More Helpful Content

Knowing how to calculate inventory turnover will help you understand the current performance of your business, recognize problems that are negatively affecting revenue, and find out the way to solve them, which allows you to make better business decisions in the future. Therefore, if you want to learn about how to calculate inventory turnover, do not skip this article.

Before diving deep into how to calculate inventory turnover, let's understand its definition below. Inventory turnover is defined as the amount of time that elapses between the date a company purchases a good and the day when it is sold.

A business selling all of its inventory excluding damaged or lost items is considered a perfect inventory turnover. Successful businesses often have multiple turns of inventory each year, but this varies depending on the type of product and category in which the business operates.

For example, although consumer packaged goods (CPG) often have higher revenue, high-value luxury goods such as expensive watches and jewelry often are sold less and take much time to produce. Inventory management issues such as changing items according to consumer demand, inefficient supply chain planning, and stockpiling more than necessary can all affect earnings.

- Read More: Order Management System: Definition, Process And Value

- Read More: Order management system for Ecommerce: Definition, Key Effect, Benefit

To calculate inventory turnover, first determine the following variables:

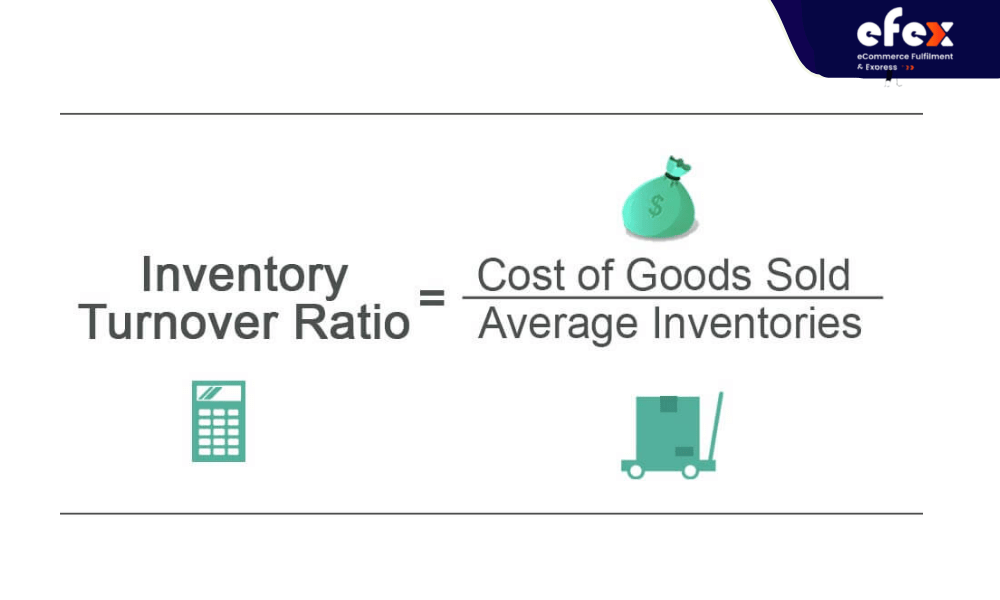

Once you've identified those factors, you can now use this formula to determine your business's inventory turnover ratio.

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventories

Inventory Turnover (SPEED) represents the number of times you sold and replenished your inventory during a given period. The rate of selling out will often have a certain difference. It calculates the percentage of shares sold in a given period (AMOUNT).

| (Quantity of products sold / volume of products on hand) x 100 = Sell-through rate |

If your company wants to succeed, it's important to maximize both of these ratios. High sales show that your product or business strategy is on the right track. In addition, a high volume indicates that the amount of goods you are shipping is very large.

Date sales of inventory determine the amount of time it takes your company to convert inventory into sales. DSI may be calculated by dividing your average inventory by the cost of sales. Then increase that figure by 365 to determine how long it takes to sell your merchandise. The lower this quantity is, the better.

| (Average stock/cost/ cost of sales) multiplied by 365 equals days of inventory |

The overall ratio of sales to the average value of your assets is your company's asset turnover. This method may be used to assess how well your company utilizes its assets to create sales and income. Your asset turnover ratio should be as high as possible. To compute this, let’s use the following formula:

Total yearly sales divided by average assets equals asset turnover.

