of the different departments' budget models because it may comprise a significant portion of a company’s total expenses.

Examine the components of production overheads to ensure they are included in your manufacturing overhead budget.

Employee cost is the sum of money paid to the staff for their services. The overhead budget takes into account the costs that the business intends to incur on its staff in the coming year, such as salary.

Depending on the number of items produced, a manufacturing business or department must pay insurance costs. It is a part of the expense of doing business in the manufacturing industry and can be seen as manufacturing overhead.

👉 Read More: What Is Capable-To-Promise? Specific Example

Property that is in use for manufacturing is typically leased by the business, thus this rent must be charged, which became a part of the firm’s overhead. As a result, the expenses that the company anticipates incurring for paying the rent in the coming year are regarded as overhead and will be included in the overhead budget.

Depreciation is the decrease in the cost of fixed assets caused by normal overuse, changes in technology, and so on, and is recorded as a cost on the business’s income statement.

Freight is the fee paid by businesses to ship goods via any mode of transportation. It is one of the necessary expenditures that many businesses must incur.

They are the costs that the business incurs for using public utility companies’ facilities or services which consist of telephone service, electricity, water, gas, sewer, etc. These costs are necessary for the company’s operation.

Maintenance costs are the expenses incurred by the company to maintain everything in good condition. It is also necessary for the operation of the company.

Taxes are the mandatory financial charges imposed by the government of a country on the people and businesses that work there. These expenses must be paid by the company and are thus classified as overhead expenses.

R&P brand is famous for costumes with embroidering arts. It allocates fabric raw materials and craftsman costs in the direct materials and labor budgets, accordingly. The following are its production overhead costs:

| Period 1 | Period 2 | Period 3 | Period 4 | |

| Administrative wages | $200,000 | $201,000 | $202,000 | $203,000 |

| Payroll taxes for administrative purposes | 20,000 | 20,000 | 25,000 | 25,000 |

| Depreciation | 35,000 | 35,000 | 38,000 | 38,000 |

| Inbound and outbound freight | 10,000 | 9,000 | 12,000 | 11,000 |

| Rent | 40,000 | 40,000 | 40,000 | 44,000 |

| Supplies | 8,000 | 6,000 | 7,000 | 8,000 |

| Travelling and entertainment | 4,000 | 4,000 | 4,000 | 4,000 |

| Utilities | 15,000 | 15,000 | 15,000 | 17,000 |

| Total production overhead | $332,000 | $330,000 | $343,000 | $350,000 |

Administrative salaries comprise payments made to manufacture managers, buying employees, production secretaries, and logistics personnel, and the line item steadily increases as time passes to respond to changes in wage levels. The depreciation expenditure remains largely constant, with a rise in the third period due to the acquisition of new machinery.

Freight and supply expenditures are very directly related to the real volume of production, therefore their quantities change in tandem with projected output levels. Rent is a fixed expenditure that rise in the fourth period to account for a planned rent increase.

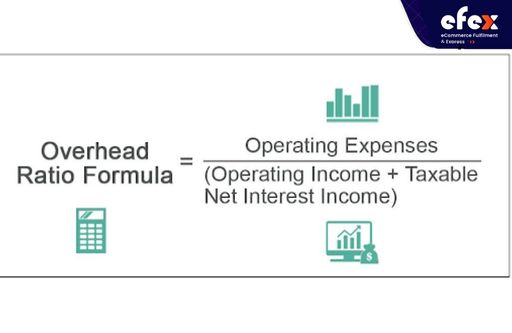

Computation of the overhead ratio might also be included in the budget. Direct labor times, for instance, may be budgeted at the bottom and divided by the overall production overhead cost every quarter to determine the allocation rate for each direct labor hour.

The majority of the data in the budget may be predicted from past data, assuming that the kinds of items created and production quantities do not differ dramatically from previous times.

Many more topics impacting the manufacturing overhead budget can be covered in the sections that follow.

A much less widely used form for the manufacturing overhead budget is to categorize the items listed into both fixed and variable expenses. When determining whether this is a variable cost or fixed cost, you can include a third cost gathering combined costs with variable and fixed cost features.

When creating a flexible budget, variable expenses should be considered independently so that the overall budget of variable costs changes to match the number of real revenues produced.

The manufacturing overhead budget in streamlined budgeting surroundings can be as straightforward as a manufacturing overhead calculated by multiplying by some types of activities, like labor hours spent directly or machine hours utilized.

This method is normally not suggested because it does not unveil the actual essence of the numerous types of costs integrated into the overhead ratio, and it may even be utilized by a less ethical superior to boost his manufacturing overhead budget while keeping it hidden from the entire of the management group.

Due to the enormity of the expenses in the budget, one needs to be careful not to include an incorrect amount, since the outcome might be a substantially inaccurate total budget. One method for detecting inaccurate figures is to compare the budgeted overall numbers per period to the exact numbers spent for similar periods the previous year.

A cash needs calculation in the factory overhead budget is unusual. Alternatively, the cash needs for a firm in its entirety are computed and reported on a different sheet of the budget.

Manufacturing overhead costs cannot be avoided. To maintain financial stability and an effective manufacturing process, all firms must include these expenditures in their budgets. Here is how to analyze and budget for manufacturing expenses to support your firm to run smoothly and effectively while maintaining financial stability.

To correctly budget production overheads for your firm, you must first calculate the specific monthly overhead expenditures. Manufacturing overhead costs include anything that contributes to the effective execution of the manufacturing process.

Costs for machine controllers, quality assurance inspectors, and other people who work directly to assure correct manufacturing can be included in these expenditures.

It can also relate to the expenses associated with equipment maintenance and repairs. Overhead costs in production might also include facility fees like insurance, electricity, and property taxes.

After calculating all monthly production overhead expenses, you must compute the overhead percentage. This refers to the monthly percentage you will have to pay for production overheads.

You are able to create an overhead budget now that you have determined the overhead percentage. This procedure is straightforward and may give significant financial benefits to any business. The most effective strategy to budget for manufacturing overhead is to keep aside enough money to pay for all overhead expenditures. The sum should be equivalent to the overhead percentage computed by dividing your costs by your monthly income.

Note that production costs and sales might fluctuate monthly. So take note of both figures and make any necessary adjustments to guarantee that your firm always has enough to cover all overhead expenditures.

Furthermore, the overhead percentage should always be reduced. This indicates that your company is making better use of its resources. If your overhead percentage is large, you should think about upgrading your manufacturing process. Improving energy-efficient production equipment and machinery, for instance, might assist cut operating expenses. You may also change the selling pricing of your items. This can increase sales and provide the additional money required to pay excessive overhead expenditures.

👉 Read More: Order Management System: Definition, Process And Value

👉 Read More: Order Management System For Ecommerce: Definition, Key Effect, Benefit

You must have a healthy manufacturing overhead budget in order to effectively manage your own manufacturing firm to create the things you sell. This budget outlines the amount it costs to operate your production facility. It does not cover the price of materials or labor to manufacture your items. They are budgeted separately. This budget allows you to estimate how much money you have to spend each month or quarter to maintain your facility operationally.