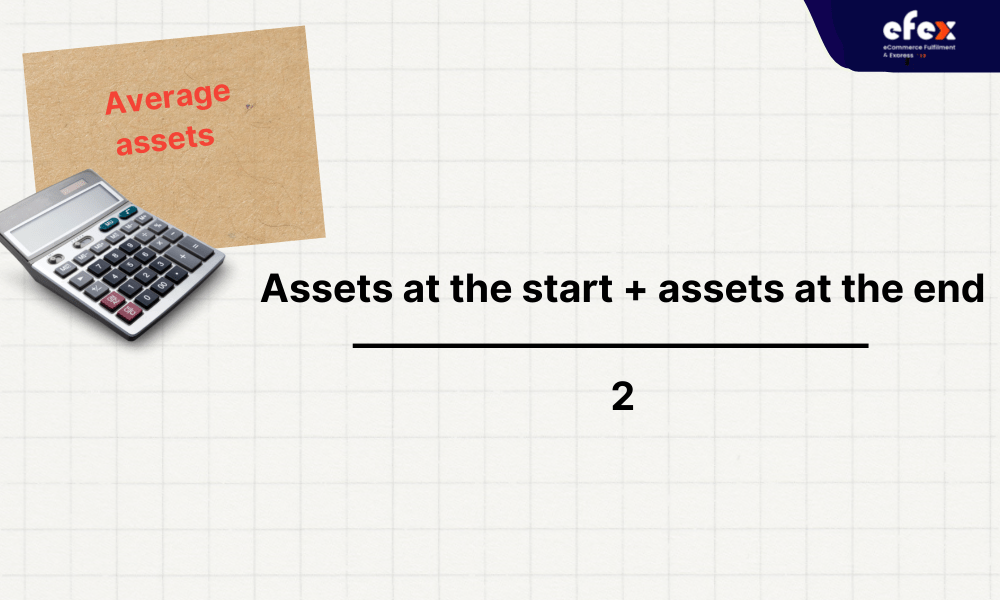

You can determine your average assets by adding your property's value at the beginning of the year with your net worth at the end of the year. Then divide the result by two.

Average Assets = (Assets at the start + Assets at the end) / 2

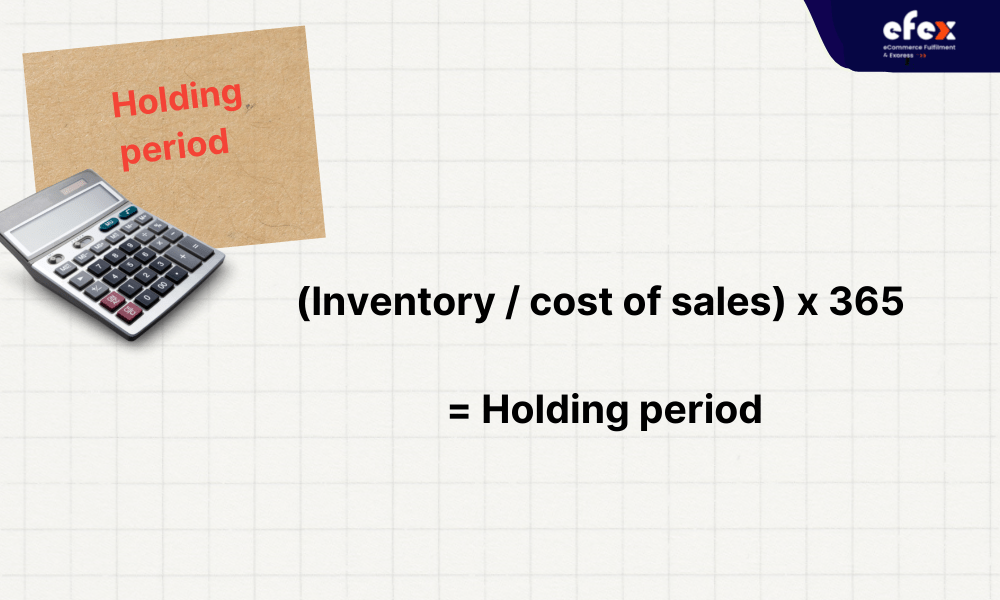

Your stock level time is the average number of days that your firm keeps inventory. The shorter the holding time, the better. Using the following formula to, compute the holding period: Holding Period = (Inventory / Cost of sales) x 365

👉 Read More: Barcode Inventory System: Its Benefits & How To Use It

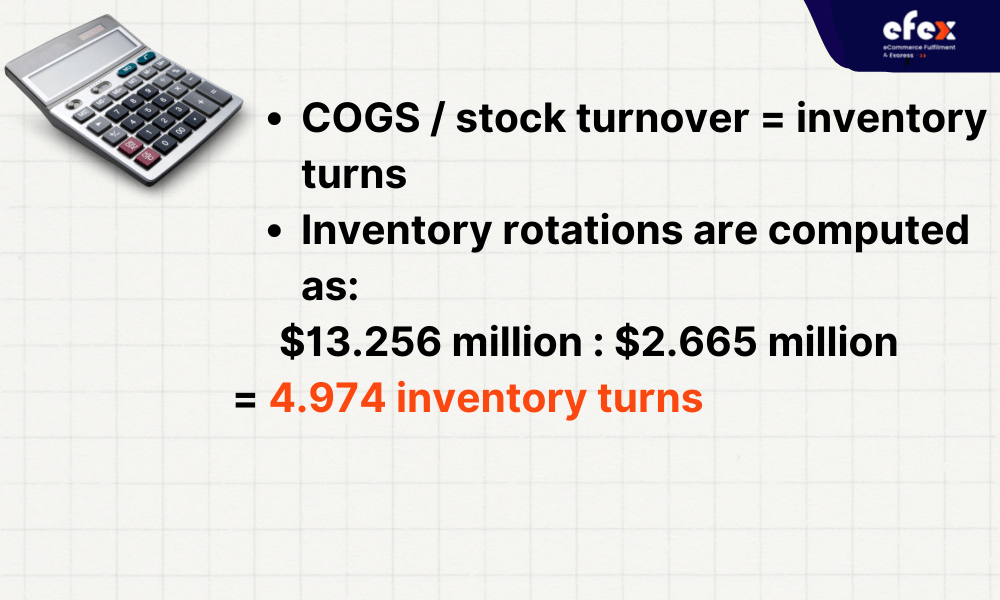

Consider the following real-world example: According to Coca-2017 Cola's financial statement, COGS was $13.256 million. Between 2016 and 2017, its average inventory cost was $2.665 million. We may calculate the ratio using these figures:

You now know that Coca-Cola's total inventory for the year was 4,974. From there, compare Coca-Cola with other companies in the same industry to assess its success of Coca-Cola. For example, if a competitor's inventory turnover is 8.6%, it means that Coca-Cola is selling slower than the competition. There are several reasons why one company's ITR may be lower than another's. One firm is not always inferior to another.

To obtain the whole picture, read the annual financial performance as well as any notes. Even though Coca-Cola's ITR is perceived to be lower, you can find some metrics that show it's still a better performer than many others in its industry. You can also get information from historical data for comparisons between different years.

The optimal inventory turnover ratio depends on two factors: the industry and the business. Therefore, it is necessary to compare the company's current performance with that of your business's past performance. At the same time, comparing with other companies in the industry will also give you an overview of the company's growth rate.

Poor sales can be due to a number of reasons such as poor product quality, overpriced products, ineffective marketing campaigns, or goods not meeting the market demand. Excess inventory will also have a high cost because goods in the warehouse for a long time cost the company money to produce but do not generate income and also take up space to store other goods.

A high stock turnover ratio can indicate good company sales. However, this high percentage may also be due to low stock levels. This can affect the company's sales because if the company does not meet the purchasing needs of customers, the company may lose customers.

For example, a business may have cash flow problems if inventory is not turned around quickly. Besides, a higher corporate turnover ratio will help businesses make more money.

The inventory turnover formula is one of the factors to evaluate the performance of the whole company. In general, a larger stock turnover indicates better operating efficiency, and conversely, poor business results can be demonstrated while a lower turnover. This is because a high hit rate shows that you are not overpaying for overbuying and wasting money on hosting fees.

It also proves that you are effectively selling the things you buy and depositing money quickly. Poor inventory turnover ratios can be caused by too much inventory, unresponsive product lines, or ineffective sales and marketing activities. That is usually a bad omen because goods can spoil and incur storage costs when they are in the warehouse for too long.

👉 Read More: QR Code Inventory Management: How To Create And Specific Example

Furthermore, excess inventory drains the company's cash and causes sales to drop significantly. However, there are complexities and exceptions to those broad ideas. A high turnover rate might result in great sales or ineffective purchasing, ultimately leading to corporate losses owing to insufficient inventory. This might result in supply shortages and, as a result, a decline in sales.

An item with a high turnover rate will save on inventory costs than an item that only sells once a year: Increased inventory turnover increases profits for the following three reasons:

There are several techniques a company can use to improve inventory turnover rate:

Calculating enough days to be able to sell off inventory after having a turnover rate is simple. You only need to spend 365 (representing 365 days of the year) on the revenue of your business. The result is the average number of days it takes to sell off your business's inventory.

A company's inventory turnover ratio fundamentally varies depending on its industry. The average number of fashion stores is between 4 and 6. Auto parts prices can go up to 40. There are about 14 grocery stores. Auto dealers are sometimes as low as 2 to 3. In summary, low-margin industries have larger inventory turnover ratios than high-margin industries because they must balance lower profitability per unit with selling volume in larger units. Furthermore, it's important to realize that the best time to buy stock - especially products that are about to hit the market or during a sale - captures these well. It will help your company increase revenue strongly.

We offer a few suggestions if you've utilized the stock turnover calculation and know you need to increase your average inventory turnover.

It is important for you to make sure that your business strategy is targeting the right ideal customers. Show them how your business will solve their problem and how it will be effective and unique, which will make them irresistible and want to buy your product immediately.

This is obvious without much debate. You should prioritize choosing products with great demand and combine with an effective marketing campaign, your business will be able to gain more profits.

By grouping items of the same type together, you can compare their performance to identify market trends and predict how much you should buy in the future.

Find products that sell low but take up a lot of space in the warehouse and get rid of them. You will save a lot of your space and money. From there you can also see which items have no potential and stop importing them.

The price of the product will also be something you need to keep in mind if the above methods don't work. The price is too high means that the percentage of goods sold will be low. You can compare the price of your products with other competitors in the industry. If your current price is high, try to bring it down to increase the flow of purchases.

This will be a safe way but also get high efficiency. Importing small quantities on a regular basis reduces the risk of large inventories for your business. You can also customize the number of goods to meet the needs of the market, not redundant, not lacking.

👉 Read More: How to Create a Barcode Inventory in Excel

Understanding how to calculate inventory turnover will help business owners better understand what is in their inventory, what is good, and what needs to be improved. Therefore, if you want to increase sales, take the time to find out.